Your Minority depository institutions ppp trading are available in this site. Minority depository institutions ppp are a wallet that is most popular and liked by everyone this time. You can Find and Download the Minority depository institutions ppp files here. News all free wallet.

If you’re looking for minority depository institutions ppp images information connected with to the minority depository institutions ppp interest, you have visit the ideal blog. Our website frequently provides you with hints for viewing the maximum quality video and picture content, please kindly surf and find more informative video articles and graphics that match your interests.

Minority Depository Institutions Ppp. 30 billion for loans made by Insured. Congress reacted to this criticism when it expanded the PPP program on April 23 2020 setting aside 30 billion of the 310 billion in new funding for loans made by credit unions community banks and community financial institutions a category that includes minority depository institutions 1 In addition lawmakers encouraged the. As of May 5 the only lenders still authorized to process Paycheck Protection Program PPP applications until the May 31 deadline are CDFIs Minority Depository Institutions MDIs Small Business Administration SBA microlenders and Certified Development Corporations. To promote access to capital initially only community financial institutions will be able to make First Draw PPP Loans first time applicants on Monday January 11 and Second Draw PPP Loans those who received PPP loans back in 2020 on Wednesday January 13.

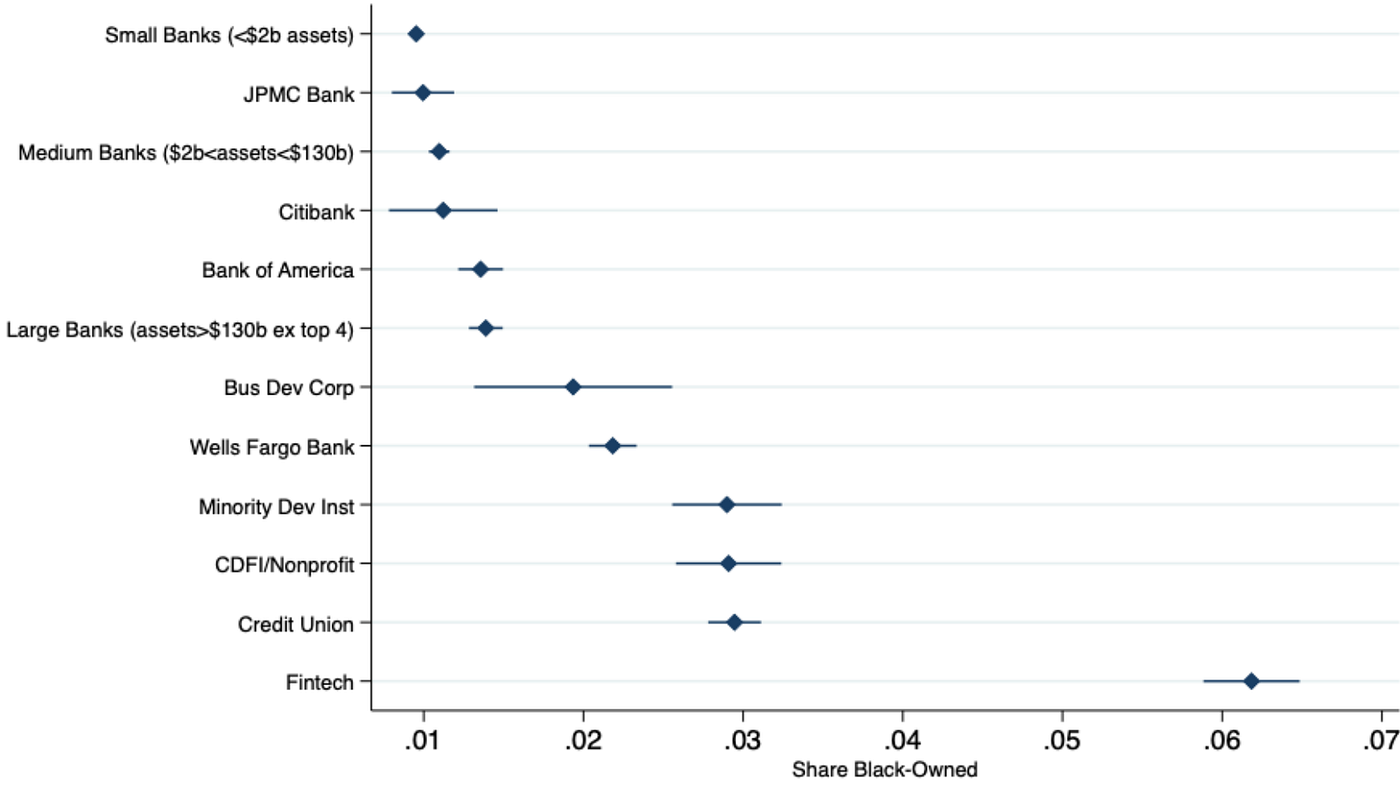

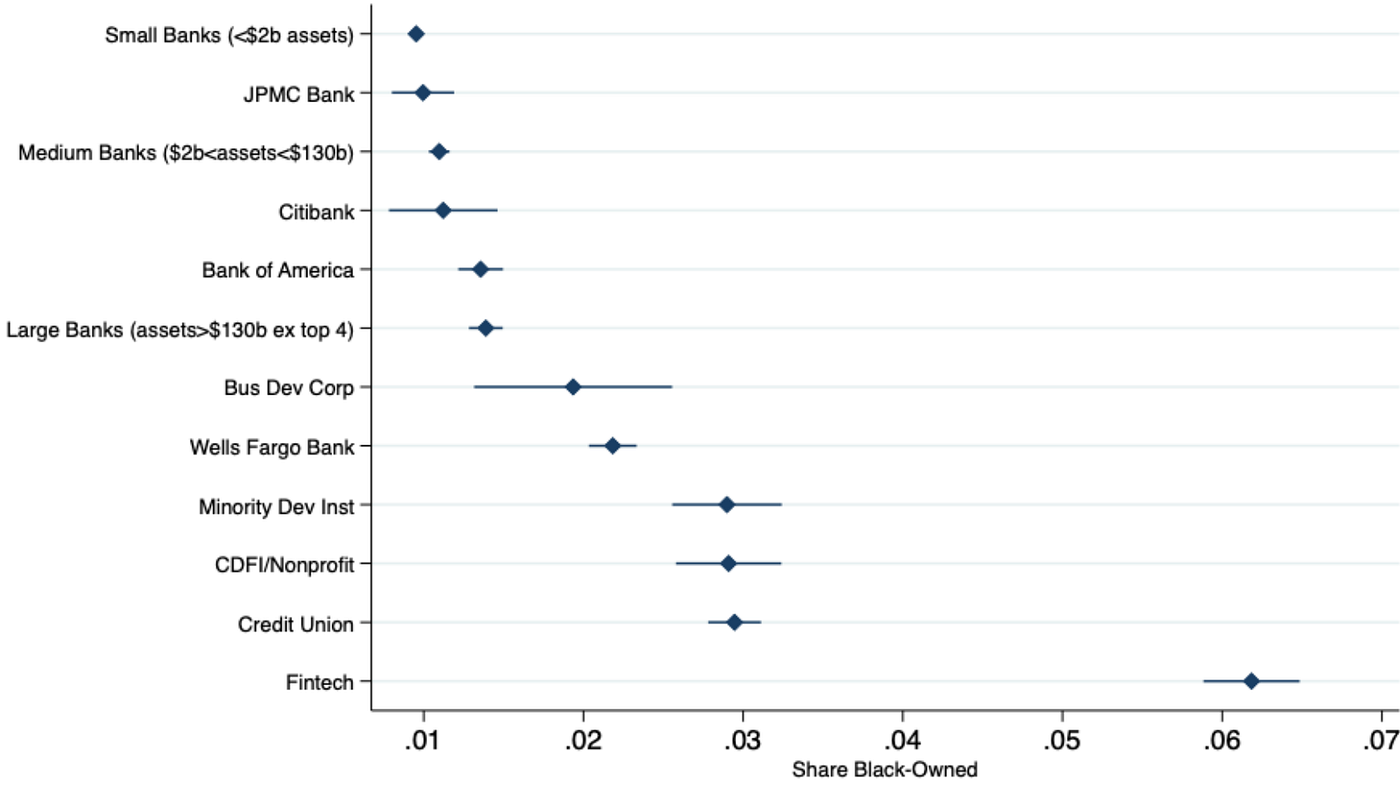

Did Fintech Save Minority Owned Businesses In The Ppp With Nyu S Dr Sabrina Howell By Ryan Zauk Wharton Fintech Medium From medium.com

Did Fintech Save Minority Owned Businesses In The Ppp With Nyu S Dr Sabrina Howell By Ryan Zauk Wharton Fintech Medium From medium.com

A minority depository institution MDI is defined in one of two ways. Citi joins the OCC Minority Depository Institutions Advisory Committee. Lenders credit unions fintechs community development financial institutions CDFIs and minority depository institutions MDIs to maximize access to the Paycheck Protection Program PPP or Program. These four types of mission lenders termed Community Financial Institutions CFIs have outperformed all other. 11 only to community development financial institutions minority depository institutions certified development corporations and microloan intermediaries making first-draw PPP loans. Specifically the following amounts have been allocated as PPP loans to be made by the following institutions.

At least 51 of voting stock is owned by minorities OR.

As of May 5 the only lenders still authorized to process Paycheck Protection Program PPP applications until the May 31 deadline are CDFIs Minority Depository Institutions MDIs Small Business Administration SBA microlenders and Certified Development Corporations. The White House is working with the SBA to increase equitable access to underserved small businesses to assure the integrity of the. Congress reacted to this criticism when it expanded the PPP program on April 23 2020 setting aside 30 billion of the 310 billion in new funding for loans made by credit unions community banks and community financial institutions a category that includes minority depository institutions 1 In addition lawmakers encouraged the. The PPP will open to all participating lenders shortly thereafter. To promote access to capital initially only community financial institutions will be able to make First Draw PPP Loans first time applicants on Monday January 11 and Second Draw PPP Loans those who received PPP loans back in 2020 on Wednesday January 13. OneUnited Bank a Preferred SBA 7a lender is offering PPP loans to its existing and new customers on a nationwide basis.

Source: thebusinessjournal.com

Source: thebusinessjournal.com

The White House is working with the SBA to increase equitable access to underserved small businesses to assure the integrity of the. Or 2 a majority. African American-Owned Banks Are Making Sure Minority Businesses Are Receiving Stimulus Funds. SBA is continuing to encourage and support these efforts that have benefitted the smallest businesses and underserved communities. Supporting equity of representation within the banking industry starts with looking at ownership and control and hence Minority Depository Institutions or MDIs.

Source: hopepolicy.org

Source: hopepolicy.org

January 2020 Unity National Bank joins TMBPP. When the PPP loan portal re-opened today it initially accepted First Draw PPP loan applications from participating CFIs which include Community Development Financial Institutions CDFIs Minority Depository Institutions MDIs Certified Development Companies CDCs and Microloan Intermediaries. A majority of the banking industry is owned and controlled by white individuals mostly men. NATIONAL CREDIT UNION ADMINISTRATION MINORITY DEPOSITORY INSTITUTIONS June 30. An MDI may be a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals.

Source: americanbanker.com

Source: americanbanker.com

The SBA is still accepting PPP loan applications from Certified Development Companies CDCs SBA Microlenders Community Development Financial Institutions CDFIs and Minority Depository Institutions MDIs until May 31 2021 or until remaining funds are exhausted. A minority depository institution MDI is defined in one of two ways. 30 Billion of 2nd Round of PPP Allocated to Community Lenders. 30 billion for loans made by Insured. Several Core Providers to Cover Cost for MDIs to Join RTP Network.

Source: content.govdelivery.com

Source: content.govdelivery.com

Citi joins the OCC Minority Depository Institutions Advisory Committee. First theres still about 9 billion in the PPP chest that the SBA set aside for minority depository institutions and community development financial institutions to lend to businesses. Congress reacted to this criticism when it expanded the PPP program on April 23 2020 setting aside 30 billion of the 310 billion in new funding for loans made by credit unions community banks and community financial institutions a category that includes minority depository institutions 1 In addition lawmakers encouraged the. Section 308 of the Financial Institutions Reform Recovery and Enforcement Act of 1989 FIRREA requires the Secretary of the Treasury to consult with the Chairman of the Board of Governors of the Federal Reserve System the Comptroller of the Currency the Chairman of the National Credit Union Administration and the Chairperson of the. A minority depository institution MDI is defined in one of two ways.

Source: sbdcnj.com

Source: sbdcnj.com

NATIONAL CREDIT UNION ADMINISTRATION MINORITY DEPOSITORY INSTITUTIONS June 30. This list of minority depository institutions is based on the archived database FOICU. Minority Depository Institutions MDIs are key contributors to their local economies and Fiserv is providing added support for MDIs and their customers through the pandemic. So what is an MDI. Several Core Providers to Cover Cost for MDIs to Join RTP Network.

Source: twitter.com

Source: twitter.com

April 2020 Citi launches 50MM loan facility to purchase PPP loans made by MDIs. April 2020 Citi launches 50MM loan facility to purchase PPP loans made by MDIs. The SBA is still accepting PPP loan applications from Certified Development Companies CDCs SBA Microlenders Community Development Financial Institutions CDFIs and Minority Depository Institutions MDIs until May 31 2021 or until remaining funds are exhausted. PPP loan approvals resume for minority- and women-owned firms. As of May 5 the only lenders still authorized to process Paycheck Protection Program PPP applications until the May 31 deadline are CDFIs Minority Depository Institutions MDIs Small Business Administration SBA microlenders and Certified Development Corporations.

Source: scnow.com

Source: scnow.com

OneUnited Bank a Preferred SBA 7a lender is offering PPP loans to its existing and new customers on a nationwide basis. Congress reacted to this criticism when it expanded the PPP program on April 23 2020 setting aside 30 billion of the 310 billion in new funding for loans made by credit unions community banks and community financial institutions a category that includes minority depository institutions 1 In addition lawmakers encouraged the. Minority Depository Institutions MDIs are key contributors to their local economies and Fiserv is providing added support for MDIs and their customers through the pandemic. 30 Billion of 2nd Round of PPP Allocated to Community Lenders. An MDI may be a federal insured depository institution for which 1 51 percent or more of the voting stock is owned by minority individuals.

Source: carsey.unh.edu

Source: carsey.unh.edu

Thats great provided there would be a carve-out for non-depository CDFIs. Specifically the following amounts have been allocated as PPP loans to be made by the following institutions. The Clearing House Jack Henry FIS and Fiserv announced today that they will cover the cost for minority-owned depository institutions to join the RTP network. January 2020 Unity National Bank joins TMBPP. To Minority Depository Institutions and.

Source: merchantmaverick.com

Source: merchantmaverick.com

The Clearing House Jack Henry FIS and Fiserv announced today that they will cover the cost for minority-owned depository institutions to join the RTP network. African American-Owned Banks Are Making Sure Minority Businesses Are Receiving Stimulus Funds. Customers may still be able to apply for a PPP loan at one of these. The Clearing House Jack Henry FIS and Fiserv announced today that they will cover the cost for minority-owned depository institutions to join the RTP network. Citi joins the OCC Minority Depository Institutions Advisory Committee.

Source: ofn.org

Source: ofn.org

July 2020 Citi joins the OCCs Roundtable for Economic. Minority Depository Institutions List. NATIONAL CREDIT UNION ADMINISTRATION MINORITY DEPOSITORY INSTITUTIONS June 30. This list of minority depository institutions is based on the archived database FOICU. January 2020 Unity National Bank joins TMBPP.

Source: mightydeposits.com

Source: mightydeposits.com

A majority of the banking industry is owned and controlled by white individuals mostly men. This limited-time offer is available to the first 100 eligible lenders that sign an agreement for Atlas PPP services between 1042021 and 3312021. Section 308 of the Financial Institutions Reform Recovery and Enforcement Act of 1989 FIRREA requires the Secretary of the Treasury to consult with the Chairman of the Board of Governors of the Federal Reserve System the Comptroller of the Currency the Chairman of the National Credit Union Administration and the Chairperson of the. OneUnited Bank a Preferred SBA 7a lender is offering PPP loans to its existing and new customers on a nationwide basis. Los Angeles CA April 29 2020 OneUnited Bank the largest Black owned bank in the country is proud to announce the launch of its Small Business Administration Paycheck Protection Program PPP.

Source: mightydeposits.com

Source: mightydeposits.com

Minority Depository Institutions MDIs are key contributors to their local economies and Fiserv is providing added support for MDIs and their customers through the pandemic. Or 2 a majority. Minority Depository Institutions List. The SBA is still accepting PPP loan applications from Certified Development Companies CDCs SBA Microlenders Community Development Financial Institutions CDFIs and Minority Depository Institutions MDIs until May 31 2021 or until remaining funds are exhausted. FDIC Definition of Minority Depository Institution.

Source: content.govdelivery.com

Source: content.govdelivery.com

Citi joins the OCC Minority Depository Institutions Advisory Committee. The Small Business Administration announced today that the Paycheck Protection Program will officially reopen on Monday Jan. These lenders made up approximately 10 of all. Lenders credit unions fintechs community development financial institutions CDFIs and minority depository institutions MDIs to maximize access to the Paycheck Protection Program PPP or Program. 11 only to community development financial institutions minority depository institutions certified development corporations and microloan intermediaries making first-draw PPP loans.

Source: hopepolicy.org

Source: hopepolicy.org

The Small Business Administration announced today that the Paycheck Protection Program will officially reopen on Monday Jan. FDIC Definition of Minority Depository Institution. A majority of the banking industry is owned and controlled by white individuals mostly men. MDIs make a greater percentage of mortgages and small-business loans to minority borrowers than other financial institutions. Congress reacted to this criticism when it expanded the PPP program on April 23 2020 setting aside 30 billion of the 310 billion in new funding for loans made by credit unions community banks and community financial institutions a category that includes minority depository institutions 1 In addition lawmakers encouraged the.

Source: hopepolicy.org

Source: hopepolicy.org

First theres still about 9 billion in the PPP chest that the SBA set aside for minority depository institutions and community development financial institutions to lend to businesses. Recently a coalition of CDFIs and small-business advocatesled by people of colorand other industry leaders have called for a set-aside of 10 billion in PPP funding for use only by CDFIs and Minority Depository Institutions MDIs. January 2020 Unity National Bank joins TMBPP. A majority of the banking industry is owned and controlled by white individuals mostly men. Los Angeles CA April 29 2020 OneUnited Bank the largest Black owned bank in the country is proud to announce the launch of its Small Business Administration Paycheck Protection Program PPP.

Source: news.cuna.org

Source: news.cuna.org

OneUnited Bank a Preferred SBA 7a lender is offering PPP loans to its existing and new customers on a nationwide basis. African American-Owned Banks Are Making Sure Minority Businesses Are Receiving Stimulus Funds. 30 Billion of 2nd Round of PPP Allocated to Community Lenders. Thats great provided there would be a carve-out for non-depository CDFIs. A majority of the board members are minorities AND the institution primarily serves communities whose populations are predominantly minority based.

Source: medium.com

Source: medium.com

To promote access to capital initially only community financial institutions will be able to make First Draw PPP Loans first time applicants on Monday January 11 and Second Draw PPP Loans those who received PPP loans back in 2020 on Wednesday January 13. African American-Owned Banks Are Making Sure Minority Businesses Are Receiving Stimulus Funds. Minority Depository Institutions List. When the PPP loan portal re-opened today it initially accepted First Draw PPP loan applications from participating CFIs which include Community Development Financial Institutions CDFIs Minority Depository Institutions MDIs Certified Development Companies CDCs and Microloan Intermediaries. January 2020 Unity National Bank joins TMBPP.

The SBA is still accepting PPP loan applications from Certified Development Companies CDCs SBA Microlenders Community Development Financial Institutions CDFIs and Minority Depository Institutions MDIs until May 31 2021 or until remaining funds are exhausted. So what is an MDI. First theres still about 9 billion in the PPP chest that the SBA set aside for minority depository institutions and community development financial institutions to lend to businesses. January 2020 Unity National Bank joins TMBPP. Small Business Administration and lenders are taking more strides to improve the Paycheck Protection Program PPP so that small businesses can access much needed PPP funds to persevere through the pandemic recover and build back better.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title minority depository institutions ppp by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.