Your G sifi banks news are available in this site. G sifi banks are a mining that is most popular and liked by everyone now. You can Find and Download the G sifi banks files here. Find and Download all royalty-free trading.

If you’re searching for g sifi banks images information related to the g sifi banks keyword, you have pay a visit to the ideal blog. Our site always gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more informative video content and images that match your interests.

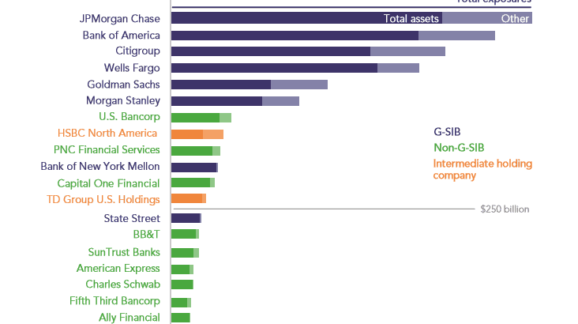

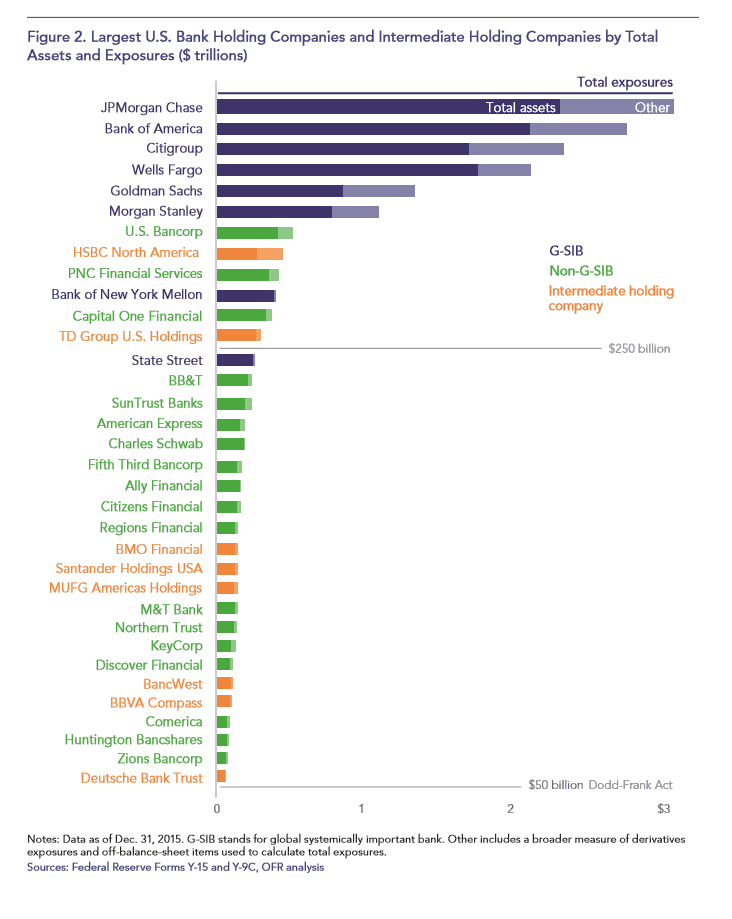

G Sifi Banks. Globally Systemically Important Banks G-SIBs and Systemically Important Financial Institutions SIFIs In line with our previous discussion on the counterpartiesprimary dealers of the Federal Reserve FED and the member banks of the FED we will now show the more international aspect of modern banking and finance. Three banks moved to a lower bucket. Because the biggest SIFI is about 50 times larger than the smallest SIFI international regulators have created a special class of SIFIs called Global Systemically Important Banks or G-SIBs. Currently 8 US.

How To Define A Systemically Important Financial Institution A New Perspective Intereconomics From intereconomics.eu

How To Define A Systemically Important Financial Institution A New Perspective Intereconomics From intereconomics.eu

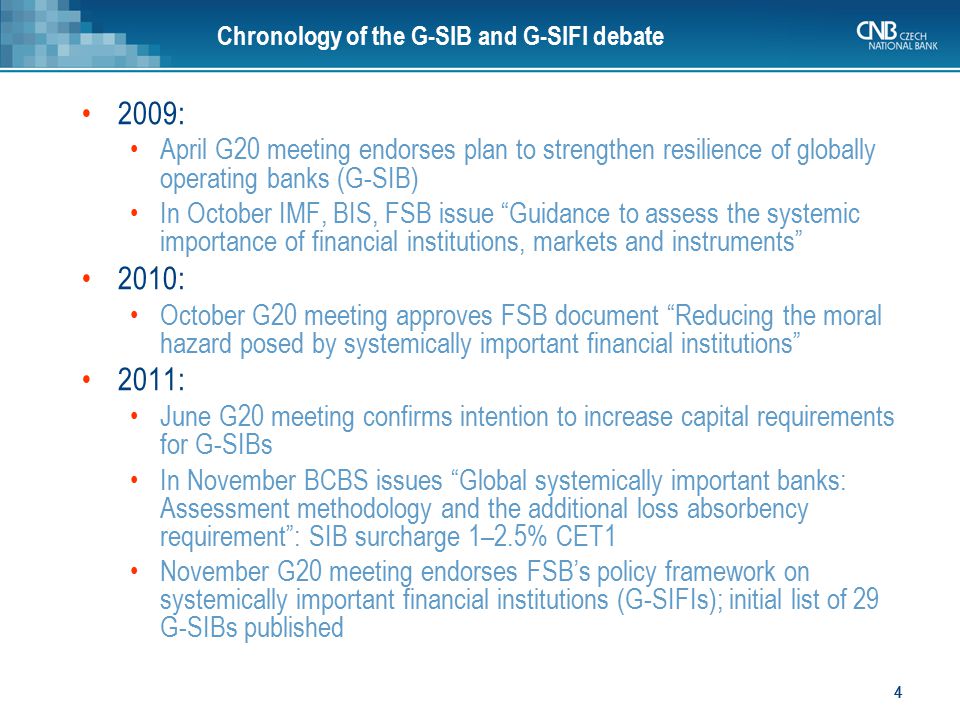

China Construction Bank. The November 2011 report noted that the group of G-SIBs would be updated annually based on new data and published by the FSB each November. Global Systemically Important Institutions G-SIIs The list of banks included in these annual sections follows the EBA Guidelines on disclosure of indicators of global systemic importance. Deleveraging Traditional versus Capital Markets Banking and the Urgent Need to Separate and Recapitalise G-SIFI Banks by Adrian Blundell-Wignall and Paul E. Globally Systemically Important Banks G-SIBs and Systemically Important Financial Institutions SIFIs In line with our previous discussion on the counterpartiesprimary dealers of the Federal Reserve FED and the member banks of the FED we will now show the more international aspect of modern banking and finance. The G-SIB dashboard shows the scores and components for global systemically important banks since 2014.

The 2020 list of global systemically important banks G-SIBs uses end-2019 data and an assessment methodology designed by the Basel Committee on Banking Supervision BCBS.

Unicredit Group 4 A new list of G-SIBs is released each November with the next one due in November 2019. Bank of New York and the Financial Services Authorityhave been working to develop resolution strategies for the failure of globally active systemically important financial institutions SIFIs or G-SIFIs with significant operations on both sides of the Atlantic. The G-SIB dashboard shows the scores and components for global systemically important banks since 2014. HSBC moved from bucket 4 to 3 Barclays. Three banks have moved to a lower bucket. The cover note to the rules text sets out the Committees summary and evaluation of the public.

Source: researchgate.net

Source: researchgate.net

Whereas the SIFI designation is based completely on the objective measure of asset size and is determined by the United States the G-SIB. Bank of New York and the Financial Services Authorityhave been working to develop resolution strategies for the failure of globally active systemically important financial institutions SIFIs or G-SIFIs with significant operations on both sides of the Atlantic. Disclosure for global systemically important banks G-SIBs 31 December 2013 Incorporated in England with registered number 966425 Principal Office. Currently 8 US. Of the total of 30 G-SIBs 13 are located in the European Union including UK banks 8 of which in the euro area.

Source: prweb.com

Source: prweb.com

Because the biggest SIFI is about 50 times larger than the smallest SIFI international regulators have created a special class of SIFIs called Global Systemically Important Banks or G-SIBs. China Construction Bank. Three banks moved to a lower bucket. Deleveraging Traditional versus Capital Markets Banking and the Urgent Need to Separate and Recapitalise G-SIFI Banks by Adrian Blundell-Wignall and Paul E. Global Systemically Important Financial Institutions G-SIFIs The FSB in consultation with the Basel Committee on Banking Supervision BCBS and national authorities has identified global systemically important banks G-SIBs since 2011.

Source: cei.org

Source: cei.org

G-SIB scores - tableau dashboards. Deleveraging Traditional versus Capital Markets Banking and the Urgent Need to Separate and Recapitalise G-SIFI Banks by Adrian Blundell-Wignall and Paul E. To reduce the probability of failure of G-SIBs the Basel Committee on Banking Supervision BCBS the going-concern loss absorbencyincreased of G. Bank of New York and the Financial Services Authorityhave been working to develop resolution strategies for the failure of globally active systemically important financial institutions SIFIs or G-SIFIs with significant operations on both sides of the Atlantic. The majority of banks reported data as of 31 December 2018.

Source: rba.gov.au

Source: rba.gov.au

Compared withthe list of G-SIBs published in 2015 the number and names of banks identified as G-SIBs remain the same. China Construction Bank. Compared withthe list of G-SIBs published in 2015 the number and names of banks identified as G-SIBs remain the same. Whereas the SIFI designation is based completely on the objective measure of asset size and is determined by the United States the G-SIB. Because the biggest SIFI is about 50 times larger than the smallest SIFI international regulators have created a special class of SIFIs called Global Systemically Important Banks or G-SIBs.

Source: cei.org

Source: cei.org

HSBC moved from bucket 4 to 3 Barclays. Globally Systemically Important Banks G-SIBs and Systemically Important Financial Institutions SIFIs In line with our previous discussion on the counterpartiesprimary dealers of the Federal Reserve FED and the member banks of the FED we will now show the more international aspect of modern banking and finance. The 2020 list of global systemically important banks G-SIBs uses end-2019 data and an assessment methodology designed by the Basel Committee on Banking Supervision BCBS. Royal Bank of Canada. 11 November 2020.

Source: lemasabachthani.wordpress.com

Source: lemasabachthani.wordpress.com

1 Basinghall Avenue London EC2V 5DD England. The list of G-SIBs is divided into buckets corresponding to required level of additional loss absorbency. 1 Basinghall Avenue London EC2V 5DD England. To reduce the probability of failure of G-SIBs the Basel Committee on Banking Supervision BCBS the going-concern loss absorbencyincreased of G. Bank of America Bank of New York Mellon Citigroup Goldman Sachs JP Morgan Chase Morgan Stanley State Street and Wells Fargo.

Source: calcbench.com

Source: calcbench.com

11 November 2020. Bank of New York and the Financial Services Authorityhave been working to develop resolution strategies for the failure of globally active systemically important financial institutions SIFIs or G-SIFIs with significant operations on both sides of the Atlantic. 11 November 2020. Royal Bank of Canada. These EBA Guidelines not only increase the transparency in the G-SIIs identification process but also achieve a level playing field in terms of disclosure.

Four banks moved to a higher bucket. Compared withthe list of G-SIBs published in 2019 the number of banks identified as G-SIBs remains 30. G-SIB scores - tableau dashboards. HSBC moved from bucket 4 to 3 Barclays. The rules text sets out the Basel Committees framework on the assessment methodology for global systemic importance the magnitude of additional loss absorbency that global systemically important banks G-SIBs should have and the arrangements by which the requirement will be phased in.

Source: theasianbanker.com

Source: theasianbanker.com

Atkinson Since the crisis even with massive support from governments and central banks widespread regulatory changes and promises from bank executives to improve the. 1 Basinghall Avenue London EC2V 5DD England. Global Systemically Important Financial Institutions G-SIFIs The FSB in consultation with the Basel Committee on Banking Supervision BCBS and national authorities has identified global systemically important banks G-SIBs since 2011. 11 November 2020. Bank of New York Mellon.

Source: researchgate.net

Source: researchgate.net

Whereas the SIFI designation is based completely on the objective measure of asset size and is determined by the United States the G-SIB. Banks above a cut-off score are identified as G-SIBs and are allocated to buckets that will be used to determine their higher loss absorbency requirement. The G-SIB dashboard shows the scores and components for global systemically important banks since 2014. BNP Paribas FR Deutsche Bank DE BPCE FR Crédit Agricole FR ING NL Santander ES Société Générale FR and Unicredit IT. 1 Basinghall Avenue London EC2V 5DD England.

Source: ft.com

Source: ft.com

G-SIB capital surcharges would i raise capital requirements between 550 and 825 percentage points for banks currently sub-ject to G-SIB capital surcharges ii create an additional surcharge of 300 percent for very large and systemically important banks that are not currently subject to any G-SIB capital surcharge and iii. To that effect the official community developed new requirements for G -SIFIs starting with global systemically important banks G-SIBs. Currently 8 US. These EBA Guidelines not only increase the transparency in the G-SIIs identification process but also achieve a level playing field in terms of disclosure. China Construction Bank.

Globally Systemically Important Banks G-SIBs and Systemically Important Financial Institutions SIFIs In line with our previous discussion on the counterpartiesprimary dealers of the Federal Reserve FED and the member banks of the FED we will now show the more international aspect of modern banking and finance. Given that the D-SIB framework complements the G-SIB framework the Committee considers that it would be appropriate if banks identified as D-SIBs by thenational ir authorities are required by those authorities to comply with the principles in line with the phase-in arrangements for the G-SIB framework ie from January 2016. Global Systemically Important Financial Institutions G-SIFIs The FSB in consultation with the Basel Committee on Banking Supervision BCBS and national authorities has identified global systemically important banks G-SIBs since 2011. Deleveraging Traditional versus Capital Markets Banking and the Urgent Need to Separate and Recapitalise G-SIFI Banks by Adrian Blundell-Wignall and Paul E. Because the biggest SIFI is about 50 times larger than the smallest SIFI international regulators have created a special class of SIFIs called Global Systemically Important Banks or G-SIBs.

Source: researchgate.net

Source: researchgate.net

Global Systemically Important Institutions G-SIIs The list of banks included in these annual sections follows the EBA Guidelines on disclosure of indicators of global systemic importance. Given that the D-SIB framework complements the G-SIB framework the Committee considers that it would be appropriate if banks identified as D-SIBs by thenational ir authorities are required by those authorities to comply with the principles in line with the phase-in arrangements for the G-SIB framework ie from January 2016. BNP Paribas FR Deutsche Bank DE BPCE FR Crédit Agricole FR ING NL Santander ES Société Générale FR and Unicredit IT. Royal Bank of Canada. Bank of New York and the Financial Services Authorityhave been working to develop resolution strategies for the failure of globally active systemically important financial institutions SIFIs or G-SIFIs with significant operations on both sides of the Atlantic.

Source: researchgate.net

Source: researchgate.net

Compared withthe list of G-SIBs published in 2015 the number and names of banks identified as G-SIBs remain the same. Unicredit Group 4 A new list of G-SIBs is released each November with the next one due in November 2019. Groupe Crédit Agricole. JP Morgan Chase has moved from bucket 4 to bucket 3 Goldman Sachs and Wells Fargo have moved from bucket 2 to bucket 1. Global Systemically Important Institutions G-SIIs The list of banks included in these annual sections follows the EBA Guidelines on disclosure of indicators of global systemic importance.

Source: centralbanking.com

Source: centralbanking.com

JP Morgan Chase has moved from bucket 4 to bucket 3 Goldman Sachs and Wells Fargo have moved from bucket 2 to bucket 1. The cover note to the rules text sets out the Committees summary and evaluation of the public. Currently 8 US. Deleveraging Traditional versus Capital Markets Banking and the Urgent Need to Separate and Recapitalise G-SIFI Banks by Adrian Blundell-Wignall and Paul E. Banks above a cut-off score are identified as G-SIBs and are allocated to buckets that will be used to determine their higher loss absorbency requirement.

Source: breakingviews.com

Source: breakingviews.com

Global Systemically Important Institutions G-SIIs The list of banks included in these annual sections follows the EBA Guidelines on disclosure of indicators of global systemic importance. The cover note to the rules text sets out the Committees summary and evaluation of the public. The 2020 list of global systemically important banks G-SIBs uses end-2019 data and an assessment methodology designed by the Basel Committee on Banking Supervision BCBS. Disclosure for global systemically important banks G-SIBs 31 December 2013 Incorporated in England with registered number 966425 Principal Office. Global Systemically Important Institutions G-SIIs The list of banks included in these annual sections follows the EBA Guidelines on disclosure of indicators of global systemic importance.

Source: ft.com

Source: ft.com

11 November 2020. Global Systemically Important Institutions G-SIIs The list of banks included in these annual sections follows the EBA Guidelines on disclosure of indicators of global systemic importance. Compared withthe list of G-SIBs published in 2015 the number and names of banks identified as G-SIBs remain the same. To that effect the official community developed new requirements for G -SIFIs starting with global systemically important banks G-SIBs. Deleveraging Traditional versus Capital Markets Banking and the Urgent Need to Separate and Recapitalise G-SIFI Banks by Adrian Blundell-Wignall and Paul E.

Source: slideplayer.com

Source: slideplayer.com

The list of G-SIBs is divided into buckets corresponding to required level of additional loss absorbency. Compared with the list of G-SIBs published in 2019 the number of banks identified as G-SIBs remains 30. 1 Basinghall Avenue London EC2V 5DD England. Globally Systemically Important Banks G-SIBs and Systemically Important Financial Institutions SIFIs In line with our previous discussion on the counterpartiesprimary dealers of the Federal Reserve FED and the member banks of the FED we will now show the more international aspect of modern banking and finance. Compared withthe list of G-SIBs published in 2019 the number of banks identified as G-SIBs remains 30.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title g sifi banks by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.