Your Meaning of financial intermediation coin are ready. Meaning of financial intermediation are a coin that is most popular and liked by everyone today. You can Find and Download the Meaning of financial intermediation files here. Get all royalty-free exchange.

If you’re searching for meaning of financial intermediation pictures information connected with to the meaning of financial intermediation keyword, you have pay a visit to the right blog. Our site always gives you hints for seeking the highest quality video and image content, please kindly search and find more enlightening video articles and images that match your interests.

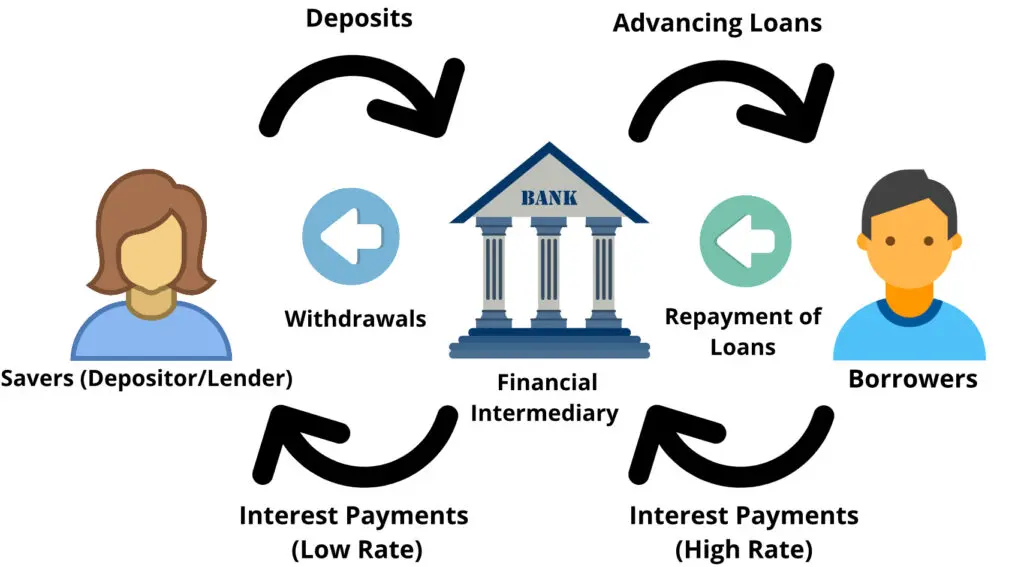

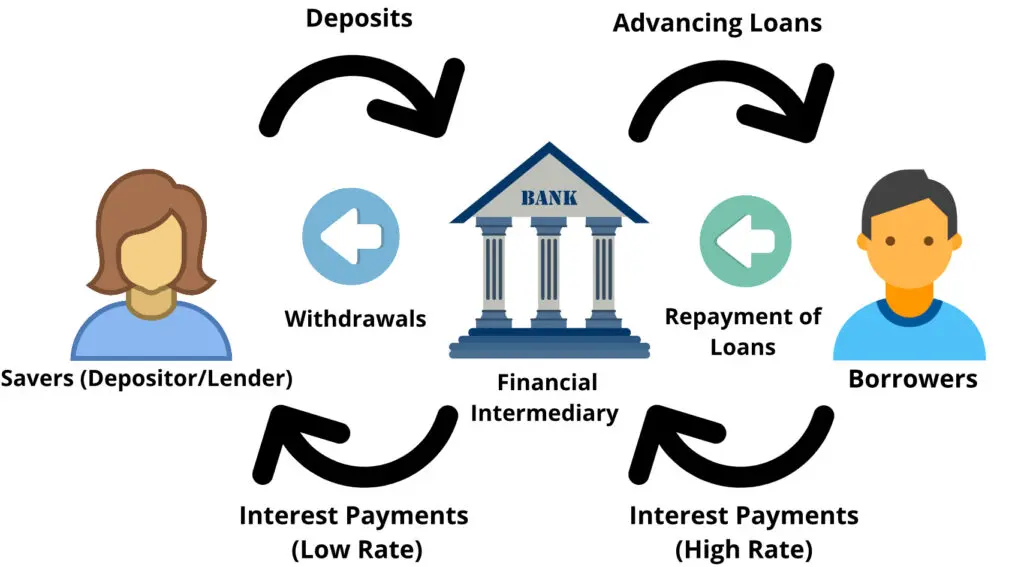

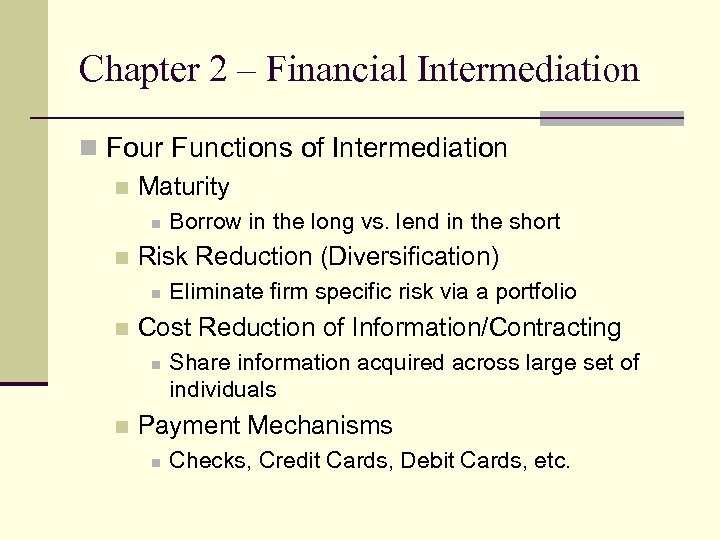

Meaning Of Financial Intermediation. 20102 The authors characterize the transition from a bank-centered to a decentralized model in this way. Financial intermediaries hold the middle position between two parties and manage the financial transaction. The financial intermediation process channels funds between third parties with a surplus and those with a lack of funds. Common types include commercial banks investment banks stockbrokers pooled investment funds and stock exchanges.

Role Of Financial Intermediaries In Economic Development Mba Knowledge Base From mbaknol.com

Role Of Financial Intermediaries In Economic Development Mba Knowledge Base From mbaknol.com

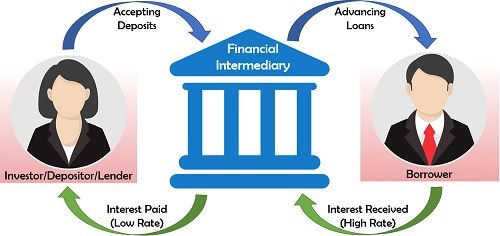

The bank then aggregates all the deposits and then lends them out to pe. For example in the saleof a house a bankusually serves as a financial intermediary by providing a mortgageto the buyer to pay the seller. Lets consider your relationship with your bank. Meaning of Financial Intermediaries FIs. Suppose you want to start a computer repair business and at the same time a woman named Susan who lives in. A financial intermediary does not only act as an agent for other institutional units but places itself at risk by acquiring financial assets and incurring liabilities on its own account for example banks insurance.

The financial intermediation is defined as the process which had been carried out by the financial intermediaries as the middleman between the borrower spender and lender saver to smooth the flow of fund.

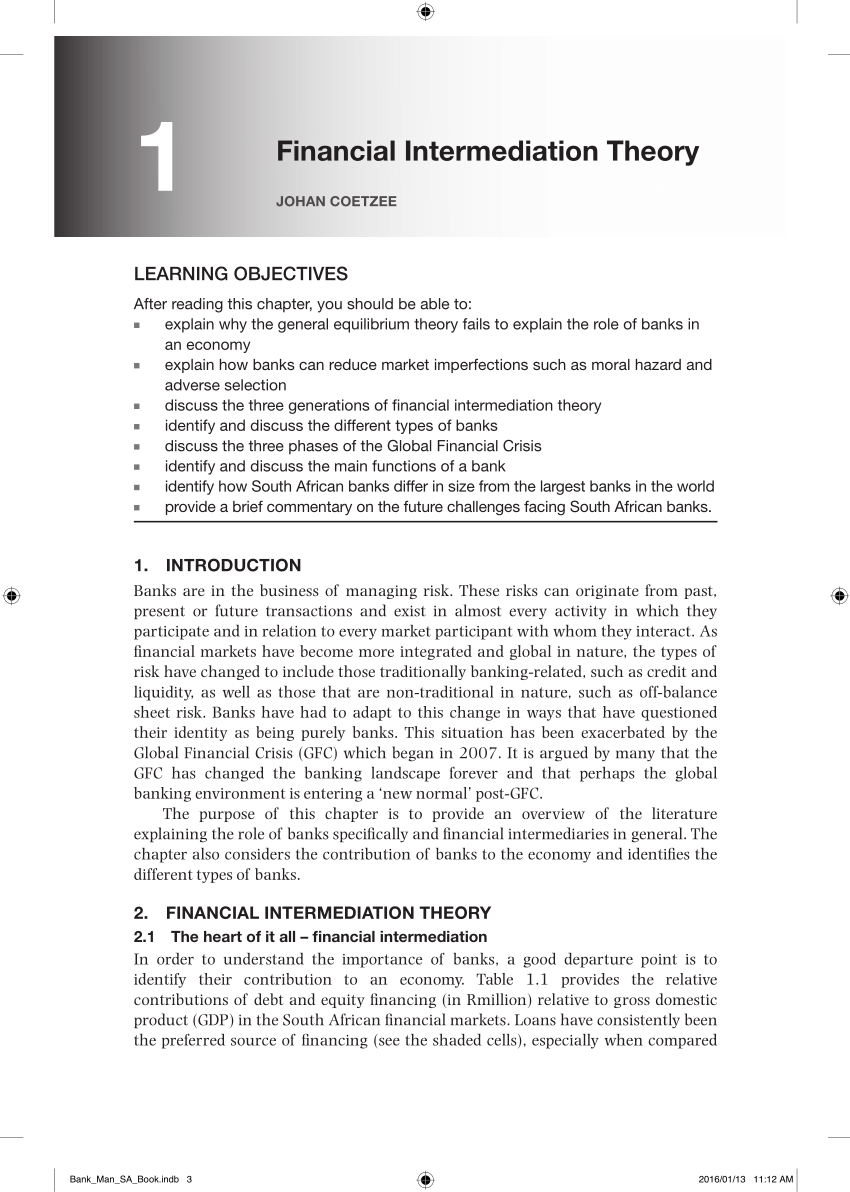

Common types include commercial banks investment banks stockbrokers pooled investment funds and stock exchanges. Except the person who is writing this article for some stupid exam and the person who is reading his article for some stupid exam Definition. A situation in which a financial institution stands between counterpartiesin a transaction. Savers want to securely store value and earn a return that protects funds from the effects of inflation. These theories of intermediation have been built on the models of resource allocation based on perfect and complete markets by sug-gesting that it is frictions such as transaction costs and asymmetric information that are important in. The financial intermediation process channels funds between third parties with a surplus and those with a lack of funds.

Source: in.pinterest.com

Source: in.pinterest.com

And these institutions play a vital role in the economy. The savingsinvestment process in capitalist economies is organized around financial intermediation making them a central institution of economic growth. Foreign counterpart means the authority in another country that exercise similar powers and performs similar functions as the Superintendent. The institutions that channel funds from savers to users are called financial intermediaries. Our critical analysis of this theory leads to several building blocks of a new theory of financial intermediation.

Source: slidetodoc.com

Source: slidetodoc.com

This is kind-of an easy question to answer but also kind-of difficult. Financial intermediation is a productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market. A financial institution such as a commercial bank or thrift that facilitates the flow of funds from savers to borrowers. Financial intermediaries profit from the spread between the amount they pay for the funds and the rate they charge for the funds. Financial intermediation means a process of transferring funds from one entity to another entity.

Source: mbaknol.com

Source: mbaknol.com

Financial intermediaries FIs are financial institutions that intermediate between ultimate lenders and ultimate borrowers. A financial intermediary does not only act as an agent for other institutional units but places itself at risk by acquiring financial assets and incurring liabilities on its own account for example banks insurance. A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction such as a commercial bank investment bank mutual fund or pension fund. Financial Intermediation Defined. Meaning of Financial Intermediaries FIs.

Source: slideplayer.com

Source: slideplayer.com

A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction such as a commercial bank investment bank mutual fund or pension fund. The institutions that channel funds from savers to users are called financial intermediaries. Financial intermediaries include depository institutions insurance companies regulated investment companies investment banks pension funds. The financial intermediation called as the process of using the indirect finance in the financial system which the primary route to transfer. Except the person who is writing this article for some stupid exam and the person who is reading his article for some stupid exam Definition.

Source: theinvestorsbook.com

Source: theinvestorsbook.com

Answer 1 of 2. They are financial institutions specialized in the activity of buying and selling at the same time assets and financial contracts. Savers want to securely store value and earn a return that protects funds from the effects of inflation. Suppose you want to start a computer repair business and at the same time a woman named Susan who lives in. Lets consider your relationship with your bank.

Source: slideplayer.com

Source: slideplayer.com

Meaning of Financial Intermediaries FIs. For example in the saleof a house a bankusually serves as a financial intermediary by providing a mortgageto the buyer to pay the seller. Financial intermediation and real-world practice. Financial intermediaries include depository institutions insurance companies regulated investment companies investment banks pension funds. Thus in financial intermediation everyone goes home happy.

Source: researchgate.net

Source: researchgate.net

Intermediation chain with specialized markets and nonbank institutions playing a part along the way. A financial institution such as a commercial bank or thrift that facilitates the flow of funds from savers to borrowers. Financial intermediation is a productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market. Financial Intermediation Defined. Common types include commercial banks investment banks stockbrokers pooled investment funds and stock exchanges.

Source: qsstudy.com

Source: qsstudy.com

Financial intermediation is a productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market. Acting as a third party an intermediary aims to meet the financial needs of both parties to mutual satisfaction. And these institutions play a vital role in the economy. This is the so-called shadow banking model of financial intermediation as described for instance in Pozsar et al. Financial intermediation is a business model that facilitates financial transactions between savers and borrowers.

Source: slideplayer.com

Source: slideplayer.com

Thus in financial intermediation everyone goes home happy. Financial intermediaries include depository institutions insurance companies regulated investment companies investment banks pension funds. A situation in which a financial institution stands between counterpartiesin a transaction. Financial intermediation is a productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market. The financial intermediation is defined as the process which had been carried out by the financial intermediaries as the middleman between the borrower spender and lender saver to smooth the flow of fund.

Source: slidetodoc.com

Source: slidetodoc.com

A situation in which a financial institution stands between counterpartiesin a transaction. Financial Intermediation Defined. Acting as a third party an intermediary aims to meet the financial needs of both parties to mutual satisfaction. Financial intermediation means a process of transferring funds from one entity to another entity. The role of financial intermediaries is to channel funds from lenders to borrowers by intermediating.

Source: slideplayer.com

Source: slideplayer.com

Financial intermediation means a process of transferring funds from one entity to another entity. Thus in financial intermediation everyone goes home happy. This is kind-of an easy question to answer but also kind-of difficult. Suppose you want to start a computer repair business and at the same time a woman named Susan who lives in. A financial intermediary is an entity that acts as the middleman between two parties in a financial transaction such as a commercial bank investment bank mutual fund or pension fund.

Source: present5.com

Source: present5.com

This is kind-of an easy question to answer but also kind-of difficult. The institutions that channel funds from savers to users are called financial intermediaries. Answer 1 of 2. Financial intermediation and real-world practice. And these institutions play a vital role in the economy.

Source: slideplayer.com

Source: slideplayer.com

Financial intermediaries include depository institutions insurance companies regulated investment companies investment banks pension funds. A situation in which a financial institution stands between counterpartiesin a transaction. Intermediation chain with specialized markets and nonbank institutions playing a part along the way. Funds flow from ultimate lenders to ultimate borrowers either directly or indirectly through financial institutions. The financial intermediaries are commercial banks investment banks stock exchanges insurance companies etc.

Source: theinvestorsbook.com

Source: theinvestorsbook.com

A situation in which a financial institution stands between counterpartiesin a transaction. The role of financial intermediaries is to channel funds from lenders to borrowers by intermediating. Financial intermediaries include depository institutions insurance companies regulated investment companies investment banks pension funds. Financial intermediation is a productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market. They are financial institutions specialized in the activity of buying and selling at the same time assets and financial contracts.

Source: researchgate.net

Source: researchgate.net

Savers want to securely store value and earn a return that protects funds from the effects of inflation. Except the person who is writing this article for some stupid exam and the person who is reading his article for some stupid exam Definition. For example in the saleof a house a bankusually serves as a financial intermediary by providing a mortgageto the buyer to pay the seller. Common types include commercial banks investment banks stockbrokers pooled investment funds and stock exchanges. The role of financial intermediaries is to channel funds from lenders to borrowers by intermediating.

Source: pinterest.com

Source: pinterest.com

This is kind-of an easy question to answer but also kind-of difficult. Financial intermediation means a process of transferring funds from one entity to another entity. They are financial institutions specialized in the activity of buying and selling at the same time assets and financial contracts. A situation in which a financial institution stands between counterpartiesin a transaction. Financial intermediation is a business model that facilitates financial transactions between savers and borrowers.

Source: theinvestorsbook.com

Source: theinvestorsbook.com

This is kind-of an easy question to answer but also kind-of difficult. The financial intermediation called as the process of using the indirect finance in the financial system which the primary route to transfer. Financial intermediaries profit from the spread between the amount they pay for the funds and the rate they charge for the funds. Financial intermediation is a productive activity in which an institutional unit incurs liabilities on its own account for the purpose of acquiring financial assets by engaging in financial transactions on the market. Funds flow from ultimate lenders to ultimate borrowers either directly or indirectly through financial institutions.

Source: slideplayer.com

Source: slideplayer.com

Foreign counterpart means the authority in another country that exercise similar powers and performs similar functions as the Superintendent. Financial intermediaries include depository institutions insurance companies regulated investment companies investment banks pension funds. This is kind-of an easy question to answer but also kind-of difficult. You have 100 that you do not need at the moment so you deposit it into your account. Financial Intermediation Defined.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title meaning of financial intermediation by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.