Your Crr credit institution bitcoin are obtainable. Crr credit institution are a exchange that is most popular and liked by everyone today. You can News the Crr credit institution files here. Download all royalty-free wallet.

If you’re looking for crr credit institution pictures information linked to the crr credit institution keyword, you have come to the right blog. Our website frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Crr Credit Institution. 3 in relation to the definition of electronic money issuer and payment service provider 215 a credit institution as defined by 1a and includes a branch of the credit institution within the meaning of article 4117 of the UK CRR 230 which is situated within the UK 230 and which has its head office in a territory outside the UK 230. Regulation on prudential requirements for credit institutions and investment firms CRR. Regulatory challenges for the next three years 7. Under section 10a 1 of the KWG a group of institutions a financial holding group or a mixed financial holding group group consists of a superordinate company and one or more subordinate companies.

Crr Credit Institution Authorisation Process From www2.deloitte.com

Crr Credit Institution Authorisation Process From www2.deloitte.com

1 credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account. The taking of deposits from retail customers is the licensable activity that distinguishes a credit institution. 3d sentence 1 of the German Banking Act KWG in conjunction with Art. Legally defined as an undertaking whose business is to receive deposits or other repayable funds from the public and to grant credits for its own account. For the purposes of this Regulation the following definitions shall apply. A CRR credit institution is generally referred to as a fully licensed bank.

Z credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account.

Credit institutions are entities licensed to operate under the Banking Act Chapter 371 of the Laws of Malta. 1 of the CRR Regulation Regulation EU No. 3 in relation to the definition of electronic money issuer and payment service provider 215 a credit institution as defined by 1a and includes a branch of the credit institution within the meaning of article 4117 of the UK CRR 230 which is situated within the UK 230 and which has its head office in a territory outside the UK 230. Legally defined as an undertaking whose business is to receive deposits or other repayable funds from the public and to grant credits for its own account. To qualify as a credit institution under the KWG it is sufficient to conduct a single banking transaction from the catalog in section 1 1 sentence 2 of the KWG. While CRR I states that credit institutions will have to apply a 8 capital charge respectively 12 for highly risked CIUs CRR II applies a more conservative approach with a 100 capital charge if the investments in the fund are not looked through and the calculations not certified.

Source: educba.com

Source: educba.com

Regulation on prudential requirements for credit institutions and investment firms CRR. Credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account. 1 of the CRR Regulation Regulation EU No. Under section 10a 1 of the KWG a group of institutions a financial holding group or a mixed financial holding group group consists of a superordinate company and one or more subordinate companies. Credit institution Other financial undertaking Financial holding company Credit institution Financial institution Ancillary services undertaking EU Subsidiary II Subsidiary I Third-Country IPU 1 Point of non-viability Supervision on consolidated level CRR II.

Source: researchgate.net

Source: researchgate.net

Class 1 investment firms. September 18 2020. Z credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account. As a result the amended CRR definition of credit institutions implies that undertakings which meet point a above remain classified as credit institutions and also that investment firms which meet any of the points bi to biii ie. 3d sentence 1 of the German Banking Act KWG in conjunction with Art.

Source:

Credit institution Other financial undertaking Financial holding company Credit institution Financial institution Ancillary services undertaking EU Subsidiary II Subsidiary I Third-Country IPU 1 Point of non-viability Supervision on consolidated level CRR II. Credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account. 1 of the CRR Regulation Regulation EU No. Pursuant to section 1 3d of the Banking Act a CRR credit institution is a credit institution that also meets the narrower definition of a credit institution in accordance with Article 4 1 no. 3d sentence 1 of the German Banking Act KWG in conjunction with Art.

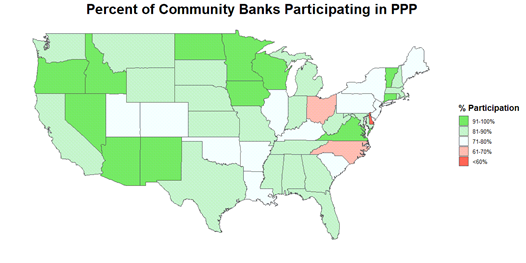

Source: slideserve.com

Source: slideserve.com

A CRR credit institution is generally referred to as a fully licensed bank. EBA published an Opinion addressed to EC to raise awareness about the opportunity to clarify certain issues related to the definition of credit institution in the upcoming review of the Capital Requirements Directive and Regulation CRD and CRR. 1 of the CRR Regulation Regulation EU No. Branches of credit institutions authorised in another EEA country which have the right to passport their activities. September 18 2020.

Source: in.pinterest.com

Source: in.pinterest.com

Regulation on prudential requirements for credit institutions and investment firms CRR. 3d sentence 1 of the German Banking Act KWG in conjunction with Art. The term credit institution used in the CRR is not the same as the term credit institution in the KWG according to Section 1 1 KWG. EBA published an Opinion addressed to EC to raise awareness about the opportunity to clarify certain issues related to the definition of credit institution in the upcoming review of the Capital Requirements Directive and Regulation CRD and CRR. 1 of the EU Capital Requirements Regulation CRR.

Source: pinterest.com

Source: pinterest.com

3 in relation to the definition of electronic money issuer and payment service provider 215 a credit institution as defined by 1a and includes a branch of the credit institution within the meaning of article 4117 of the UK CRR 230 which is situated within the UK 230 and which has its head office in a territory outside the UK 230. A CRR credit institution pursuant to Section 1 para. As a result the amended CRR definition of credit institutions implies that undertakings which meet point a above remain classified as credit institutions and also that investment firms which meet any of the points bi to biii ie. Credit institution Other financial undertaking Financial holding company Credit institution Financial institution Ancillary services undertaking EU Subsidiary II Subsidiary I Third-Country IPU 1 Point of non-viability Supervision on consolidated level CRR II. The taking of deposits from retail customers is the licensable activity that distinguishes a credit institution.

Source: researchgate.net

Source: researchgate.net

Regulatory challenges for the next three years 7. Such investment firms will be reclassified as credit institutions making them subject to the same prudential requirements as large credit institutions under the CRR and the CRD IV regimes 12. Credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account. Regulation on prudential requirements for credit institutions and investment firms CRR. 1 credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account.

Source: www2.deloitte.com

Source: www2.deloitte.com

The definition of credit institution is set out in Article 54 point 1 letter a of the CRR providing that. A CRR credit institution belongs has the meaning defined in section 10a 1 of the KWG. Regulation on prudential requirements for credit institutions and investment firms CRR. September 18 2020. Contribution on the licensing procedure according to 32 KWG under the Single Supervisory Mechanism for the establishment of CRR financial institutions by Mathias Hanten Service Line Leader Banking Finance Deloitte Legal Frankfurt Betriebs-Berater.

Source:

Source:

As a result the amended CRR definition of credit institutions implies that undertakings which meet point a above remain classified as credit institutions and also that investment firms which meet any of the points bi to biii ie. Credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account. Contribution on the licensing procedure according to 32 KWG under the Single Supervisory Mechanism for the establishment of CRR financial institutions by Mathias Hanten Service Line Leader Banking Finance Deloitte Legal Frankfurt Betriebs-Berater. Pursuant to section 1 3d of the Banking Act a CRR credit institution is a credit institution that also meets the narrower definition of a credit institution in accordance with Article 4 1 no. Where an investment firm has deposited with a credit institution any cash or financial instrument belonging to a client this constitutes a credit risk exposure to the credit institution according to Article 119 CRR to the extent that the investment firm needs to provide compensation to the client in case of not or not completely receiving back from the credit institution the cash or financial instrument that had.

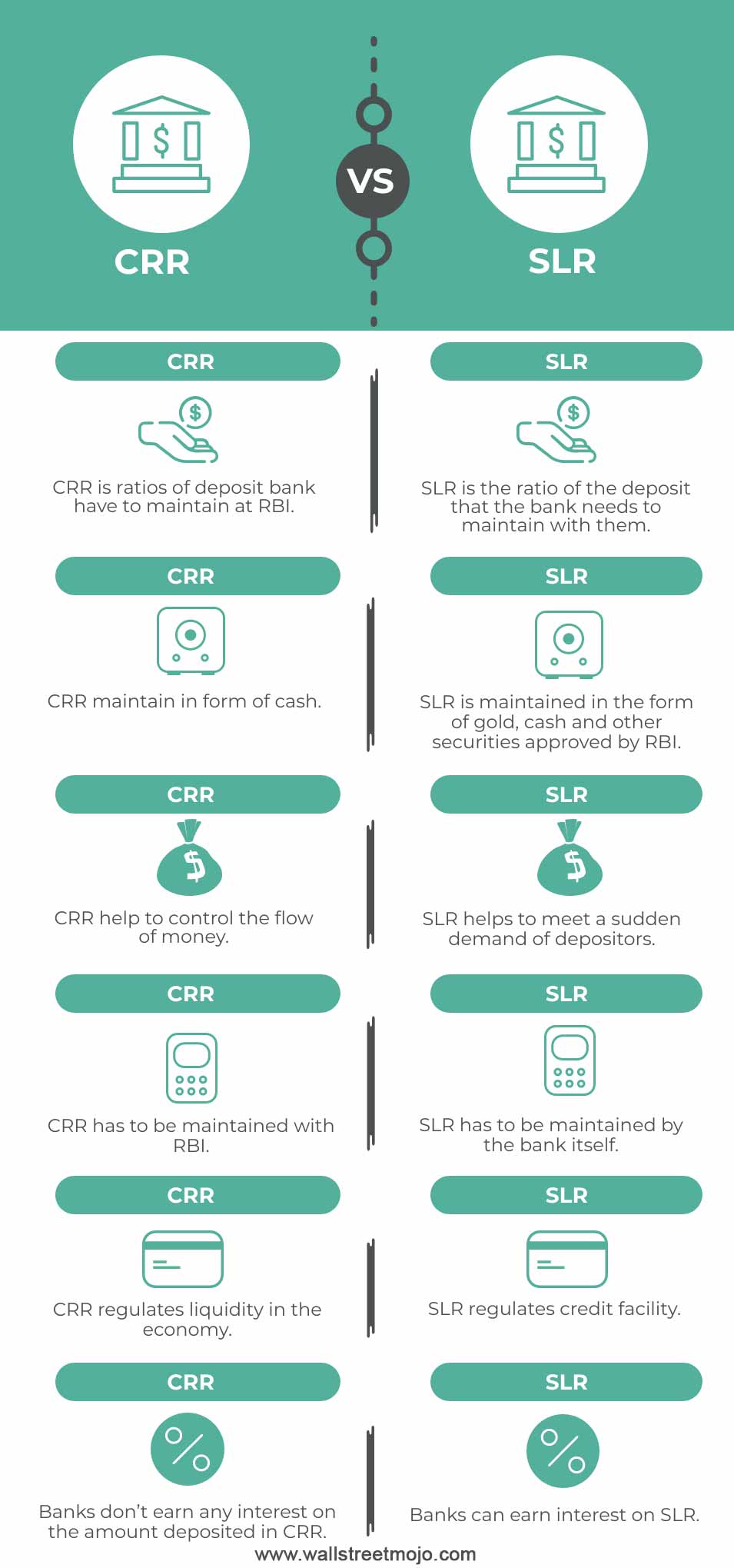

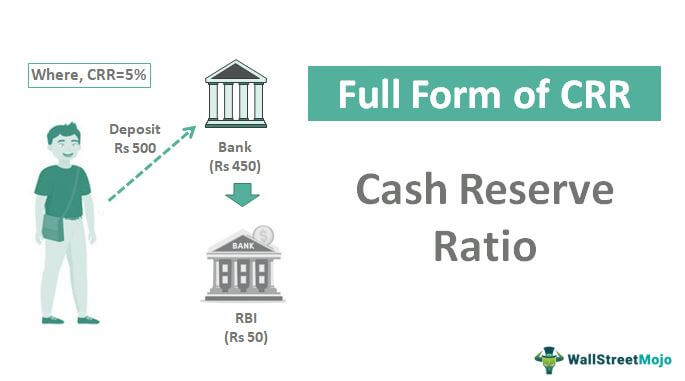

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Branches of credit institutions authorised in another EEA country which have the right to passport their activities. 3d sentence 1 of the German Banking Act KWG in conjunction with Art. CRR Credit Institution means a credit institution as defined in Article 4 para 1 no. To qualify as a credit institution under the KWG it is sufficient to conduct a single banking transaction from the catalog in section 1 1 sentence 2 of the KWG. Credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account.

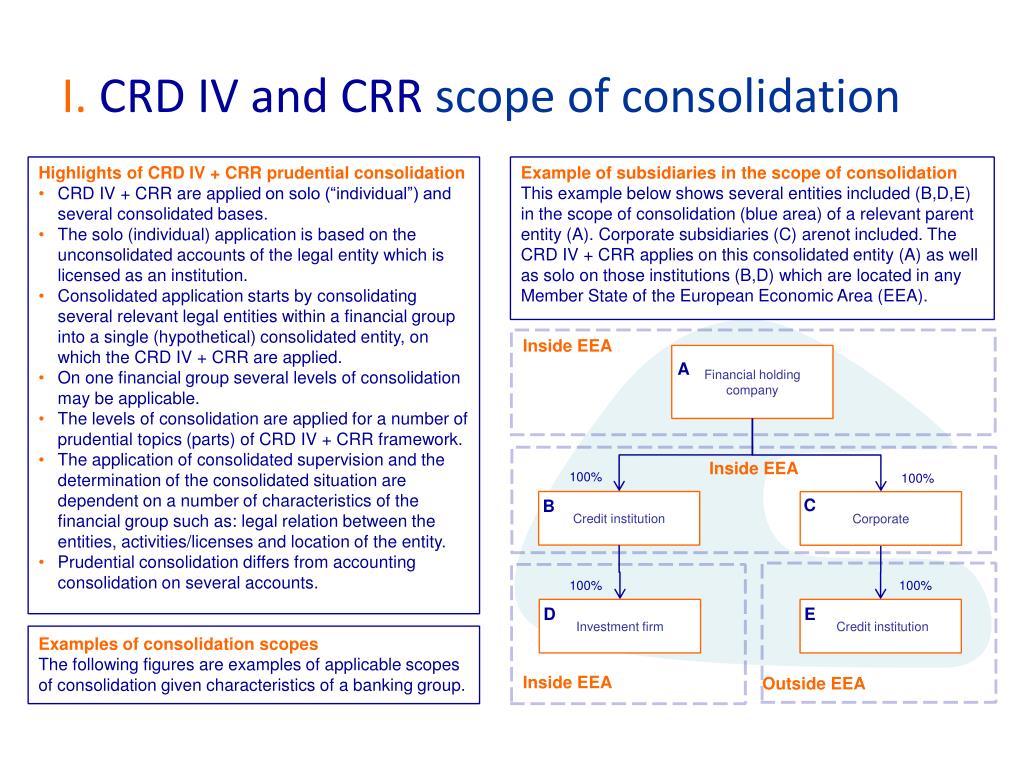

Source: eba.europa.eu

Source: eba.europa.eu

Class 1 investment firms will be required to apply for a license as a credit institution and will thereafter be subject to the CRRCRD requirements in the same. A CRR credit institution pursuant to Section 1 para. 3d sentence 1 of the German Banking Act KWG in conjunction with Art. For the purposes of this Regulation the following definitions shall apply. Z credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account.

Source: bafin.de

Source: bafin.de

The term is therefore more narrowly. Legally defined as an undertaking whose business is to receive deposits or other repayable funds from the public and to grant credits for its own account. September 18 2020. IFR amends the definition of a credit institution in the CRR 13 by including firms. EBA published an Opinion addressed to EC to raise awareness about the opportunity to clarify certain issues related to the definition of credit institution in the upcoming review of the Capital Requirements Directive and Regulation CRD and CRR.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

The taking of deposits from retail customers is the licensable activity that distinguishes a credit institution. To qualify as a credit institution under the KWG it is sufficient to conduct a single banking transaction from the catalog in section 1 1 sentence 2 of the KWG. 5752013 is a company that conducts deposit-taking as well as lending business. 1 credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account. Z credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account.

Source: pinterest.com

Source: pinterest.com

Credit institution Other financial undertaking Financial holding company Credit institution Financial institution Ancillary services undertaking EU Subsidiary II Subsidiary I Third-Country IPU 1 Point of non-viability Supervision on consolidated level CRR II. Credit institution Other financial undertaking Financial holding company Credit institution Financial institution Ancillary services undertaking EU Subsidiary II Subsidiary I Third-Country IPU 1 Point of non-viability Supervision on consolidated level CRR II. Legally defined as an undertaking whose business is to receive deposits or other repayable funds from the public and to grant credits for its own account. Under section 10a 1 of the KWG a group of institutions a financial holding group or a mixed financial holding group group consists of a superordinate company and one or more subordinate companies. A CRR credit institution pursuant to Section 1 para.

Source: researchgate.net

New credit institutions IFR will reclassify some systemically important or large investment firms as credit institutions for the purposes of CRRCRD and other EU legislation this is the regulatory class currently reserved for deposit-taking banks. A CRR credit institution pursuant to Section 1 para. The term credit institution used in the CRR is not the same as the term credit institution in the KWG according to Section 1 1 KWG. 1 credit institution means an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account. Regulatory challenges for the next three years 7.

Source: profitmart.in

Source: profitmart.in

Branches of credit institutions authorised in another EEA country which have the right to passport their activities. Regulatory challenges for the next three years 7. 6 CRR to be amended by. Contribution on the licensing procedure according to 32 KWG under the Single Supervisory Mechanism for the establishment of CRR financial institutions by Mathias Hanten Service Line Leader Banking Finance Deloitte Legal Frankfurt Betriebs-Berater. 1 of Regulation 5752013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation 6482012 OJ EU No L 321 of 30 November 2013p.

Source: educba.com

Source: educba.com

5752013 is a company that conducts deposit-taking as well as lending business. A CRR credit institution is generally referred to as a fully licensed bank. Where an investment firm has deposited with a credit institution any cash or financial instrument belonging to a client this constitutes a credit risk exposure to the credit institution according to Article 119 CRR to the extent that the investment firm needs to provide compensation to the client in case of not or not completely receiving back from the credit institution the cash or financial instrument that had. New credit institutions IFR will reclassify some systemically important or large investment firms as credit institutions for the purposes of CRRCRD and other EU legislation this is the regulatory class currently reserved for deposit-taking banks. Such investment firms will be reclassified as credit institutions making them subject to the same prudential requirements as large credit institutions under the CRR and the CRD IV regimes 12.

Source: in.pinterest.com

Source: in.pinterest.com

The definition of credit institution is set out in Article 54 point 1 letter a of the CRR providing that. For the purposes of this Regulation the following definitions shall apply. 1 of Regulation 5752013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation 6482012 OJ EU No L 321 of 30 November 2013p. Pursuant to section 1 3d of the Banking Act a CRR credit institution is a credit institution that also meets the narrower definition of a credit institution in accordance with Article 4 1 no. Contribution on the licensing procedure according to 32 KWG under the Single Supervisory Mechanism for the establishment of CRR financial institutions by Mathias Hanten Service Line Leader Banking Finance Deloitte Legal Frankfurt Betriebs-Berater.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title crr credit institution by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.