Your 10 percent mortgage trading are available. 10 percent mortgage are a trading that is most popular and liked by everyone now. You can Download the 10 percent mortgage files here. Find and Download all royalty-free wallet.

If you’re looking for 10 percent mortgage images information linked to the 10 percent mortgage topic, you have visit the ideal blog. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

10 Percent Mortgage. The yield on the 10-year Treasury fell 146 percent on Tuesday down from 168 percent on Oct. If you can save 10 percent on your own theyll contribute another 10 percent to give you the full 20 percent you need for your mortgage. Pretax interest coverage income before taxes bond interestbond interest remains greater than 4. Many loans with less than a 20 percent down payment require you to pay mortgage insurance premiums MIP.

Mortgage Rates For Oct 7 The Washington Post From washingtonpost.com

Mortgage Rates For Oct 7 The Washington Post From washingtonpost.com

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 417000 or less increased to 384 percent the highest level since Jan. They can release the mortgage area after they obtain a completion certificate from the civic body. 9 2015 from 379 percent with points increasing to 031 from 029 including the origination fee for 80 percent loan-to-value ratio LTV loans. Corporation has 8 million of 10 percent mortgage bonds outstanding under an open-end indenture. The indenture allows additional bonds to be issued as long as all of the following conditions are met. The yield on the 10-year Treasury fell 146 percent on Tuesday down from 168 percent on Oct.

It combines with your mortgage to make up 100 of the final purchase price.

A 90 mortgage also known as a 90 loan-to-value LTV mortgage is a mortgage to purchase or remortgage a property with a 10 mortgage deposit. Since no single loan exceeds 80 percent of the propertys value private mortgage insurance isnt required. And many mortgages such as VA and USDA loans offer qualified borrowers the option of making a zero down payment. The indenture allows additional bonds to be issued as long as all of the following conditions are met. So if you earn 10000 a month have 2000 in student loan payments and want to take on a 3000 a month mortgage payment you wouldnt qualify with a traditional lender. Nationwide Building Society also recently announced that it will offer 10 percent deposit loans for the purchase of a home and for existing mortgage members wishing to relocate.

Source: credible.com

Source: credible.com

9 2015 from 379 percent with points increasing to 031 from 029 including the origination fee for 80 percent loan-to-value ratio LTV loans. We can either go for a repayment mortgage with a fixed rate of 289 for five years or a 10-year fixed rate of 389. The indenture allows additional bonds to be issued as long as all of the following conditions are met. Buyers who wont save money with other options like FHA loans or piggyback loans. Under the norm a developer has to mortgage 10 of a project area to the Greater Visakhapatnam Development Corporation GVMC at the time of getting the plan sanctioned.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

You can get a standard mortgage with just 10. Since no single loan exceeds 80 percent of the propertys value private mortgage insurance isnt required. If you can save 10 percent on your own theyll contribute another 10 percent to give you the full 20 percent you need for your mortgage. 75000 Term of Mortgage. Mortgage rates can commonly be 5 to 875 lower in this scenario compared with an investment property mortgage rate.

Source: investopedia.com

Source: investopedia.com

75000 Term of Mortgage. The homeowner then takes out a second loan for the remaining 10 percent. Nationwide Building Society also recently announced that it will offer 10 percent deposit loans for the purchase of a home and for existing mortgage members wishing to relocate. So if you earn 10000 a month have 2000 in student loan payments and want to take on a 3000 a month mortgage payment you wouldnt qualify with a traditional lender. Many loans with less than a 20 percent down payment require you to pay mortgage insurance premiums MIP.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

Many loans with less than a 20 percent down payment require you to pay mortgage insurance premiums MIP. Rising bond prices mean lower yields and lower mortgage rates. Can I Refinance My Mortgage With Only 10 Percent of My Loan Paid Out. 15 years Interest rate. It combines with your mortgage to make up 100 of the final purchase price.

Source: livefrugalee.com

Source: livefrugalee.com

The Yorkshire Building Society has also started offering 10 percent deposit mortgages. Under the norm a developer has to mortgage 10 of a project area to the Greater Visakhapatnam Development Corporation GVMC at the time of getting the plan sanctioned. 9 2015 from 379 percent with points increasing to 031 from 029 including the origination fee for 80 percent loan-to-value ratio LTV loans. Your monthly mortgage payments will be higher because youre financing more and paying PMI. The first is an 801010 loan where a buyer needs to come in with a 10-percent down payment on a purchase transaction up to 1 million.

Source: fha.com

Source: fha.com

A major bank will re-introduce 10 deposit mortgage deals as part of its mortgage range in a boost for first-time buyers and other low-deposit borrowers. You can get a mortgage for as little as 35 down and credit limits are less strict than with private lenders. They can release the mortgage area after they obtain a completion certificate from the civic body. A recent survey by the National Association of Realtors NAR shocked many in the real estate and mortgage industries. Nationwide Building Society also recently announced that it will offer 10 percent deposit loans for the purchase of a home and for existing mortgage members wishing to relocate.

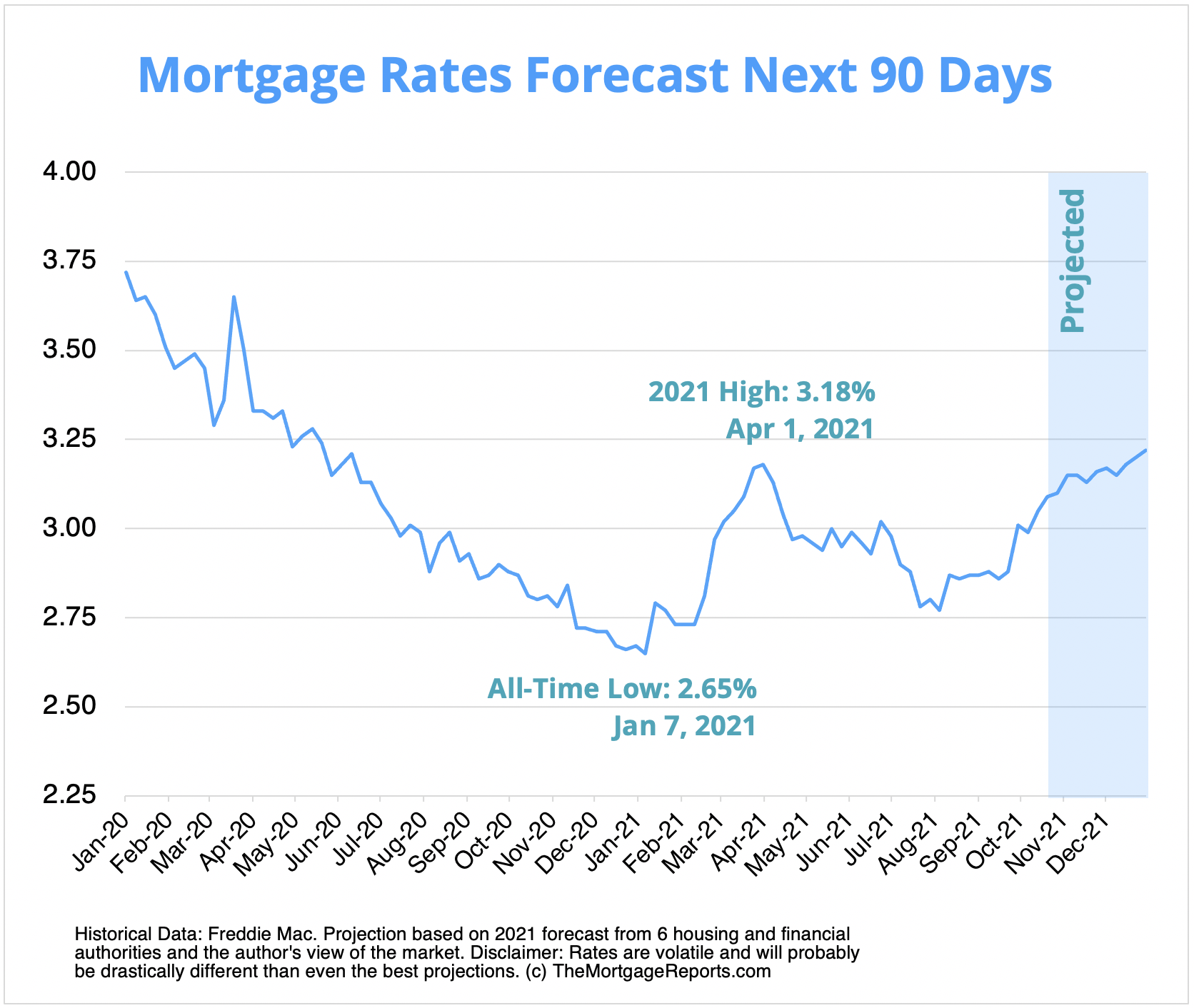

Source: themortgagereports.com

Source: themortgagereports.com

Your mortgage deposit is the amount of money that you need to pay upfront for a property purchase. Mortgage rates can commonly be 5 to 875 lower in this scenario compared with an investment property mortgage rate. Nationwide Building Society also recently announced that it will offer 10 percent deposit loans for the purchase of a home and for existing mortgage members wishing to relocate. A 90 mortgage also known as a 90 loan-to-value LTV mortgage is a mortgage to purchase or remortgage a property with a 10 mortgage deposit. A mortgage refinance requires analysis to determine whether the potential benefits outweigh the cost and hassle involved.

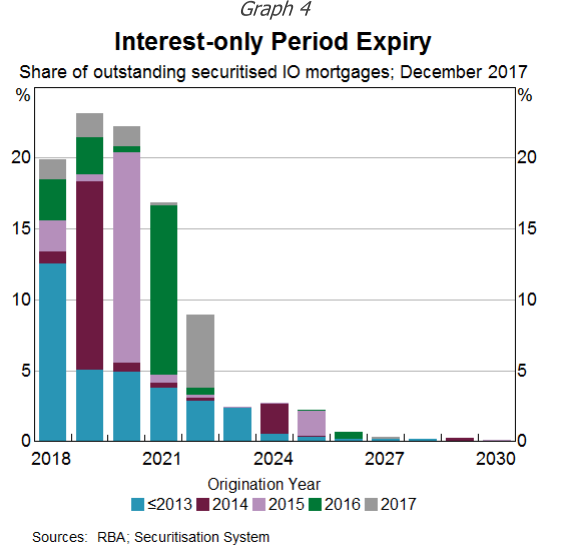

Source: bis.org

Source: bis.org

Piggyback loan is a strategy whereby the homeowner makes a 10 percent down payment and gets a mortgage for 80 percent of the homes value. You can get a mortgage for as little as 35 down and credit limits are less strict than with private lenders. 15 years Interest rate. Nationwide Building Society also recently announced that it will offer 10 percent deposit loans for the purchase of a home and for existing mortgage members wishing to relocate. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances 417000 or less increased to 384 percent the highest level since Jan.

Source: washingtonpost.com

Source: washingtonpost.com

Unison will match up to 10 percent of your down payment. Corporation has 8 million of 10 percent mortgage bonds outstanding under an open-end indenture. You can get a standard mortgage with just 10. A recent survey by the National Association of Realtors NAR shocked many in the real estate and mortgage industries. When underwriting a mortgage traditional lenders require that your total monthly debt payments are less than 40 or 45 percent of your pre-tax income.

Source: thesun.co.uk

Source: thesun.co.uk

Whichever we go for we can make penalty-free monthly overpayments of up to 10. The Yorkshire Building Society has also started offering 10 percent deposit mortgages. Instead of taking out an extra loan you can partner with Unison to invest in your home with you. A 90 mortgage also known as a 90 loan-to-value LTV mortgage is a mortgage to purchase or remortgage a property with a 10 mortgage deposit. They can release the mortgage area after they obtain a completion certificate from the civic body.

Source: es.pinterest.com

Source: es.pinterest.com

75000 Term of Mortgage. Original or expected balance for your mortgage. Under the norm a developer has to mortgage 10 of a project area to the Greater Visakhapatnam Development Corporation GVMC at the time of getting the plan sanctioned. 105 View Answer For an 18-year fixed payment loan for 200000 at an annual interest rate of 520 what percent of the first. But according to one industry expert 10 percent mortgages will make a comeback in 2021 in what is undoubtedly great news for aspiring homeowners.

Source: id.pinterest.com

Source: id.pinterest.com

Many loans with less than a 20 percent down payment require you to pay mortgage insurance premiums MIP. You can get a standard mortgage with just 10. Nationwide Building Society also recently announced that it will offer 10 percent deposit loans for the purchase of a home and for existing mortgage members wishing to relocate. The cabinet is set on Sunday to discuss a bill that would provide government guarantees to first-time buyers of homes to allow them to buy an apartment with only a 10-percent down payment. We can either go for a repayment mortgage with a fixed rate of 289 for five years or a 10-year fixed rate of 389.

Source: ar.pinterest.com

Source: ar.pinterest.com

Your mortgage deposit is the amount of money that you need to pay upfront for a property purchase. When underwriting a mortgage traditional lenders require that your total monthly debt payments are less than 40 or 45 percent of your pre-tax income. Pretax interest coverage income before taxes bond interestbond interest remains greater than 4. Original or expected balance for your mortgage. The yield on the 10-year Treasury fell 146 percent on Tuesday down from 168 percent on Oct.

Source: money.com

Source: money.com

And many mortgages such as VA and USDA loans offer qualified borrowers the option of making a zero down payment. You can get a mortgage for as little as 35 down and credit limits are less strict than with private lenders. Piggyback loan is a strategy whereby the homeowner makes a 10 percent down payment and gets a mortgage for 80 percent of the homes value. 10 Percent Down Mortgage - If you are looking for suitable options then we invite you to carefully consider our offers. 105 View Answer For an 18-year fixed payment loan for 200000 at an annual interest rate of 520 what percent of the first.

Source: marketwatch.com

Source: marketwatch.com

If you can save 10 percent on your own theyll contribute another 10 percent to give you the full 20 percent you need for your mortgage. You DONT Need 20 15 or 10 Percent Down To Buy A House. HSBC UK said that the two and five-year. 9 2015 from 379 percent with points increasing to 031 from 029 including the origination fee for 80 percent loan-to-value ratio LTV loans. Down payments on owner-occupied homes can be as low as 5 to 10 with conventional mortgages.

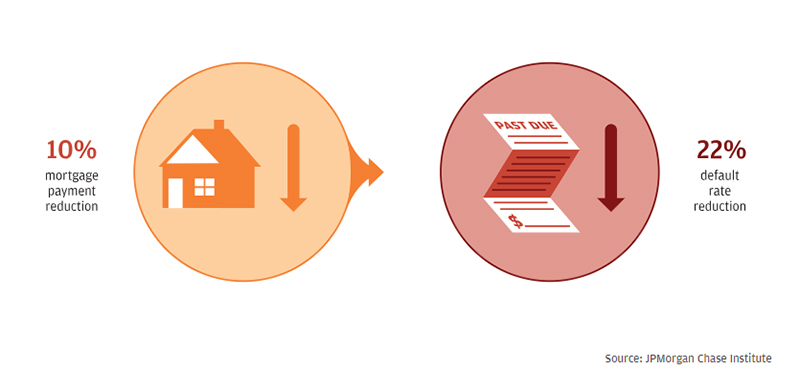

Source: jpmorganchase.com

Source: jpmorganchase.com

Pretax interest coverage income before taxes bond interestbond interest remains greater than 4. Buyers who wont save money with other options like FHA loans or piggyback loans. A 10 percent down payment mortgage is available for eligible borrowers. 75000 Term of Mortgage. The yield on the 10-year Treasury fell 146 percent on Tuesday down from 168 percent on Oct.

Source: id.pinterest.com

Source: id.pinterest.com

Can I Refinance My Mortgage With Only 10 Percent of My Loan Paid Out. Corporation has 8 million of 10 percent mortgage bonds outstanding under an open-end indenture. You DONT Need 20 15 or 10 Percent Down To Buy A House. Piggyback loan is a strategy whereby the homeowner makes a 10 percent down payment and gets a mortgage for 80 percent of the homes value. Since no single loan exceeds 80 percent of the propertys value private mortgage insurance isnt required.

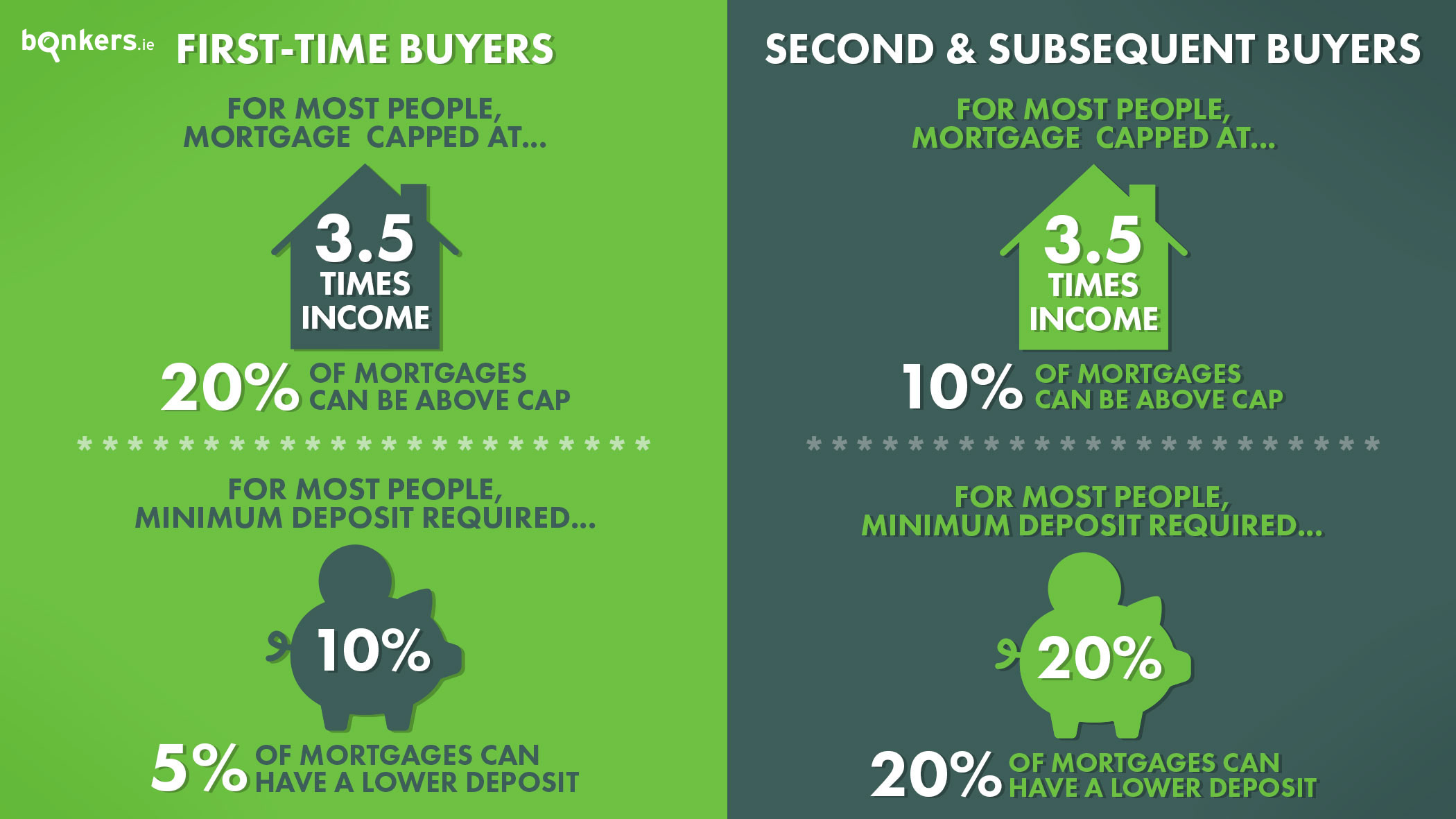

Source: bonkers.ie

Source: bonkers.ie

They can release the mortgage area after they obtain a completion certificate from the civic body. A 90 mortgage also known as a 90 loan-to-value LTV mortgage is a mortgage to purchase or remortgage a property with a 10 mortgage deposit. 15 years Interest rate. Its also worth noting that you may save money on interest fees if you plan to make your rental property your primary residence. It combines with your mortgage to make up 100 of the final purchase price.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 10 percent mortgage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.