Your Brokerage on rbi bonds bitcoin are ready in this website. Brokerage on rbi bonds are a mining that is most popular and liked by everyone now. You can Download the Brokerage on rbi bonds files here. News all royalty-free mining.

If you’re searching for brokerage on rbi bonds images information related to the brokerage on rbi bonds keyword, you have visit the ideal site. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

Brokerage On Rbi Bonds. Click here for RBI Govt. Brokerage - Brokerage at the rate of 05 of the amount mobilized will be paid to the Receiving Offices and they shall share at least 50 of the brokerage so received with brokerssub brokers registered with them on the applications tendered by. You can buy them from any of the 12 PSU banks and hdfc bankICICI bank axis bank. The brokerage fees will be paid for by the Central Accounts Section of the Reserve Bank of India located in Nagpur.

Banks To Get 5 Year Crr Relief For Lending To Auto Housing Msmes Corporate Bonds The Borrowers Mutuals Funds From pinterest.com

Banks To Get 5 Year Crr Relief For Lending To Auto Housing Msmes Corporate Bonds The Borrowers Mutuals Funds From pinterest.com

The idea according to RBI governor Shaktikanta Das is to democratise access to the bond markets which are mostly institutional in nature unlike the equity markets. A person investing in the RBI savings bonds is required to pay brokerage charges at a rate of Re 1 per Rs 100 to the brokers registered with the receiving offices on the applications tendered by them and bearing their stamp on behalf of their clients. Sanriya IAPL on 9175193456 9175937626. Do note that NSC rates are dependent on Government securities rate and get announced every quarter. Brokerage Brokerage at the rate of 05 of the amount mobilized will be paid to the Receiving Offices and they shall share at least 50 of the brokerage so received with brokerssub brokers registered with them on the applications tendered by. Its available in on-line and offline mode.

Brokerage at the rate of 100 Rupee One only per 100- will be paid to brokers registeredenrolled with agency banks on applications tendered for investment in the bonds in the form of Bond Ledger Account BLA at designated branches on behalf of their clients and bearing their stamp.

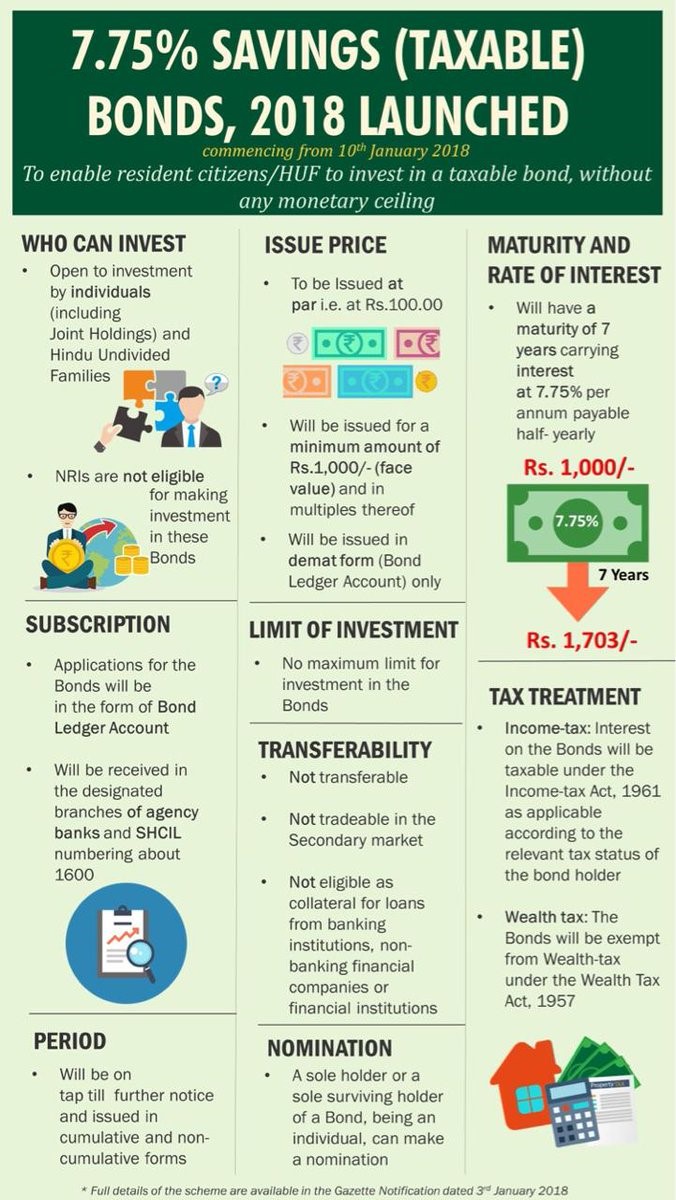

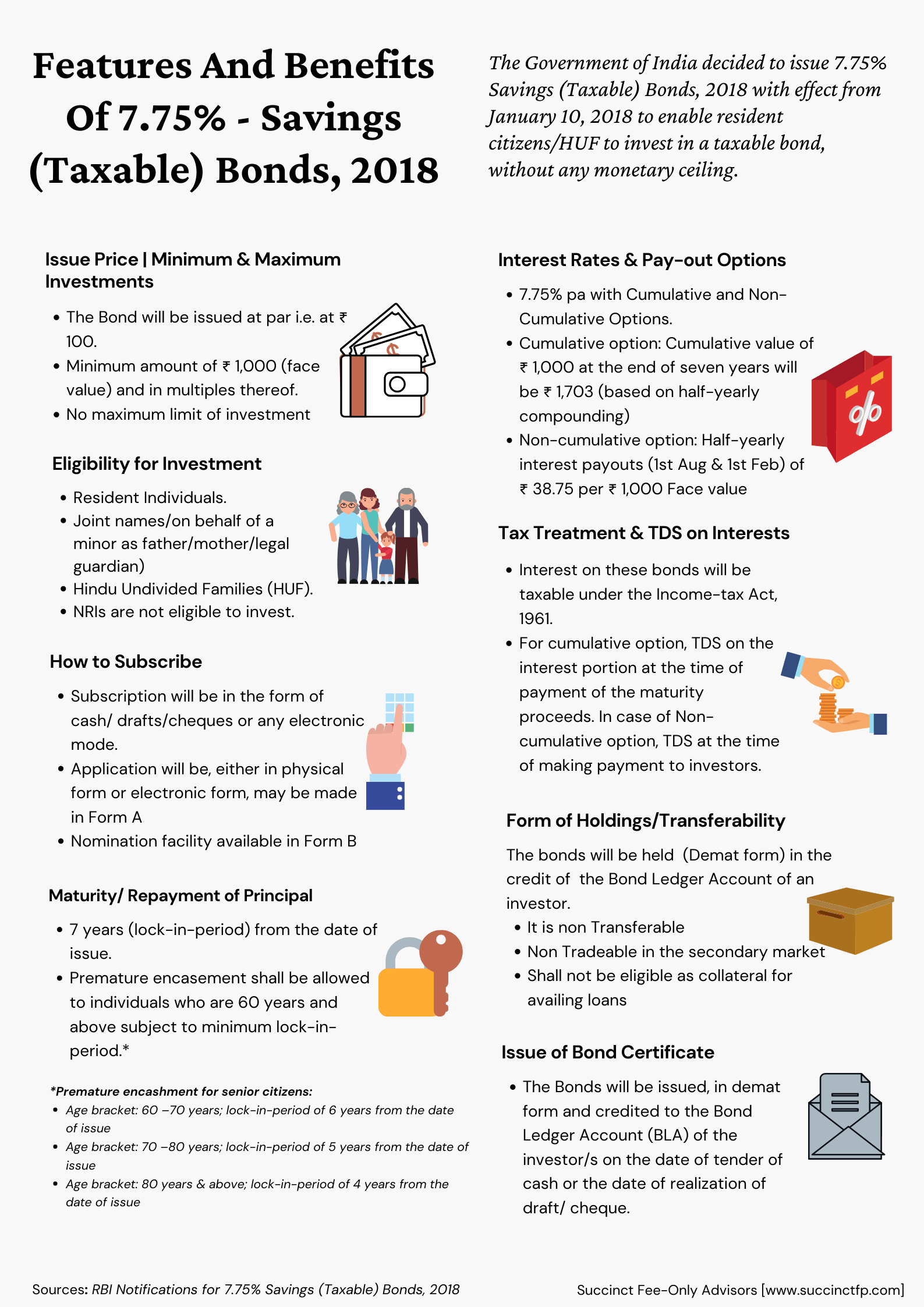

No max limit on investmentlock in period 7 years. Ministry of Finance has announced now that they would be issuing Floating Rate Saving Bonds 2020 Taxable that would open for subscription from 1 July 2020. Of India 715 Floating Rate Savings Taxable Bond Application Form details form filling Process and Submission centers. Tax will be deducted at source while interest is paid. There is no option to pay interest on cumulative basis. No brokerage is payable in case the broker is one of the investorsapplicants.

Source: sanriya.in

Source: sanriya.in

Remember that these bonds are illiquid in nature. The brokerage fees will be paid for by the Central Accounts Section of the Reserve Bank of India located in Nagpur. Ministry of Finance has announced now that they would be issuing Floating Rate Saving Bonds 2020 Taxable that would open for subscription from 1 July 2020. The current rate of NSC is 68 which is the basis of arriving at the 715 rate 68035. No tax is required to be deducted at source by the agency banks while making payment of brokerage in respect of the ReliefSavings bonds business canvassed by brokers in terms of Section 194 H of the Income Tax Act 1961.

Source: in.pinterest.com

Source: in.pinterest.com

No brokerage is payable in case the broker is one of the investorsapplicants. Ministry of Finance has announced now that they would be issuing Floating Rate Saving Bonds 2020 Taxable that would open for subscription from 1 July 2020. No brokerage is payable in case the broker is one of the investorsapplicants. There is no option to pay interest on cumulative basis. The couponinterest of the bond will be reset half yearly based on National Savings Certificate NSC rate Base rate 35bps.

Source: profitsolo.com

Source: profitsolo.com

RBI-RD is a platform that is aimed at encouraging retail investors into buying government securities. Under the Retail Direct option retail. Current interest rate is 715 which is paid twice a year in Jan and July. Brokerage at the rate of 050 Fifty paise only per 100- will be paid to brokers registeredenrolled with the Receiving Offices on applications tendered for investment in the bonds in the form of Bond Ledger Account BLA at Receiving Offices on. The current rate of NSC is 68 which is the basis of arriving at the 715 rate 68035.

Source: profitsolo.com

Source: profitsolo.com

No max limit on investmentlock in period 7 years. Brokerage at the rate of 100 Rupee One only per 100- will be paid to brokers registeredenrolled with agency banks on applications tendered for investment in the bonds in the form of Bond Ledger Account BLA at designated branches on behalf of their clients and bearing their stamp. Brokerage at the rate of Re100 per Rs100 will be paid to the brokers registered with the receiving offices the RBI notification said. Brokerage Brokerage at the rate of 05 of the amount mobilized will be paid to the Receiving Offices and they shall share at least 50 of the brokerage so received with brokerssub brokers registered with them on the applications tendered by. The non-broking products services like Mutual Funds Insurance FD Bonds loans PMS Tax Elocker NPS IPO Research Financial Learning ESOP funding etc.

Source: unovest.co

Source: unovest.co

Distributors can earn up to 1 commission on these bonds. The Interest rate for next half-year will be reset every six months the first reset being on January 01 2021. Brokerage at the rate of 05 of the amount mobilized will be paid to the Receiving Offices and they shall share at least 50 of the brokerage so received with brokerssub brokers registered with them on the applications tendered by them and bearing their stamp on behalf of their clients. The interest rate on RBI Bonds for period July 1 2021 to December 31 2021 and payable on January 1 2022 remains at 715 unchanged from the previous half-year. Key points to remember before you apply.

Source: pinterest.com

Source: pinterest.com

This issue replaces the 8 Savings Bonds Scheme that closed for subscription on Tuesday. Here are some key features of the bond. The Interest rate for next half-year will be reset every six months the first reset being on January 01 2021. Brokerage at the rate of 100 Rupee One only per 100- will be paid to brokers registeredenrolled with agency banks on applications tendered for investment in the bonds in the form of Bond Ledger Account BLA at designated branches on behalf of their clients and bearing their stamp. Sanriya IAPL on 9175193456 9175937626.

Source: pinterest.com

Source: pinterest.com

RBI-RD is a platform that is aimed at encouraging retail investors into buying government securities. Brokerage Brokerage at the rate of 05 of the amount mobilized will be paid to the Receiving Offices and they shall share at least 50 of the brokerage so received with brokerssub brokers registered with them on the applications tendered by. Brokerage at the rate of 05 of the amount mobilized will be paid to the Receiving Offices and they shall share at least 50 of the brokerage so received with brokerssub brokers registered with them on the applications tendered by them and bearing their stamp on behalf of their clients. Distributors can earn up to 1 commission on these bonds. Brokerage at the rate of 100 Rupee One only per 100- will be paid to brokers registeredenrolled with agency banks on applications tendered for investment in the bonds in the form of Bond Ledger Account BLA at designated branches on behalf of their clients and bearing their stamp.

Source: icicidirect.com

Source: icicidirect.com

Cut Off Price Accrued Interest CommissionBrokerage 006 per Rs 100 Interest Payment. No brokerage is payable in case the broker is one of the investorsapplicants. Brokerage at the rate of 05 of the amount mobilized will be paid to the Receiving Offices and they shall share at least 50 of the brokerage so received with brokerssub brokers registered with them on the applications tendered by them and bearing their stamp on behalf of their clients. Income from the bonds is taxable. Remember that these bonds are illiquid in nature.

Source: pinterest.com

Source: pinterest.com

This article aims to explain the process to apply for RBI Bonds Online Offline. RBI had proposed the launch of such a platform. RBI Bonds Online Offline. RBI-RD is a platform that is aimed at encouraging retail investors into buying government securities. RBI 775 Savings Taxable Bond agents advisors broker distributor ifa.

Source: profitsolo.com

Source: profitsolo.com

There is no option to pay interest on cumulative basis. Here are some key features of the bond. No TDS on payment of brokerage. The Reserve Bank of India has launched a retail direct scheme which allows retail investors to directly trade in government securities. There is no option to pay interest on cumulative basis.

Source: pinterest.com

Source: pinterest.com

RBI 775 Savings Taxable Bond agents advisors broker distributor ifa. Here are some key features of the bond. RBI Bonds Online Offline. This article aims to explain the process to apply for RBI Bonds Online Offline. You can buy them from any of the 12 PSU banks and hdfc bankICICI bank axis bank.

Source: analyticssteps.com

Source: analyticssteps.com

The coupon on 1st January 2021 shall be paid at 715. Brokerage Brokerage at the rate of 05 of the amount mobilized will be paid to the Receiving Offices and they shall share at least 50 of the brokerage so received with brokerssub brokers registered with them on the applications tendered by. Half Yearly Interest to the holders will be paid from date of allotmentissue up to next interest payment date and thereafter half yearly till the maturity date. Half-yearly interest is payable on 1st January 1st July. The non-broking products services like Mutual Funds Insurance FD Bonds loans PMS Tax Elocker NPS IPO Research Financial Learning ESOP funding etc.

Source: pinterest.com

Source: pinterest.com

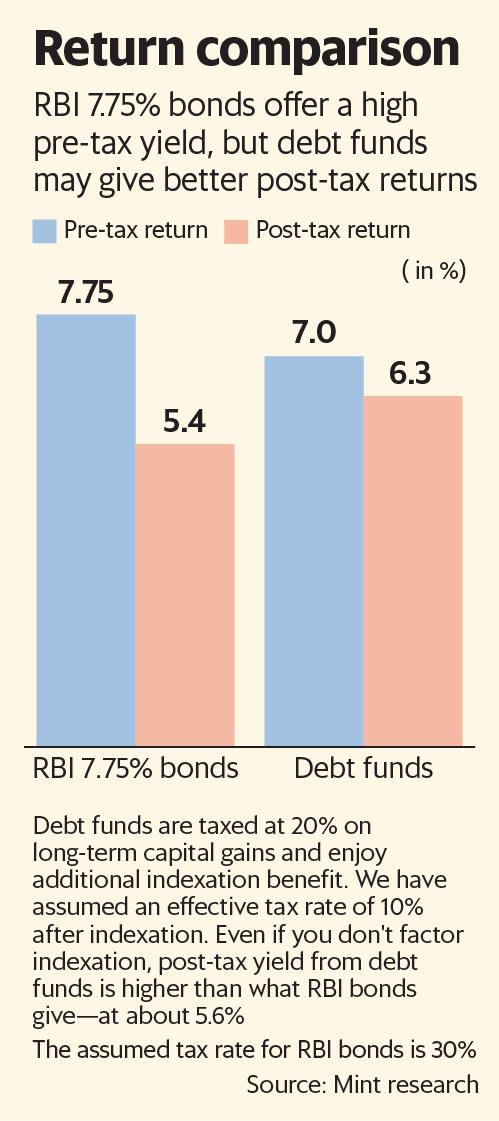

No tax is required to be deducted at source by the agency banks while making payment of brokerage in respect of the ReliefSavings bonds business canvassed by brokers in terms of Section 194 H of the Income Tax Act 1961. Also Read Government Bonds India A Detailed Guide for 2021. RBI Floating Rate Savings Bonds 2021 Features and Interest Rates GOI has issued taxable bonds 775 during 2018-2020 and discontinued in May 2020. The Reserve Bank of India has launched a retail direct scheme which allows retail investors to directly trade in government securities. The current rate of NSC is 68 which is the basis of arriving at the 715 rate 68035.

Source: in.pinterest.com

Source: in.pinterest.com

Cut Off Price Accrued Interest CommissionBrokerage 006 per Rs 100 Interest Payment. Remember that these bonds are illiquid in nature. Brokerage at the rate of 100 Rupee One only per 100- will be paid to brokers registeredenrolled with agency banks on applications tendered for investment in the bonds in the form of Bond Ledger Account BLA at designated branches on behalf of their clients and bearing their stamp. RBI Bonds Online Offline. Half Yearly Interest to the holders will be paid from date of allotmentissue up to next interest payment date and thereafter half yearly till the maturity date.

Source: cafemutual.com

Source: cafemutual.com

RBI 775 Savings Taxable Bond agents advisors broker distributor ifa. No brokerage is payable in case the broker is one of the investorsapplicants. No transfers or trading allowed. Is just acting as a distributor referral Agent of such products services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal. Half-yearly interest is payable on 1st January 1st July.

Source: livemint.com

Source: livemint.com

The interest on the bonds is payable semi-annually on 1st Jan and 1st July every year. The current rate of NSC is 68 which is the basis of arriving at the 715 rate 68035. Of India 715 Floating Rate Savings Taxable Bond Application Form details form filling Process and Submission centers. This includes PPF and UTI agents who are registered with the offices or banks that have been authorised to issue these bonds as well as the Receiving Offices as has been mentioned above by the Reserve Bank of India. No max limit on investmentlock in period 7 years.

Source: succinctfp.com

Source: succinctfp.com

Sanriya IAPL on 9175193456 9175937626. Distributors can earn up to 1 commission on these bonds. RBI Bonds Online Offline. Minimum Investment Face Value Rs 10000-. This issue replaces the 8 Savings Bonds Scheme that closed for subscription on Tuesday.

Source: pinterest.com

Source: pinterest.com

Click here for RBI Govt. Current interest rate is 715 which is paid twice a year in Jan and July. RBI Bonds are issued by the Reserve Bank of India with an interest rate of 715 compounded payable half-yearly. Are not exchange traded products services and ICICI Securities Ltd. Further consumers can also directly participate in primary market auctions for the issuance of new bonds through this scheme in what was otherwise perceived to be a convoluted and arcane process.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title brokerage on rbi bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.