Your Fdic minority depository institutions wallet are ready. Fdic minority depository institutions are a trading that is most popular and liked by everyone now. You can News the Fdic minority depository institutions files here. Get all royalty-free exchange.

If you’re looking for fdic minority depository institutions pictures information linked to the fdic minority depository institutions topic, you have pay a visit to the right blog. Our site frequently gives you suggestions for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

Fdic Minority Depository Institutions. The FDIC considers an institution to be an MDI if it is a Federally-insured depository institution where a majority of a banks voting stock is owned by minority individuals. Shining a light on minority depository institutions MDIs in June 2019 the Federal Deposit Insurance Corporation FDIC hosted the 2019 Interagency Minority Depository Institution and CDFI Bank Conference in partnership with the Federal Reserve Board of Governors and the Office of the Comptroller of the Currency. To meet this goal FDIC officials meet periodically with trade groups representing MDIs. EDT on Wednesday July 21 2021.

Minority Depository Institutions In The Deep South Hope Policy Institute From hopepolicy.org

Minority Depository Institutions In The Deep South Hope Policy Institute From hopepolicy.org

The FDIC defines a minority depository institution MDI as a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals. To meet this goal FDIC officials meet periodically with trade groups representing MDIs. An MDI may be a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals. MDIs are vital service providers for minority populations. 2019 Minority Depository Institutions Structure Performance and Social Impact. Insured depository institutions may realize business and regulatory benefits from partnerships and collaborative relationships with minority depository institutions MDIs.

In addition FDIC staff provides technical assistance for groups interested in organizing new institutions and applying for deposit insurance.

MINORITY FINANCIAL INSTITUTIONThe term minority depository institution means any depository institution that if a privately owned institution 51 percent is owned by one or more socially- and economically-disadvantaged individuals. Minority Depository Institution Advisory Committee. Minority Depository Institutions play a vital role in assisting minority and underserved communities and are resources to foster the economic viability of these communities. Collaboration among MDIs or. The FDICs Statement of Policy Regarding Minority Depository Institutions MDIs outlines two definitions of how FDIC-insured commercial banks and savings associations may qualify for MDI status. Since 2018 the FDIC has taken several steps to expand the agencys minority depository institutions program including raising awareness of the role that minority-owned banks play in the communities they serve publishing a report on the impact of such banks over an 18-year period and creating a subcommittee that provides guidance to the FDICs advisory committee on community.

Source: fdic.gov

Source: fdic.gov

A MDI is defined under the FDICs Policy Statement Regarding Minority Depository Institutions as one where 51 or more of the voting stock is owned by minority individuals or collectively owned by a minority group such as a Native American tribe. The FDIC defines minority as any Black American Asian American Hispanic American or Native American Source. The Federal Deposit Insurance Corporation FDIC recognizes that minority depository institutions MDIs play a unique role in promoting economic viability in minority and low- and moderate-income LMI communities. If not for your institutions individuals in low- and moderate-income communities. Or a majority of the institutions Board of.

Source: trendsmap.com

Source: trendsmap.com

The Federal Deposit Insurance Corporation FDIC today announced the agencys Minority Depository Institutions MDI Subcommittee to the Advisory Committee on Community Banking will hold an open meeting at 1 pm. To meet this goal FDIC officials meet periodically with trade groups representing MDIs. Collaboration among MDIs or. FDIC Chairman Jelena McWilliams welcomes bankers to the Large Bank Minority Depository Institution Roundtable in Washington DC on June 27 2019. Minority as defined by Section 308 of FIRREA means any.

Source: hopepolicy.org

Source: hopepolicy.org

A bank can qualify as an MDI if 1 51 percent or more of the voting stock is owned by minority individuals. The Federal Deposit Insurance Corporation FDIC recognizes that minority depository institutions MDIs play a unique role in promoting economic viability in minority and low- and moderate-income LMI communities. Or 2 a majority of the board of directors is minority and the. The FDIC defines a minority depository institution MDI as a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals. EDT on Wednesday July 21 2021.

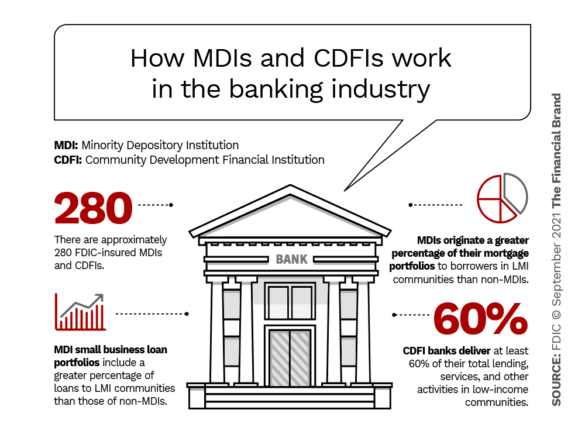

Source: thefinancialbrand.com

Source: thefinancialbrand.com

Minority Depository Institutions play a vital role in assisting minority and underserved communities and are resources to foster the economic viability of these communities. Given the ambiguous nature of the phrase socially and economically disadvantaged individuals the FDICs Policy Statement defines minority depository institution as any Federally insured depository institution where 51 percent or more of the voting stock is owned by minority individuals. Minority Depository Institutions play a vital role in assisting minority and underserved communities and are resources to foster the economic viability of these communities. FDIC Chairman Jelena McWilliams welcomes bankers to the Large Bank Minority Depository Institution Roundtable in Washington DC on June 27 2019. In addition FDIC staff provides technical assistance for groups interested in organizing new institutions and applying for deposit insurance.

Source: researchgate.net

Source: researchgate.net

The FDICs Statement of Policy Regarding Minority Depository Institutions MDIs outlines two definitions of how FDIC-insured commercial banks and savings associations may qualify for MDI status. The FDICs Minority Depository Institutions program supports a statutory goal to promote and encourage creation of new minority depository institutions MDIs. The Federal Deposit Insurance Corporation FDIC recognizes that minority depository institutions MDIs play a unique role in promoting economic viability in minority and low- and moderate-income LMI communities. FDIC Chairman Jelena McWilliams recognizes the contributions of Minority Depository Institutions in communities throughout America. When I joined the FDIC as Chairman last year I made it a priority to increase the agencys efforts to promote and preserve minority depository institutions MDIs.

Source: mbemag.com

Source: mbemag.com

Or a majority of the institutions Board of. FDIC OIG logo Minority Depository Institution Program at the FDIC September 2019 EVAL-19-002 Evaluation Report Program Audits and Evaluations Integrity Independence Accuracy Objectivity Accountability Executive Summary Minority Depository Institution Program at the FDIC Minority Depository Institutions MDI play a vital role in assisting minority and under-served communities and. In addition FDIC staff provides technical assistance for groups interested in organizing new institutions and applying for deposit insurance. Since 2018 the FDIC has taken several steps to expand the agencys minority depository institutions program including raising awareness of the role that minority-owned banks play in the communities they serve publishing a report on the impact of such banks over an 18-year period and creating a subcommittee that provides guidance to the FDICs advisory committee on community. The FDIC defines a minority depository institution MDI as a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals.

Insured depository institutions may realize business and regulatory benefits from partnerships and collaborative relationships with minority depository institutions MDIs. If not for your institutions individuals in low- and moderate-income communities. Or 2 a majority of the board of directors is minority and the. Minority Depository Institutions Program. The Federal Deposit Insurance Corporation FDIC today announced the agencys Minority Depository Institutions MDI Subcommittee to the Advisory Committee on Community Banking will hold an open meeting at 1 pm.

When I joined the FDIC as Chairman last year I made it a priority to increase the agencys efforts to promote and preserve minority depository institutions MDIs. A bank can qualify as an MDI if 1 51 percent or more of the voting stock is owned by minority individuals. FDIC OIG logo Minority Depository Institution Program at the FDIC September 2019 EVAL-19-002 Evaluation Report Program Audits and Evaluations Integrity Independence Accuracy Objectivity Accountability Executive Summary Minority Depository Institution Program at the FDIC Minority Depository Institutions MDI play a vital role in assisting minority and under-served communities and. 2019 Minority Depository Institutions Structure Performance and Social Impact. Minority Depository Institutions play a vital role in assisting minority and underserved communities and are resources to foster the economic viability of these communities.

Source: fdic.gov

Source: fdic.gov

MDIs are vital service providers for minority populations. The new Office of Minority and Community Development Banking will promote private sector investments in low- and moderate-income communities and expand collaboration with mission. MINORITY FINANCIAL INSTITUTIONThe term minority depository institution means any depository institution that if a privately owned institution 51 percent is owned by one or more socially- and economically-disadvantaged individuals. The FDIC defines a minority depository institution MDI as a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals. 2019 Minority Depository Institutions Structure Performance and Social Impact.

Source: researchgate.net

Source: researchgate.net

On June 25 2019 the FDIC released a new research study on Minority Depository Institutions MDIs. FDIC proposes revisions to policy statement on minority depository institutions August 24 2020 FDIC 0 Revisions to its policy statement on how the agency will encourage and preserve minority depository institutions MDIs including among other things in the area of technical assistance were proposed by the Federal Deposit Insurance. FDIC Chairman Jelena McWilliams welcomes bankers to the Large Bank Minority Depository Institution Roundtable in Washington DC on June 27 2019. This study explores changes in MDIs their role in the financial services industry and. EDT on Wednesday July 21 2021.

A bank can qualify as an MDI if 1 51 percent or more of the voting stock is owned by minority individuals. Minority Depository Institutions MDI play a vital role in assisting minority and under-served communities and are resources to foster the economic viability of these communities. The new Office of Minority and Community Development Banking will promote private sector investments in low- and moderate-income communities and expand collaboration with mission. The FDICs Minority Depository Institutions program supports a statutory goal to promote and encourage creation of new minority depository institutions MDIs. An MDI may be a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals.

Source: fdic.gov

Source: fdic.gov

FDIC Chairman Jelena McWilliams welcomes bankers to the Large Bank Minority Depository Institution Roundtable in Washington DC on June 27 2019. An MDI may be a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals. Collaboration among MDIs or. The Federal Deposit Insurance Corporation FDIC recognizes that minority depository institutions MDIs play a unique role in promoting economic viability in minority and low- and moderate-income LMI communities. The FDIC announced today that it is creating a new office to support its engagement with mission-driven banks including minority depository institutions and community development financial institution banks.

Source: mightydeposits.com

Source: mightydeposits.com

2019 Minority Depository Institutions Structure Performance and Social Impact. Or 2 a majority of the board of directors is minority and the community that the institution serves is predominantly minority. To meet this goal FDIC officials meet periodically with trade groups representing MDIs. A MDI is defined under the FDICs Policy Statement Regarding Minority Depository Institutions as one where 51 or more of the voting stock is owned by minority individuals or collectively owned by a minority group such as a Native American tribe. MINORITY FINANCIAL INSTITUTIONThe term minority depository institution means any depository institution that if a privately owned institution 51 percent is owned by one or more socially- and economically-disadvantaged individuals.

Source: financialregnews.com

Source: financialregnews.com

An MDI may be a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals. Since 2018 the FDIC has taken several steps to expand the agencys minority depository institutions program including raising awareness of the role that minority-owned banks play in the communities they serve publishing a report on the impact of such banks over an 18-year period and creating a subcommittee that provides guidance to the FDICs advisory committee on community. The Federal Deposit Insurance Corporation FDIC recognizes that minority depository institutions MDIs play a unique role in promoting economic viability in minority and low- and moderate-income LMI communities. Minority Depository Institutions Program. MINORITY FINANCIAL INSTITUTIONThe term minority depository institution means any depository institution that if a privately owned institution 51 percent is owned by one or more socially- and economically-disadvantaged individuals.

Source: amazon.com

Source: amazon.com

The FDIC defines a minority depository institution MDI as a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals. Or 2 a majority of the board of directors is minority and the. Minority Depository Institutions Program. MINORITY FINANCIAL INSTITUTIONThe term minority depository institution means any depository institution that if a privately owned institution 51 percent is owned by one or more socially- and economically-disadvantaged individuals. Minority Depository Institution Advisory Committee.

Source: fdic.gov

Source: fdic.gov

Minority Depository Institutions MDI play a vital role in assisting minority and under-served communities and are resources to foster the economic viability of these communities. The FDICs Statement of Policy Regarding Minority Depository Institutions MDIs outlines two definitions of how FDIC-insured commercial banks and savings associations may qualify for MDI status. The new Office of Minority and Community Development Banking will promote private sector investments in low- and moderate-income communities and expand collaboration with mission. Or a majority of the institutions Board of. Or 2 a majority of the board of directors is minority and the community that the institution serves is predominantly minority.

Source: cratoday.com

Source: cratoday.com

FDIC Chairman Jelena McWilliams recognizes the contributions of Minority Depository Institutions in communities throughout America. FDIC proposes revisions to policy statement on minority depository institutions August 24 2020 FDIC 0 Revisions to its policy statement on how the agency will encourage and preserve minority depository institutions MDIs including among other things in the area of technical assistance were proposed by the Federal Deposit Insurance. Minority Depository Institution Advisory Committee. The Federal Deposit Insurance Corporation FDIC today announced the agencys Minority Depository Institutions MDI Subcommittee to the Advisory Committee on Community Banking will hold an open meeting at 1 pm. Minority Depository Institutions play a vital role in assisting minority and underserved communities and are resources to foster the economic viability of these communities.

A MDI is defined under the FDICs Policy Statement Regarding Minority Depository Institutions as one where 51 or more of the voting stock is owned by minority individuals or collectively owned by a minority group such as a Native American tribe. This study explores changes in MDIs their role in the financial services industry and. A bank can qualify as an MDI if 1 51 percent or more of the voting stock is owned by minority individuals. The FDIC defines minority as any Black American Asian American Hispanic American or Native American Source. FDIC OIG logo Minority Depository Institution Program at the FDIC September 2019 EVAL-19-002 Evaluation Report Program Audits and Evaluations Integrity Independence Accuracy Objectivity Accountability Executive Summary Minority Depository Institution Program at the FDIC Minority Depository Institutions MDI play a vital role in assisting minority and under-served communities and.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title fdic minority depository institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.