Your Captive financial institutions news are ready. Captive financial institutions are a mining that is most popular and liked by everyone this time. You can Find and Download the Captive financial institutions files here. Find and Download all free wallet.

If you’re searching for captive financial institutions images information related to the captive financial institutions keyword, you have pay a visit to the ideal site. Our site always gives you hints for seeking the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Captive Financial Institutions. This sub-sample features S127 firms whose total assets are. Gabriele Di Filippo and Frédéric Pierret. The paper provides insights into captive financial institutions and money lenders sector S127 in Luxembourg. By main economic activity performed by the groups.

The Us Auto Finance Industry Understanding The Reasons Behind The Dominance Of Captive Oem Financiers Blogs Televisory From televisory.com

The Us Auto Finance Industry Understanding The Reasons Behind The Dominance Of Captive Oem Financiers Blogs Televisory From televisory.com

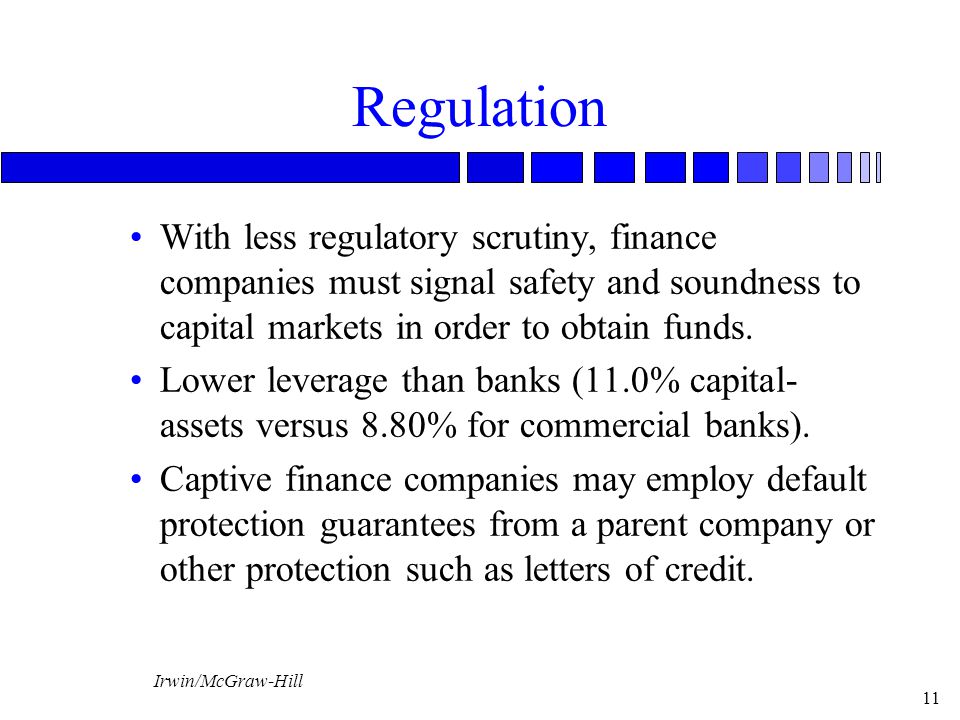

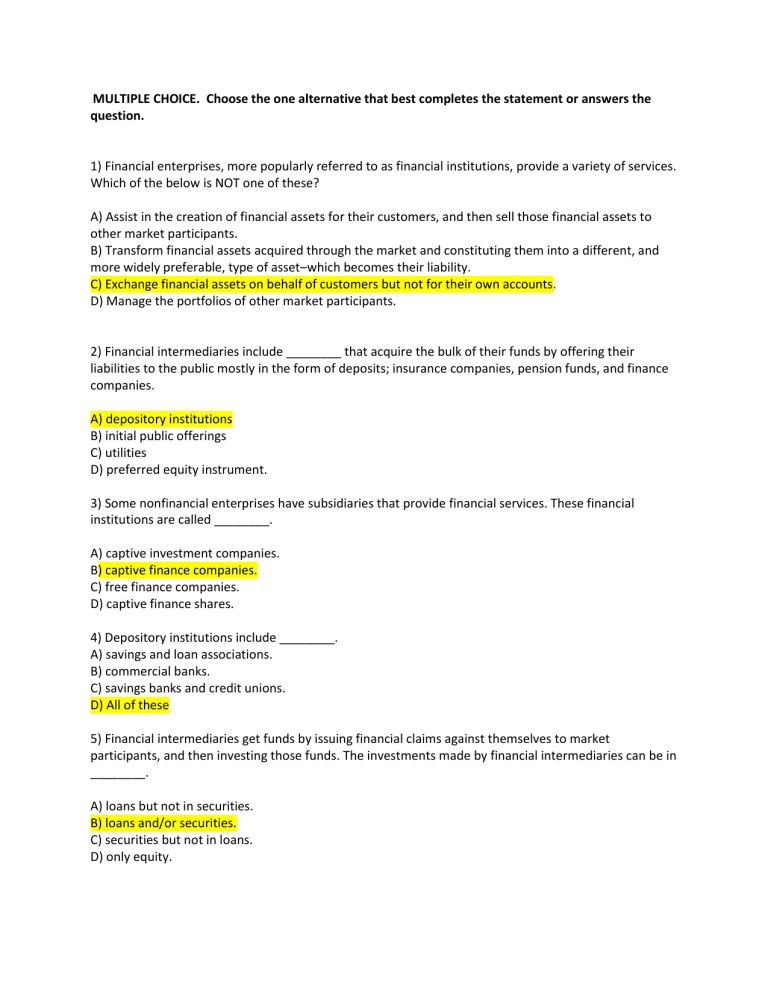

A captive finance company is a wholly-owned subsidiary of an automaker or retailer that provides loans and other financial services to the customers of those companies. Their basic function is to enable centralized cash management of corporate groups and provide financial services to group members with the aim of making the groups financial management more efficient. A captive finance company CFC is a type of non-bank financial institution owned by large and mid-sized corporates. The paper provides insights into captive financial institutions and money lenders sector S127 in Luxembourg. General government may also set up special units with characteristics and functions similar to the captive financial institutions and artificial subsidiaries of corporations just described. We develop a theoretical model that incorporates this feature and in doing so provide an explanation for the emergence of captive finance companies as well as a prediction.

The paper presents a typology of captive financial institutions and money lenders sector S127 in Luxembourg.

It is not unusual for a captive bank to serve as a tax haven for the owners. The paper presents a typology of captive financial institutions and money lenders sector S127 in Luxembourg. The paper presents a typology of captive financial institutions and money lenders sector S127 in Luxembourg. Captive Financial Institutions CFIs have to submit register information for the exact determination of the reporting obligation and the processing of reports. Captive banks are financial institutions that are partially or wholly owned by another entity and are normally created for the exclusive use of the firm or firms that own the bank. By main economic activity performed by the groups.

Source: slidetodoc.com

Source: slidetodoc.com

Captive financial institutions and money lenders. The group captive or pool may also provide other risk management services for the group. No 146 BCL working papers from Central Bank of Luxembourg Abstract. Captive Financial Institutions CFIs have to submit register information for the exact determination of the reporting obligation and the processing of reports. A key feature of a captive finance company is that its credit decision takes into account not only the return from granting captive loans but also the return from the sale of products purchased with captive loans.

Source: cso.ie

Source: cso.ie

Ivory Consulting works with leading captive finance companies to implement sophisticated centrally-controlled modeling and pricing solutions tailored to the captive. General government may also set up special units with characteristics and functions similar to the captive financial institutions and artificial subsidiaries of corporations just described. Examples of other units that are also treated as captive financial institutions are units with the characteristics of SPEs as described above including investment and pension funds and units used for holding and managing wealth for individuals or families issuing debt securities on behalf of related companies such a company may be called a conduit and carrying out other financial functions. No 146 BCL working papers from Central Bank of Luxembourg Abstract. As specialty vehicles designed to assist firms to manage self-insurance of all or a portion of their own risk captives and captive-type solutions can enable firms to manage their TCOR through self-insured retentions and secure coverage which is difficult to obtain from the insurance market.

Source: televisory.com

Source: televisory.com

A captive finance company is a wholly-owned subsidiary of an automaker or retailer that provides loans and other financial services to the customers of those companies. Captive financial institutions and money lenders. Special purpose vehicles hedge funds securities brokers money market funds pension funds insurance companies financial leasing corporations CCPs unit trusts other financial auxiliaries and other captive financial institutions. Given data availability the analysis relies on a sub-sample of the whole population of S127 firms. Other financial intermediaries except insurance companies pension funds financial auxiliaries and captive financial institutions and money lenders.

Source: www2.deloitte.com

Source: www2.deloitte.com

For financial institutions reducing the total cost of risk TCOR is imperative. Liability IMA Transactions BOGZ1FA773181115Q from Q4 1946 to Q1 2021 about transactions equity IMA liabilities and USA. Captive finance companies provide store credit cards for retailers and full-scale banking including multi-year auto loans. 4 Other than the sections of the Financial Institutions Act referred to in subsection 1 and the provisions of the Insurance Act prescribed for the purposes of subsections 1 and 3 those Acts do not apply to a captive insurance company. The paper presents a typology of captive financial institutions and money lenders sector S127 in Luxembourg.

Source: slidetodoc.com

Source: slidetodoc.com

A captive finance company CFC is a type of non-bank financial institution owned by large and mid-sized corporates. To this end the paper relies on two metrics. Examples of other units that are also treated as captive financial institutions are units with the characteristics of SPEs as described above including investment and pension funds and units used for holding and managing wealth for individuals or families issuing debt securities on behalf of related companies such a company may be called a conduit and carrying out other financial functions. Captive finance companies are financial institutions that offer their services to customers of some retailers in order to let the customers buy the retailers products. We develop a theoretical model that incorporates this feature and in doing so provide an explanation for the emergence of captive finance companies as well as a prediction.

Source: slidetodoc.com

Source: slidetodoc.com

Gabriele Di Filippo and Frédéric Pierret. The analysis breaks down the evolution of both metrics across various dimensions. For more information you can contact our reporting team for CFIs via email-address si-media dnbnl. Captive banks are financial institutions that are partially or wholly owned by another entity and are normally created for the exclusive use of the firm or firms that own the bank. To this end the paper relies on two metrics.

Source: slideplayer.com

Source: slideplayer.com

Captive finance companies are financial institutions that offer their services to customers of some retailers in order to let the customers buy the retailers products. As specialty vehicles designed to assist firms to manage self-insurance of all or a portion of their own risk captives and captive-type solutions can enable firms to manage their TCOR through self-insured retentions and secure coverage which is difficult to obtain from the insurance market. We develop a theoretical model that incorporates this feature and in doing so provide an explanation for the emergence of captive finance companies as well as a prediction. Captive Financial Institutions CFIs have to submit register information for the exact determination of the reporting obligation and the processing of reports. Liability FL604135005 Q Other financial intermediaries except insurance companies pension funds financial auxiliaries and captive financial institutions and money lenders.

Source: slideplayer.com

Source: slideplayer.com

As specialty vehicles designed to assist firms to manage self-insurance of all or a portion of their own risk captives and captive-type solutions can enable firms to manage their TCOR through self-insured retentions and secure coverage which is difficult to obtain from the insurance market. Captive finance companies also extend financing to customers or corporations with a poor credit rating that might otherwise be turned down by other financial institutions. A key feature of a captive finance company is that its credit decision takes into account not only the return from granting captive loans but also the return from the sale of products purchased with captive loans. It is not unusual for a captive bank to serve as a tax haven for the owners. Captive finance companies provide store credit cards for retailers and full-scale banking including multi-year auto loans.

Source: slidetodoc.com

Source: slidetodoc.com

For more information you can contact our reporting team for CFIs via email-address si-media dnbnl. The total assets and the total number of S127 entities. The paper presents a typology of captive financial institutions and money lenders sector S127 in Luxembourg. By main economic activity performed by the groups. Captive finance companies provide store credit cards for retailers and full-scale banking including multi-year auto loans.

Source: slideplayer.com

Source: slideplayer.com

Graph and download economic data for Captive Financial Institutions and Money Lenders. A captive finance company CFC is a type of non-bank financial institution owned by large and mid-sized corporates. The paper provides insights into captive financial institutions and money lenders sector S127 in Luxembourg. Financial institutions which are neither engaged in financial intermediation nor in providing financial auxiliary services and where most of either their assets or their liabilities are not transacted on open markets. Non-bank financial corporations include the following entities.

Source: www2.deloitte.com

Source: www2.deloitte.com

Graph and download economic data for Captive Financial Institutions and Money Lenders. A captive finance company is a wholly-owned subsidiary of an automaker or retailer that provides loans and other financial services to the customers of those companies. Captive banks are financial institutions that are partially or wholly owned by another entity and are normally created for the exclusive use of the firm or firms that own the bank. Their basic function is to enable centralized cash management of corporate groups and provide financial services to group members with the aim of making the groups financial management more efficient. A captive finance company is a wholly-owned subsidiary of an automaker or retailer that provides loans and other financial services to the customers of those companies.

Source: mondaq.com

Source: mondaq.com

Captive financial institutions and money lenders. Special purpose vehicles hedge funds securities brokers money market funds pension funds insurance companies financial leasing corporations CCPs unit trusts other financial auxiliaries and other captive financial institutions. By main economic activity performed by the groups. As specialty vehicles designed to assist firms to manage self-insurance of all or a portion of their own risk captives and captive-type solutions can enable firms to manage their TCOR through self-insured retentions and secure coverage which is difficult to obtain from the insurance market. To this end the paper relies on two metrics.

Source: www2.deloitte.com

Source: www2.deloitte.com

Sponsored captive insurers sometimes referred to as nonowned or nonaffiliated captives have many of the same elements as a pure captive insurer. Growth was mainly driven through the. 4 Other than the sections of the Financial Institutions Act referred to in subsection 1 and the provisions of the Insurance Act prescribed for the purposes of subsections 1 and 3 those Acts do not apply to a captive insurance company. A Typology of Captive Financial Institutions and Money Lenders sector S127 in Luxembourg. Captive banks are financial institutions that are partially or wholly owned by another entity and are normally created for the exclusive use of the firm or firms that own the bank.

Source: studylib.net

Source: studylib.net

Captive Financial Institutions CFIs have to submit register information for the exact determination of the reporting obligation and the processing of reports. Non-bank financial corporations include the following entities. As specialty vehicles designed to assist firms to manage self-insurance of all or a portion of their own risk captives and captive-type solutions can enable firms to manage their TCOR through self-insured retentions and secure coverage which is difficult to obtain from the insurance market. Ivory Consulting works with leading captive finance companies to implement sophisticated centrally-controlled modeling and pricing solutions tailored to the captive. To this end the paper relies on two metrics.

Source: televisory.com

Source: televisory.com

The group captive or pool may also provide other risk management services for the group. Given data availability the analysis relies on a sub-sample of the whole population of S127 firms. Captive banks are financial institutions that are partially or wholly owned by another entity and are normally created for the exclusive use of the firm or firms that own the bank. A captive finance company CFC is a type of non-bank financial institution owned by large and mid-sized corporates. Given data availability the analysis relies on a sub-sample of the whole.

Source: finance-watch.org

Source: finance-watch.org

As specialty vehicles designed to assist firms to manage self-insurance of all or a portion of their own risk captives and captive-type solutions can enable firms to manage their TCOR through self-insured retentions and secure coverage which is difficult to obtain from the insurance market. We develop a theoretical model that incorporates this feature and in doing so provide an explanation for the emergence of captive finance companies as well as a prediction. General government may also set up special units with characteristics and functions similar to the captive financial institutions and artificial subsidiaries of corporations just described. Non-bank financial corporations include the following entities. The insureds are required to put their capital at risk risks are financed outside of the commercial regulatory.

Source: slideplayer.com

Source: slideplayer.com

They provide financial solutions to customers helping them afford the payment for goods and services. UN-2 A holding company that simply owns the assets of subsidiaries is one example of a captive financial institution. This sector includes institutional units that hold. Gabriele Di Filippo and Frédéric Pierret. Captive finance companies provide store credit cards for retailers and full-scale banking including multi-year auto loans.

A key feature of a captive finance company is that its credit decision takes into account not only the return from granting captive loans but also the return from the sale of products purchased with captive loans. The insureds are required to put their capital at risk risks are financed outside of the commercial regulatory. For financial institutions reducing the total cost of risk TCOR is imperative. Sponsored captive insurers sometimes referred to as nonowned or nonaffiliated captives have many of the same elements as a pure captive insurer. Non-bank financial corporations include the following entities.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title captive financial institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.