Your Four types of financial institutions trading are available in this site. Four types of financial institutions are a news that is most popular and liked by everyone now. You can Get the Four types of financial institutions files here. News all royalty-free trading.

If you’re looking for four types of financial institutions pictures information linked to the four types of financial institutions interest, you have come to the ideal site. Our site always provides you with suggestions for seeking the highest quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

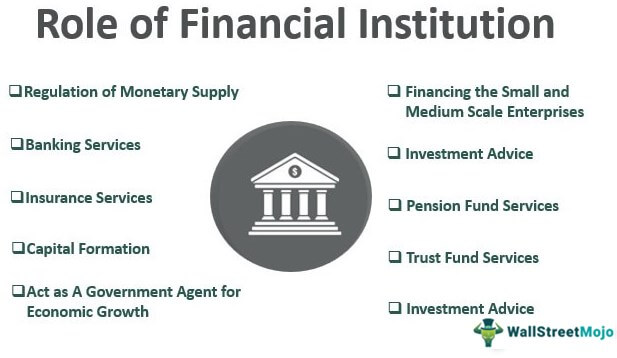

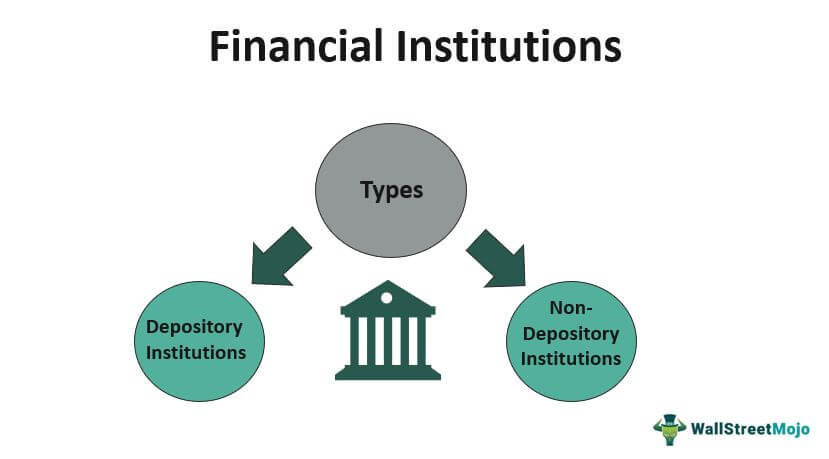

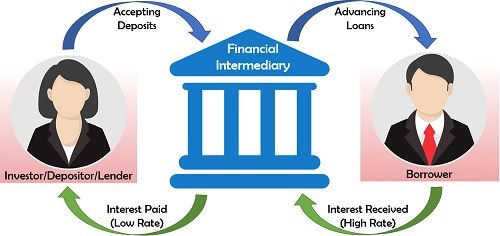

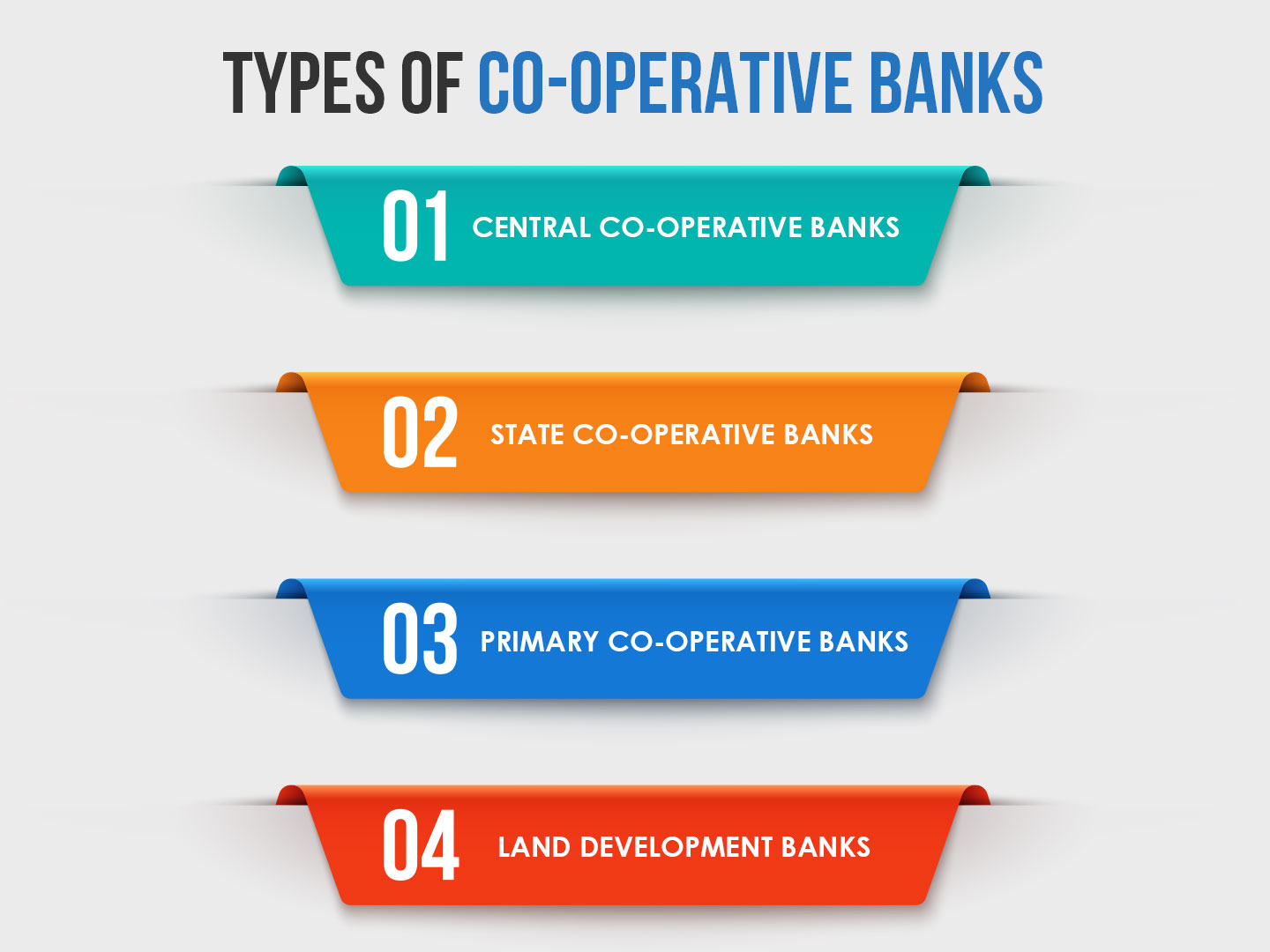

Four Types Of Financial Institutions. They are the standardised solutions to collective problems. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. Financial institutions are also known as financial Intermediaries. Institutions develop out of certain human needs or interests.

Financial Institutions Definition Example Top 2 Types From wallstreetmojo.com

Financial Institutions Definition Example Top 2 Types From wallstreetmojo.com

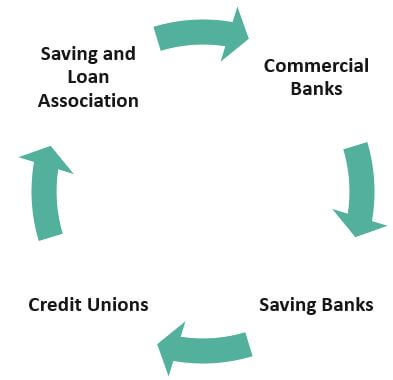

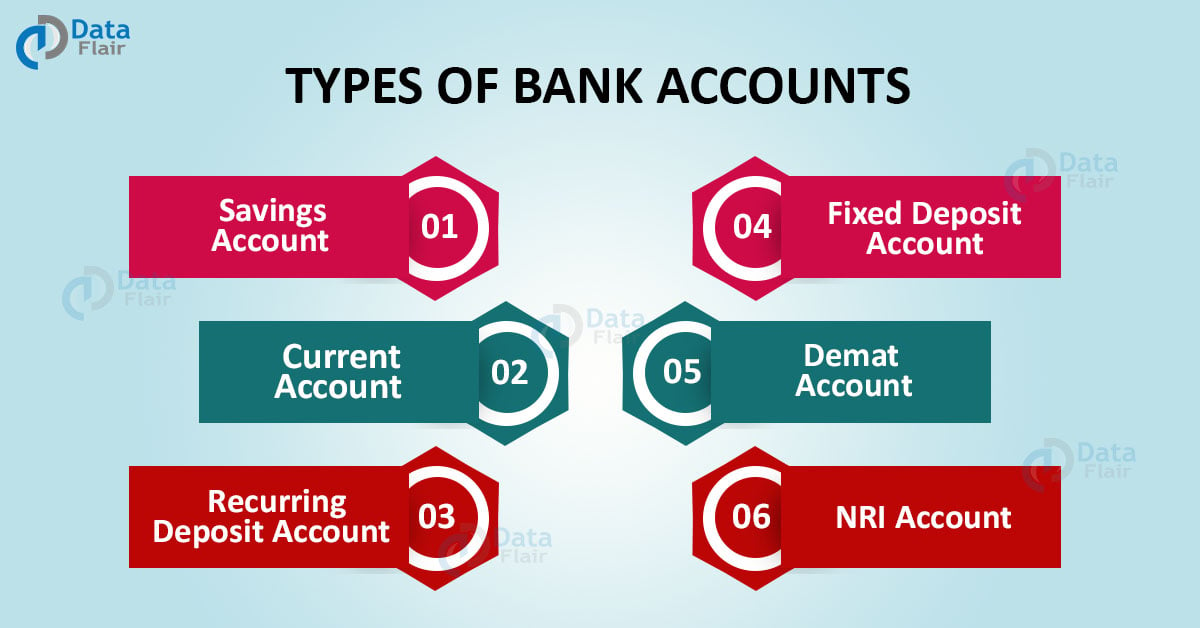

Authorised Deposit-taking Institutions ADIs Type of institution. Types of Financial Institutions. It is an organised way of doing something. They are depository and non-depository. Social control institutions for solving social problems of society and personality. Often these types of institutions work with and through banks and similar organizations in order to.

Types of Financial Institutions.

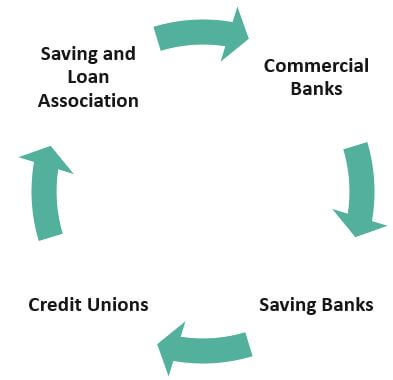

Insurers and Funds Managers. The largest and oldest of all financial institutions relying mainly on checking and savings accounts as sources of funds for loans to businesses and individuals. These include private lenders mortgage companies loan companies brokerage houses and retirement fund management corporations. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. Types of Financial Institutions. Often these types of institutions work with and through banks and similar organizations in order to.

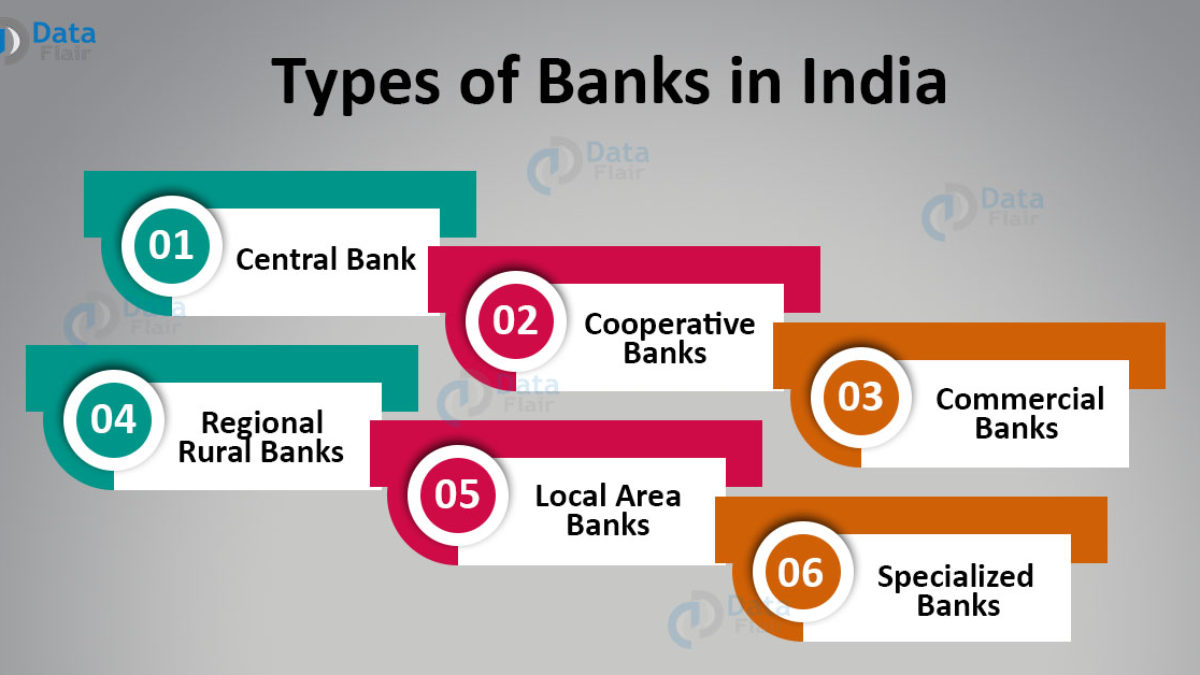

Source: data-flair.training

Source: data-flair.training

Financial institutions oversee monetary transactions such as loans deposits and investments. The type of financial institutions can be divided into two types as follows. There are nine major types of financial institutions. Understand the major types of financial institutions that exist and learn the purpose of each. Financial institutions are also known as financial Intermediaries.

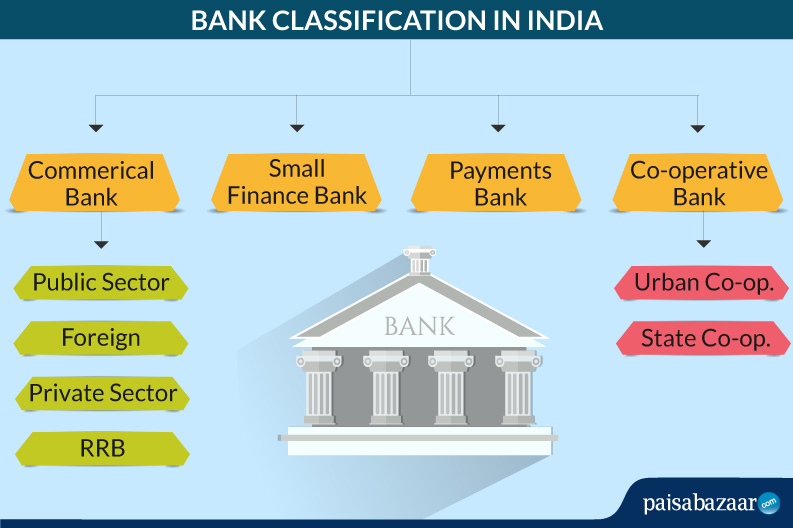

Source: paisabazaar.com

Source: paisabazaar.com

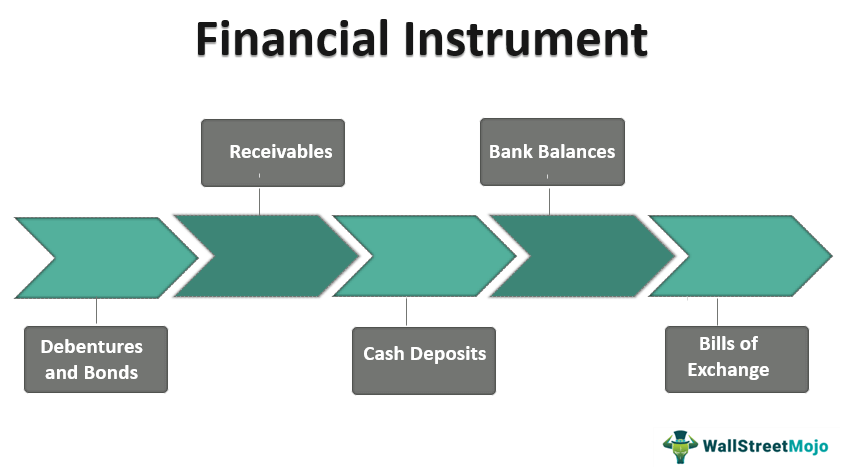

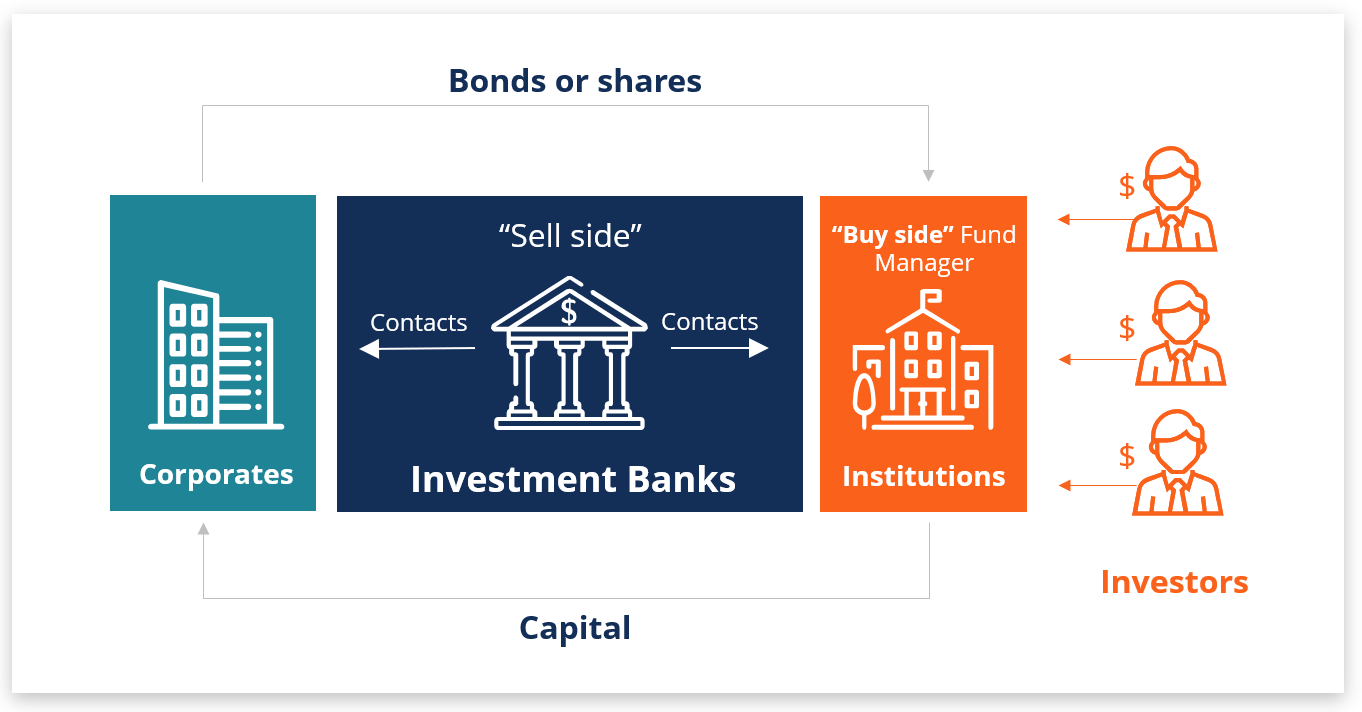

Introduction to Banking - FREE Corporate Finance InstituteView full playlist. These include private lenders mortgage companies loan companies brokerage houses and retirement fund management corporations. Financial institutions are also known as financial Intermediaries. A financial institution can be defined as an organization that processes financial transactions such as loans deposits and investments. Financial institutions FI are corporations which are responsible for the supply of money to the market through the transfer of funds from investors to the companies in the form of loans deposits and investments.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

The type of financial institutions can be divided into two types as follows. These include private lenders mortgage companies loan companies brokerage houses and retirement fund management corporations. Each claim is a financial. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. Financial institutions are business organization.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

There are nine major types of financial institutions. Introduction to Banking - FREE Corporate Finance InstituteView full playlist. Financial institutions FI are corporations which are responsible for the supply of money to the market through the transfer of funds from investors to the companies in the form of loans deposits and investments. The most common types of financial institutions include commercial banks trust companies investment banks brokerage firms or. Authorised Deposit-taking Institutions ADIs Type of institution.

Source: theinvestorsbook.com

Source: theinvestorsbook.com

The type of financial institutions can be divided into two types as follows. Some of them involve in depositary type of transactions whereas other involve in non-depositary type of transactions. They trade money and money equivalent paper. Financial institutions are also known as financial Intermediaries. The largest and oldest of all financial institutions relying mainly on checking and savings accounts as sources of funds for loans to businesses and individuals.

Source: efinancemanagement.com

Source: efinancemanagement.com

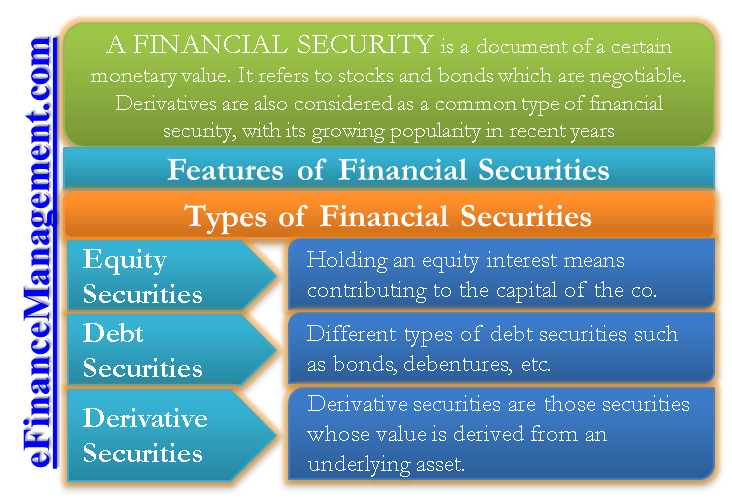

Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. The most common types of financial institutions include commercial banks trust companies investment banks brokerage firms or. They are the standardised solutions to collective problems. Financial institutions are also known as financial Intermediaries. Financial instruments may give rise to financial claims.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Authorised Deposit-taking Institutions ADIs Type of institution. Understand the major types of financial institutions that exist and learn the purpose of each. There are nine major types of financial institutions. Types of Financial Institutions Their Functions. But in developed countries there are three types of financial institutions.

Source: data-flair.training

Source: data-flair.training

There are nine major types of financial institutions. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. Depository institutions deposit-taking institutions that accept and manage deposits and make loans including banks building societies credit unions trust companies and. Introduction to Banking - FREE Corporate Finance InstituteView full playlist. Financial instruments may give rise to financial claims.

Source: businessjargons.com

Source: businessjargons.com

Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. Financial instruments comprise the full range of financial contracts made between institutional units. In financial market there are many types of financial institutions or intermediaries exist for the flow of funds. But in developed countries there are three types of financial institutions. Generally there are two types of financial institution.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Each claim is a financial. Every institution performs some functionsmanifest and latent both. Often these types of institutions work with and through banks and similar organizations in order to. Financial instruments may give rise to financial claims. Some of them involve in depositary type of transactions whereas other involve in non-depositary type of transactions.

Source: theinvestorsbook.com

Source: theinvestorsbook.com

A financial claim is an asset that typically entitles the creditor to receive funds or other resources from the debtor under the terms of a liability. Understand the major types of financial institutions that exist and learn the purpose of each. They are the standardised solutions to collective problems. A financial claim is an asset that typically entitles the creditor to receive funds or other resources from the debtor under the terms of a liability. Financial institutions oversee monetary transactions such as loans deposits and investments.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Financial institutions oversee monetary transactions such as loans deposits and investments. Financial institutions FI are corporations which are responsible for the supply of money to the market through the transfer of funds from investors to the companies in the form of loans deposits and investments. Insurers and Funds Managers. Some of them involve in depositary type of transactions whereas other involve in non-depositary type of transactions. There are nine major types of financial institutions.

Source: efinancemanagement.com

Source: efinancemanagement.com

A financial institution can be defined as an organization that processes financial transactions such as loans deposits and investments. In financial market there are many types of financial institutions or intermediaries exist for the flow of funds. The largest and oldest of all financial institutions relying mainly on checking and savings accounts as sources of funds for loans to businesses and individuals. It is an organised way of doing something. Thus to know which financial institution or institutions can meet your specific need it is important to know about all.

Source: pinterest.com

Source: pinterest.com

Financial institutions are also known as financial Intermediaries. They trade money and money equivalent paper. These include private lenders mortgage companies loan companies brokerage houses and retirement fund management corporations. But in developed countries there are three types of financial institutions. Social control institutions for solving social problems of society and personality.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Often these types of institutions work with and through banks and similar organizations in order to. Financial institutions otherwise known as banking institutions are corporations that provide services as intermediaries of financial marketsBroadly speaking there are three major types of financial institutions. Every institution performs some functionsmanifest and latent both. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. The largest and oldest of all financial institutions relying mainly on checking and savings accounts as sources of funds for loans to businesses and individuals.

Source: educba.com

Source: educba.com

Explore the definition examples and roles of. Financial institutions are also known as financial Intermediaries. But in developed countries there are three types of financial institutions. Financial institutions FI are corporations which are responsible for the supply of money to the market through the transfer of funds from investors to the companies in the form of loans deposits and investments. Often these types of institutions work with and through banks and similar organizations in order to.

Source: pinterest.com

Source: pinterest.com

The most common types of financial institutions include commercial banks trust companies investment banks brokerage firms or. Institutions develop out of certain human needs or interests. Financial institutions otherwise known as banking institutions are corporations that provide services as intermediaries of financial marketsBroadly speaking there are three major types of financial institutions. Understand the major types of financial institutions that exist and learn the purpose of each. In financial market there are many types of financial institutions or intermediaries exist for the flow of funds.

Source: ask.careers

Source: ask.careers

Financial institutions oversee monetary transactions such as loans deposits and investments. But in developed countries there are three types of financial institutions. The type of financial institutions can be divided into two types as follows. They trade money and money equivalent paper. Each claim is a financial.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title four types of financial institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.