Your Best solo roth 401k providers trading are ready. Best solo roth 401k providers are a mining that is most popular and liked by everyone now. You can Get the Best solo roth 401k providers files here. Get all free trading.

If you’re looking for best solo roth 401k providers pictures information connected with to the best solo roth 401k providers keyword, you have pay a visit to the right site. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Best Solo Roth 401k Providers. It offers 401 k plans payroll insurance human resources tax filing and other services. There are nearly 20 companies offering individual or solo 401Ks. But it appears it is not the only company in its pedigree. Usually the key to selecting a solo 401k provider is to determine your needs.

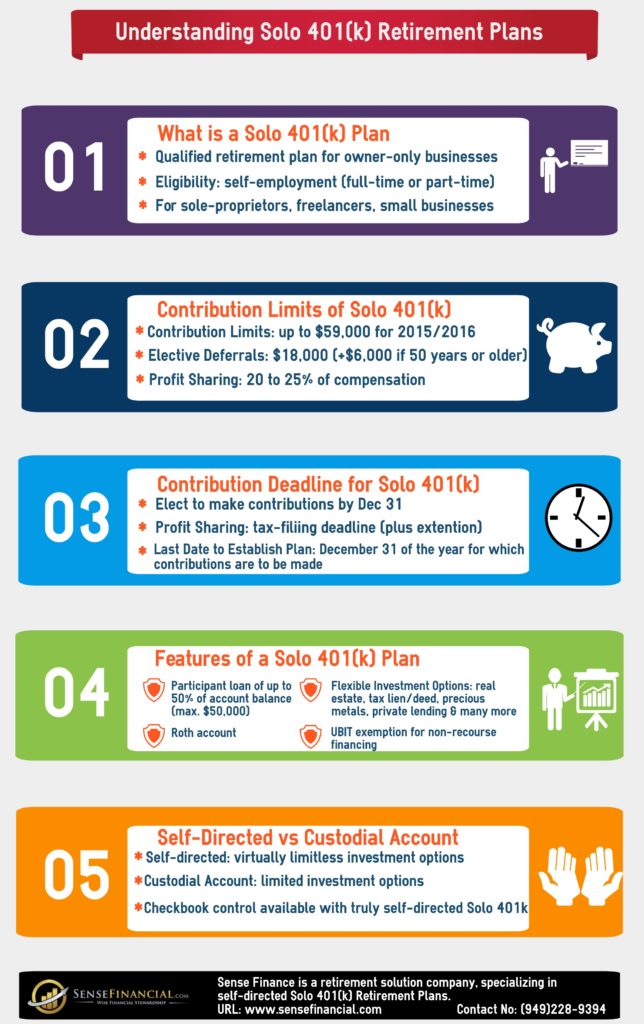

Solo 401k Infographics Sense Financial Services Llc From sensefinancial.com

Solo 401k Infographics Sense Financial Services Llc From sensefinancial.com

The three brokerages mentioned above all offer them. Solo 401k Providers. Vanguard is a wonderful company for just about everything except their i401k offering Fidelity No Roth. Advisor services are available to help you select the suite. You get to choose. Is there really such a thing as best Solo 401k PlansWell it depends on what you are looking for in your Solo 401k providerIn other words all Solo 401k plans are approved by the IRS through the issuance of an IRS determination letter.

These fees can be waived for account holders who have at least 50000 in Vanguard accounts.

Fidelity Schwab Ameritrade etc. In addition most Solo 401k plan providers do not allow for in-plan Roth conversions or rollovers. It is comparable to the difference in Wal-Mart and 7-11. Vanguard Allows Roth contributions but no rollovers or 401k loans. ADP is another 401 k provider that offers combined services for small employers. Fidelity Charles Schwab ETRADE and TD Ameritrade are all a.

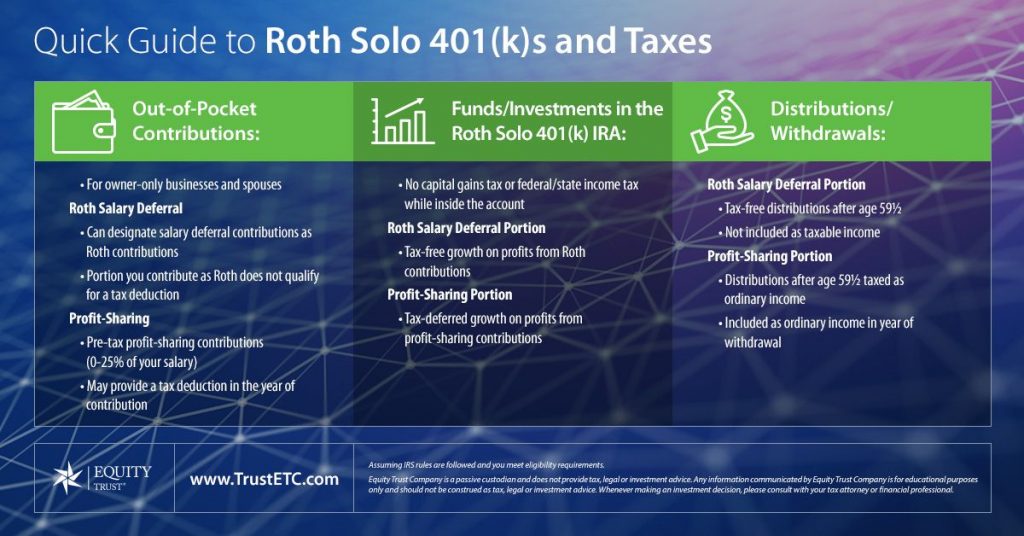

Source: trustetc.com

Source: trustetc.com

Is there really such a thing as best Solo 401k PlansWell it depends on what you are looking for in your Solo 401k providerIn other words all Solo 401k plans are approved by the IRS through the issuance of an IRS determination letter. There are great options at Vanguard Fidelity Schwab and TD Ameritrade. Answer 1 of 7. Vanguard is a wonderful company for just about everything except their i401k offering Fidelity No Roth. There are no account maintenance fees or trading costs which is a big plus.

Source: mysolo401k.net

Source: mysolo401k.net

20 annual fee for each different Vanguard fund in the account until you hold more than 50k with Vanguard very limited investment offerings. It offers 401 k plans payroll insurance human resources tax filing and other services. Whereas IRA Financial Groups Solo 401k Plan allows for in-plan Roth conversions. Advisor services are available to help you select the suite. Find out which solo 401k provider is best for you.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

If you want to buy Vanguard funds such as VTSAX just use Vanguard since they will be commission-free there. However the Solo 401k Plan participant must pay income tax on the amount converted. 20 annual fee for each different Vanguard fund in the account until you hold more than 50k with Vanguard very limited investment offerings. ADP is another 401 k provider that offers combined services for small employers. It is the only traditional brokerage that allows Roth contributions conversions to Roth rollovers of any kind into the account and loans from the account.

Source: pinterest.com

Source: pinterest.com

Solo 401k – this is more complicated. Find out which solo 401k provider is best for you. It is the only traditional brokerage that allows Roth contributions conversions to Roth rollovers of any kind into the account and loans from the account. However the Solo 401k Plan participant must pay income tax on the amount converted. Both offer similar products but the service convenience and pricing are different.

Source: districtcapitalmanagement.com

Source: districtcapitalmanagement.com

My Solo 401k Financial provides a solo 401k plan that allows the business owner to process a solo 401k loan with a 30 year loan payback period if the borrowed proceeds are used toward the purchase of a primary residence. Vanguard Allows Roth contributions but no rollovers or 401k loans. There are great options at Vanguard Fidelity Schwab and TD Ameritrade. List of the top 25 401 k Providers in Shortlister as of October 2021 presented in the order they appear in the full Vendor Listing tab. In the following well talk about all the options to look for in a Solo 401k provider including cost investment opportunities.

Source: mysolo401k.net

Source: mysolo401k.net

Vanguard Allows Roth contributions but no rollovers or 401k loans. Find out which solo 401k provider is best for you. Advisor services are available to help you select the suite. Whereas the Solo 401k contribution limit is 19500 for employees and then additional employer matching on top of this. You get to choose.

Source: thedailycpa.com

Source: thedailycpa.com

As your question in. Answer 1 of 7. It is the only traditional brokerage that allows Roth contributions conversions to Roth rollovers of any kind into the account and loans from the account. Choosing a solo 401k from any provider on this list could be a good fit for typical retirement savings and investment needs. Vanguard is very straightforward with its Solo 401 k costs.

Source: sensefinancial.com

Source: sensefinancial.com

Roth IRA – Vanguard Fidelity and Schwab all have free Roth IRAs. 20 annual fee for each different Vanguard fund in the account until you hold more than 50k with Vanguard very limited investment offerings. Whereas IRA Financial Groups Solo. Answer 1 of 7. ADP is another 401 k provider that offers combined services for small employers.

Source: ar.pinterest.com

Source: ar.pinterest.com

A checkbook solo 401k from My Solo 401k Financial can be opened at your local bank or credit union or at Fidelity or Charles Schwab with checkbook control. Here at IRA Financial we feel were the best Solo 401k provider and offer everything you could possibly need at a reasonable cost. There is a range of providers in the 401K market place. If you want to buy Vanguard funds such as VTSAX just use Vanguard since they will be commission-free there. My Solo 401k Financial provides a solo 401k plan that allows the business owner to process a solo 401k loan with a 30 year loan payback period if the borrowed proceeds are used toward the purchase of a primary residence.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

Since my contractor income is pretty small lets say like 40kyr my SEP contribution max would be 25 of that so 10k. Solo 401k – this is more complicated. Are good places to check. There is a range of providers in the 401K market place. As such I expected them to be a very low cost provider.

Source: mysolo401k.net

Source: mysolo401k.net

If you are not interested in exotic things or maximum flexibility E-Trade is the best option. Fidelity Schwab Ameritrade etc. TD Ameritrade TD Ameritrade offers one of the more flexible and cost effective plans on the market. But it appears it is not the only company in its pedigree. Vanguard Allows Roth contributions but no rollovers or 401k loans.

Source: mysolo401k.net

Source: mysolo401k.net

In addition most Solo 401k plan providers do not allow for in-plan Roth conversions or rollovers. Usually the key to selecting a solo 401k provider is to determine your needs. Vanguard is very straightforward with its Solo 401 k costs. In the following well talk about all the options to look for in a Solo 401k provider including cost investment opportunities. They allow both traditional and Roth contributions.

Source: sensefinancial.com

Source: sensefinancial.com

There are no account maintenance fees or trading costs which is a big plus. Find out which solo 401k provider is best for you. There are great options at Vanguard Fidelity Schwab and TD Ameritrade. In the following well talk about all the options to look for in a Solo 401k provider including cost investment opportunities. Therefore when determining best Solo 401k plans you need to concentrate.

Source: pinterest.com

Source: pinterest.com

I did a bunch of research before choosing TD Ameritrade. As such I expected them to be a very low cost provider. ADP is another 401 k provider that offers combined services for small employers. My Solo 401k Financial provides a solo 401k plan that allows the business owner to process a solo 401k loan with a 30 year loan payback period if the borrowed proceeds are used toward the purchase of a primary residence. You get to choose.

Source: mysolo401k.net

Source: mysolo401k.net

It specializes in small companies with up to 49 plan members and offers several 401 k plans for businesses. A checkbook solo 401k from My Solo 401k Financial can be opened at your local bank or credit union or at Fidelity or Charles Schwab with checkbook control. These fees can be waived for account holders who have at least 50000 in Vanguard accounts. You get to choose. There are no account maintenance fees or trading costs which is a big plus.

Source: pinterest.com

Source: pinterest.com

As your question in. It is comparable to the difference in Wal-Mart and 7-11. From my experience with them they are also reasonably competent doing things electronically. Answer 1 of 7. They allow both traditional and Roth contributions.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

My Solo 401k Financial provides a solo 401k plan that allows the business owner to process a solo 401k loan with a 30 year loan payback period if the borrowed proceeds are used toward the purchase of a primary residence. Vanguard is very straightforward with its Solo 401 k costs. It specializes in small companies with up to 49 plan members and offers several 401 k plans for businesses. There are nearly 20 companies offering individual or solo 401Ks. I did a bunch of research before choosing TD Ameritrade.

Source: mysolo401k.net

Source: mysolo401k.net

If you want to buy Vanguard funds such as VTSAX just use Vanguard since they will be commission-free there. TD Ameritrade TD Ameritrade offers one of the more flexible and cost effective plans on the market. Vanguard Allows Roth contributions but no rollovers or 401k loans. Best solo 401k plans Best Individual 401k Plans Best Solo 401k Providers. Is there really such a thing as best Solo 401k PlansWell it depends on what you are looking for in your Solo 401k providerIn other words all Solo 401k plans are approved by the IRS through the issuance of an IRS determination letter.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title best solo roth 401k providers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.