Your Coast capital mortgage rates trading are obtainable. Coast capital mortgage rates are a coin that is most popular and liked by everyone now. You can Download the Coast capital mortgage rates files here. Find and Download all royalty-free coin.

If you’re looking for coast capital mortgage rates pictures information related to the coast capital mortgage rates keyword, you have visit the ideal site. Our site always provides you with hints for seeking the maximum quality video and image content, please kindly search and locate more enlightening video articles and graphics that match your interests.

Coast Capital Mortgage Rates. This is a variable rate product which will fluctuate with the Coast Capital Savings prime rate. Coast Capital mortgage rates depends on the type of mortgage that is chosen for purchasing your new home the mortgage market and if you have held or are currently holding a mortgage. All rates subject to change without notice. If the term is greater than five years and you prepay after the fifth year of the term the prepayment charge is equal to 90 days interest The interest rate differential is the difference between your existing mortgage interest rate and our current posted rate.

Pin On I Like From pinterest.com

Pin On I Like From pinterest.com

The variable mortgage APR is compounded monthly not in advance. Reach out to a Coast Capital Mortgage Specialist for more details on the homebuying process. The fixed mortgage Annual Percentage Rate APR is compounded semi-annually not in advance. For fixed rate mortgages the prepayment charge is the higher of 90 days interest calculated at the applicable fixed interest rate at the time of prepayment or an amount calculated using interest rate differential IRD. Get pre-approved for a mortgage Get pre-approved for a mortgage Renew my mortgage Move my mortgage Refinance my home. Its a type of relationship pricing something thats long been practised at banks and credit unions in one form or another.

Coasts Youre the Boss mortgage comes packed with features.

APR fluctuates with Coast Capital Savings prime rate. Whether you looking for Purchase Refinance or Specialized Loans we can do it. New Brunswick Dieppe 58 Edmundston 38 Fredericton 42 Moncton 153 Saint John 119. Mortgages with big pre-payment allowances for example are more expensive to fund. In 2021 the average price of a house in BC. Most often a variable-rate mortgage will track the Bank of Canadas prime rate rising or falling in line with any changes.

Source: in.pinterest.com

Source: in.pinterest.com

Thats slightly below the. Coast Capital Savings Credit Union. For more information on rates call us at 18885177000 or visit a Coast Capital Savings branch. Each lender will follow roughly the same steps when assessing your application. Always confirm the exact up-to-date rate and terms directly with the provider itself.

Coast Capitals mortgage pre-approval application is available online and takes about 10 minutes to complete. Lets find the right mortgage together. Coast Capital Mortgage Rates Bc Applying for a home equity loan is similar but easier than applying for a new mortgage. Coast Capital mortgage rates depends on the type of mortgage that is chosen for purchasing your new home the mortgage market and if you have held or are currently holding a mortgage. The fixed mortgage Annual Percentage Rate APR is compounded semi-annually not in advance.

Source: pinterest.com

Source: pinterest.com

For fixed rate mortgages the prepayment charge is the higher of 90 days interest calculated at the applicable fixed interest rate at the time of prepayment or an amount calculated using interest rate differential IRD. Its never too early to plan ahead and discuss renewing your Coast Capital mortgage. All rates subject to change without notice. This is a variable rate product which will fluctuate with the Coast Capital Savings prime rate. Mortgages with big pre-payment allowances for example are more expensive to fund.

Source: pinterest.com

Source: pinterest.com

Getting started is as easy as a quick phone call. The fixed mortgage Annual Percentage Rate APR is compounded semi-annually not in advance. A few weeks back Coast Capital the countrys third-largest credit union started offering its best rates only if a broker customer takes four of its other products. Coast Capital mortgage rates depends on the type of mortgage that is chosen for purchasing your new home the mortgage market and if you have held or are currently holding a mortgage. Mortgages with big pre-payment allowances for example are more expensive to fund.

Source: pinterest.com

Source: pinterest.com

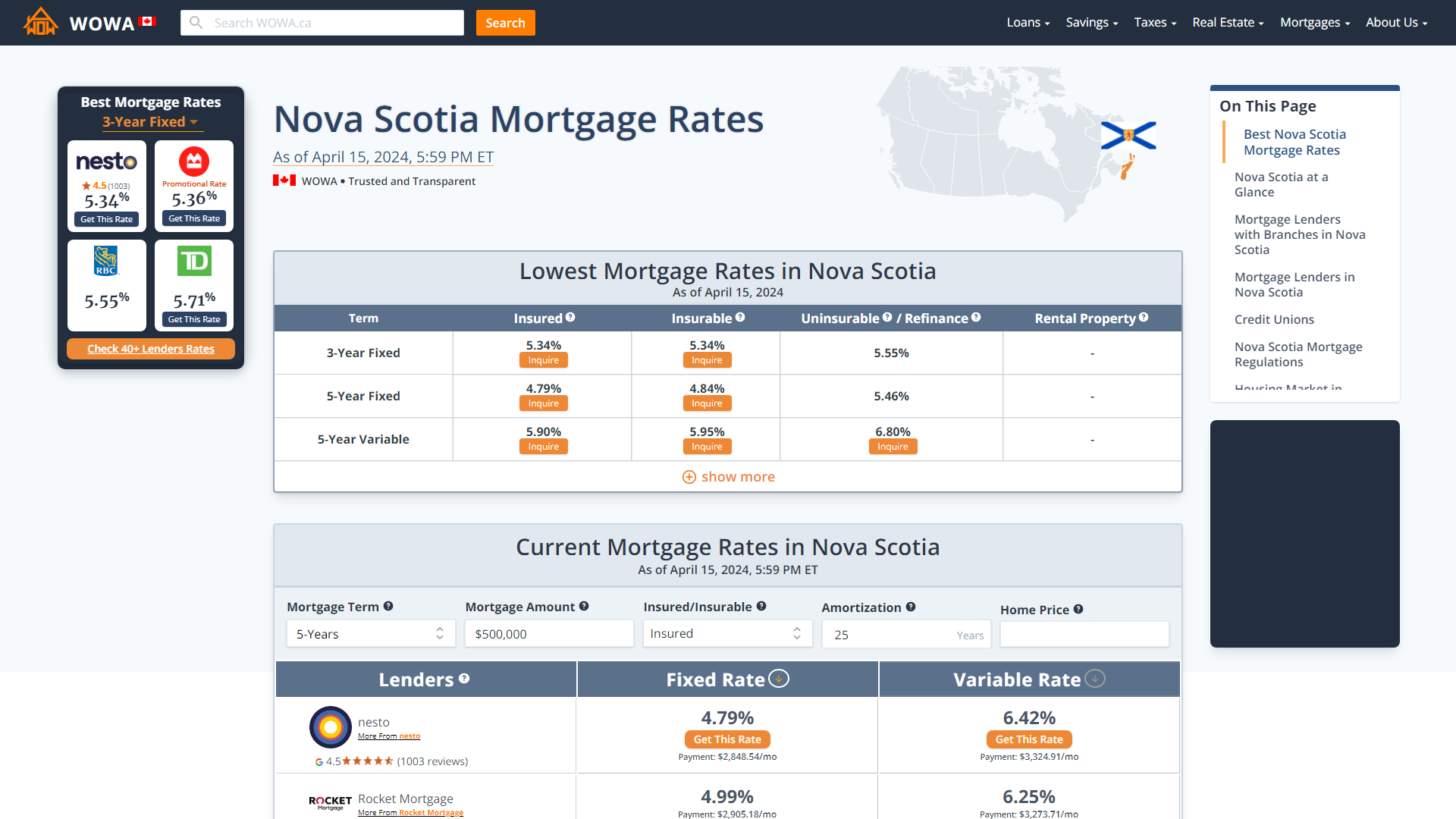

Coast Capital Mortgage Rates Bc Applying for a home equity loan is similar but easier than applying for a new mortgage. National Bank Banque Nationale was founded in 1859 and opened their first office in Quebec CityToday National Bank of Canada is headquartered in Montreal and is the sixth largest bank in Canada. The benefit of a fixed mortgage is that you are protected against interest rate fluctuations so your regular payments stay constant over the duration of your term regardless of what happens in the market. Check out our competitive mortgage rates. British Columbia Burnaby 721 Kelowna 596 Richmond 933 Surrey 1237 Vancouver 2642.

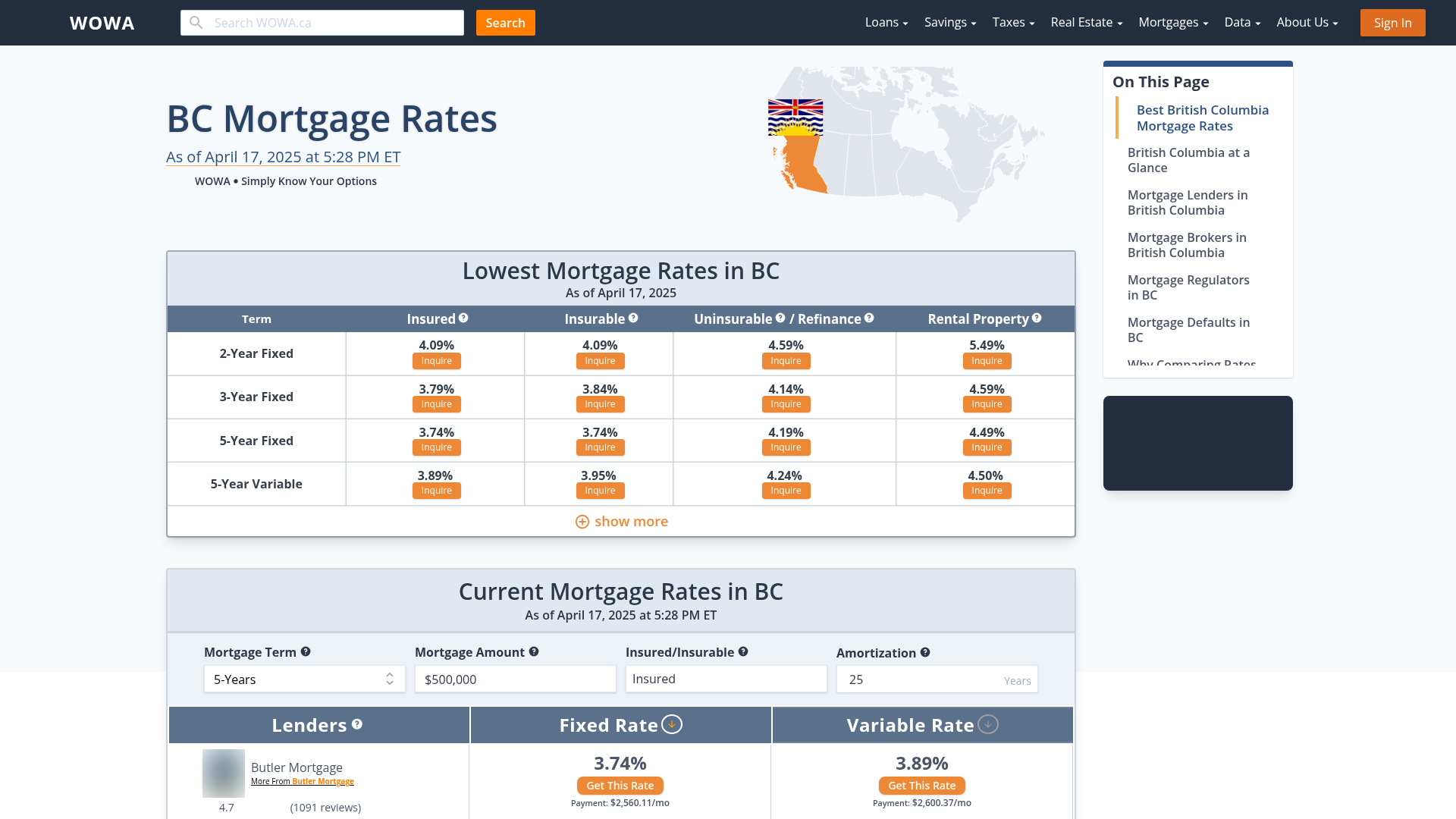

Source: wowa.ca

Source: wowa.ca

Let our low rates speak for themselves. BC credit union Coast Capital Savings has found a way to make flexibility work while still offering one of the lowest rates in the market. The fixed mortgage Annual Percentage Rate APR is compounded semi-annually not in advance. On a positive note 87 of BC homeowners say they are confident in their recent mortgage decisions with lower interest rates playing a key role in driving this sentiment for 54 of respondents. For new high-ratio-insured closed residential owner-occupied first mortgage loans made to members with a Direct Payroll Deposit to a Coast Capital Savings account and a Pre-Authorized Credit into a Coast Capital Savings investment.

Source: wowa.ca

Source: wowa.ca

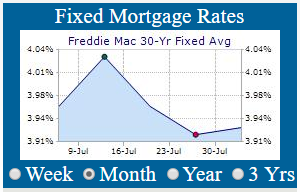

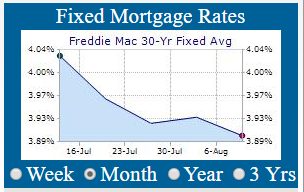

Historically speaking anything below 4 percent is a very good mortgage rate. Fixed mortgage rates are a historically popular option with 5-year fixed mortgage rates accounting for nearly 46 of new mortgages in 2020. Fixed mortgage rates. Getting started is as easy as a quick phone call. Thats slightly below the.

Source: pinterest.com

Source: pinterest.com

Fixed mortgage rates are a historically popular option with 5-year fixed mortgage rates accounting for nearly 46 of new mortgages in 2020. Contact Us 877 771-4973 or use the form on this page to take the first step toward the best interest rate and value in a mortgage. APR fluctuates with Coast Capital Savings prime rate. The benefit of a fixed mortgage is that you are protected against interest rate fluctuations so your regular payments stay constant over the duration of your term regardless of what happens in the market. If fees or charges apply the APR could increase.

Source: in.pinterest.com

Source: in.pinterest.com

For more information on rates call us at 18885177000 or visit a Coast Capital Savings branch. Most often a variable-rate mortgage will track the Bank of Canadas prime rate rising or falling in line with any changes. Reach out to a Coast Capital Mortgage Specialist for more details on the homebuying process. Getting started is as easy as a quick phone call. The fixed mortgage Annual Percentage Rate APR is compounded semi-annually not in advance.

Source: id.pinterest.com

Source: id.pinterest.com

Thats slightly below the. 575 Interest Rate 688 APR. If the BOC puts the rate up by one percentage point your rate will rise by a point to match. This is a variable rate product which will fluctuate with the Coast Capital Savings prime rate. All rates subject to change without notice.

Source: in.pinterest.com

Source: in.pinterest.com

Below are the lowest mortgage rates that RateSpy is tracking for Coast Capital Savings Credit Union. The variable mortgage APR is compounded monthly not in advance. Contact Us 877 771-4973 or use the form on this page to take the first step toward the best interest rate and value in a mortgage. Remember that the lowest. Coast Capitals mortgage pre-approval application is available online and takes about 10 minutes to complete.

Source: erate.com

Source: erate.com

Coast Capital Mortgage Rates. For more information on rates call us at 18885177000 or visit a Coast Capital Savings branch. When the Coast Capital Savings prime rate goes up or down the Half Half Rate goes up or down by one-half of the change in the prime rate. Coast Capital Mortgage Rates. The fixed mortgage Annual Percentage Rate APR is compounded semi-annually not in advance.

Source: pinterest.com

Source: pinterest.com

Contact Us 877 771-4973 or use the form on this page to take the first step toward the best interest rate and value in a mortgage. TD Canada Trust 1 Year Fixed Rate Mortgage. In 2021 the average price of a house in BC. Getting started is as easy as a quick phone call. The result is the Youre the Boss mortgage.

Source: koloans.com

Source: koloans.com

Interest rates on personal loans vary based on the application. The APR assumes the interest rate does not vary over the term. Most often a variable-rate mortgage will track the Bank of Canadas prime rate rising or falling in line with any changes. Coast Capital Savings Credit Union Mortgage Rates. The lender will ask you for much of the same information as it would when applying for Va Home Loan Illinois a mortgagesuch as access to your credit score and.

Source: erate.com

Source: erate.com

Remember that the lowest. Each lender will follow roughly the same steps when assessing your application. Coast Capital Mortgage Calculator. In 2021 the average price of a house in BC. If fees or charges apply the APR could increase.

Source: id.pinterest.com

Source: id.pinterest.com

If the BOC puts the rate up by one percentage point your rate will rise by a point to match. The variable mortgage APR is compounded monthly not in advance. Initial interest rate and the APR on a 1-year variable rate open mortgage compounded monthly. If fees or charges apply the APR could increase. Fixed mortgage rates.

Source: wowa.ca

Source: wowa.ca

Getting started is as easy as a quick phone call. When the Coast Capital Savings prime rate goes up or down the Half Half Rate goes up or down by one-half of the change in the prime rate. Coast Capital Savings Credit Union. TD Canada Trust 1 Year Fixed Rate Mortgage. For fixed rate mortgages the prepayment charge is the higher of 90 days interest calculated at the applicable fixed interest rate at the time of prepayment or an amount calculated using interest rate differential IRD.

Source: pinterest.com

Source: pinterest.com

Here at East Coast Capital Corporation we have the right loan program for you. Initial interest rate and the APR on a 1-year variable rate open mortgage compounded monthly. Getting started is as easy as a quick phone call. Fixed mortgage rates. APR fluctuates with Coast Capital Savings prime rate.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title coast capital mortgage rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.