Your Non deposit taking microfinance mining are ready. Non deposit taking microfinance are a coin that is most popular and liked by everyone this time. You can Download the Non deposit taking microfinance files here. Get all free coin.

If you’re looking for non deposit taking microfinance images information connected with to the non deposit taking microfinance keyword, you have pay a visit to the right site. Our site frequently gives you hints for viewing the highest quality video and picture content, please kindly surf and locate more enlightening video content and images that fit your interests.

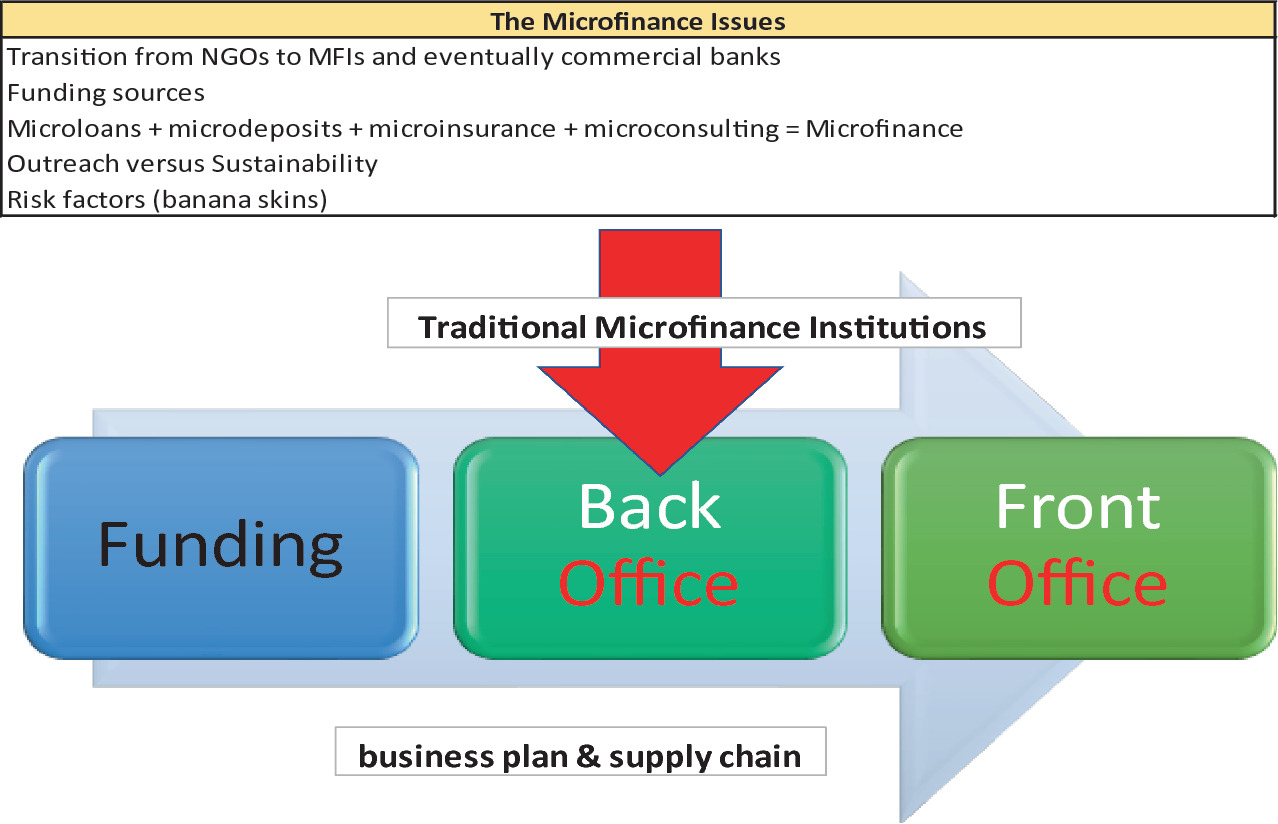

Non Deposit Taking Microfinance. At least 85 of its Total Net Assets are in. Gain Microfinance limited is a Non deposit taking institution licensed and regulated by the Uganda Microfinance Regulatory Authority UMRA. MDI means micro finance deposit-taking institution. This type of microfinance institution is not provided for in the Microfinance Act Kenya and is therefore not regulated by the Central Bank of Kenya.

Pdf A Survey On Microfinance For Developing Countries A Social Responsible Investment Opportunity From researchgate.net

Pdf A Survey On Microfinance For Developing Countries A Social Responsible Investment Opportunity From researchgate.net

There has been a surge in the number of non-deposit-taking microfinance institutions setting up in Kenya microloans are in higher demand because commercial banks are now more willing to lend to the Kenyan government which is less risky. 06 on the first 400 million in capital 072 on the excess for non-deposit-taking institutions 09 on the excess for deposit-taking. It was passed to operationalise the National Microfinance Policy 2017. For those registered in the North Eastern Region of the country Rs. The Registrar of Financial Institutions in his mandate aims at protecting depositors funds enhancing access to financial services by increasing public confidence in microfinance providers and improving operational standards. There is a surge in the number of non deposit taking micro finance institutions setting up in Kenya due to the raise in demand for micro loans because commercial banks are now more keen to lend to the Government of Kenya because it is less risky and as a result neglecting the majority of the Kenyans at the bottom of the Pyramid.

Minimum Net Owned Funds NOF of Rs5 crore.

06 on the first 400 million in capital 072 on the excess for non-deposit-taking institutions 09 on the excess for deposit-taking. Microfinance business means the business carried on as a principal business of. Issue of licence 1 The Authority shall after receiving an application consider the application and may if satisfied that the applicant meets the requirements issue a. The business name of the applicant to include either of the following words. There is a surge in the number of non deposit taking micro finance institutions setting up in Kenya due to the raise in demand for micro loans because commercial banks are now more keen to lend to the Government of Kenya because it is less risky and as a result neglecting the majority of the Kenyans at the bottom of the Pyramid. Gain Microfinance limited is a Non deposit taking institution licensed and regulated by the Uganda Microfinance Regulatory Authority UMRA.

Source: pinterest.com

Source: pinterest.com

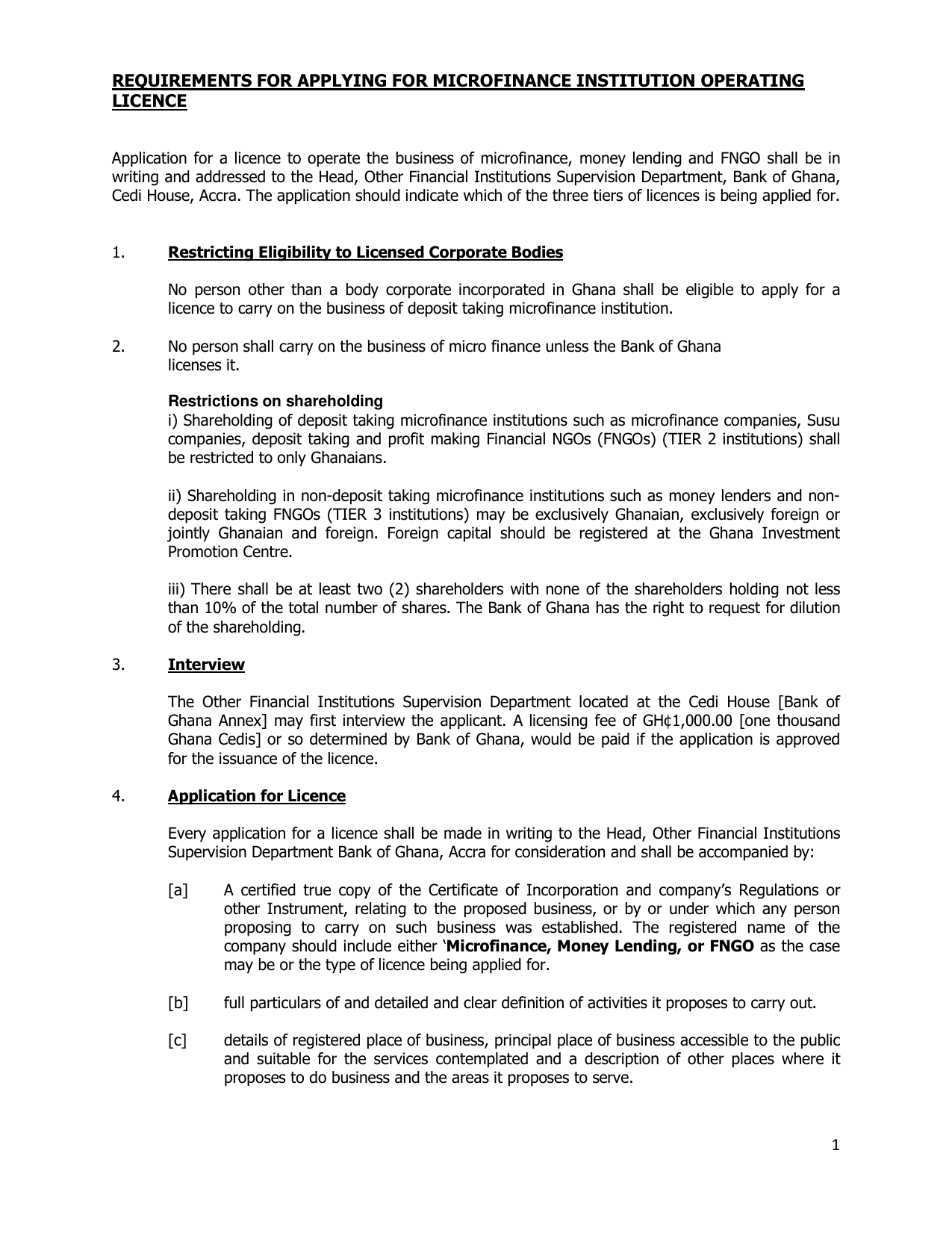

The Bank of Tanzania recently published the Microfinance Non-Deposit Taking Microfinance Service Providers Regulations Regulations issued under the Microfinance Act 2018 MFA. The words Money lending in their names. The applicant formally be established under the Companies Act or any other relevant laws in case of entities. 2 A Non-Deposit Taking Microfinance Institution shall maintain a Complaints Register where the following details shall be recorded a date complaint is received. Registrar means the Registrar of Cooperatives within the meaning of the Cooperative Societies Act.

Source: researchgate.net

Source: researchgate.net

It is a high quality micro financial services Institution which leverages on Information Communication Technology ICT to manage its operations efficiently and which enables it to scale rapidly in rural areas as it delivers better services to clients. Microfinance business means the business carried on as a principal business of. A non-deposit taking institution also known as a credit only entity is an institution that does not take any form of deposit or cash collateral from any person. A Non-Deposit Taking Microfinance Institution shall have in place complaints handling procedures to guide clients in the event of complaints. Non deposit-taking institutions shall be allotted uncollateralized Receiver General balances under the terms and conditions of a debenture issued by the participant.

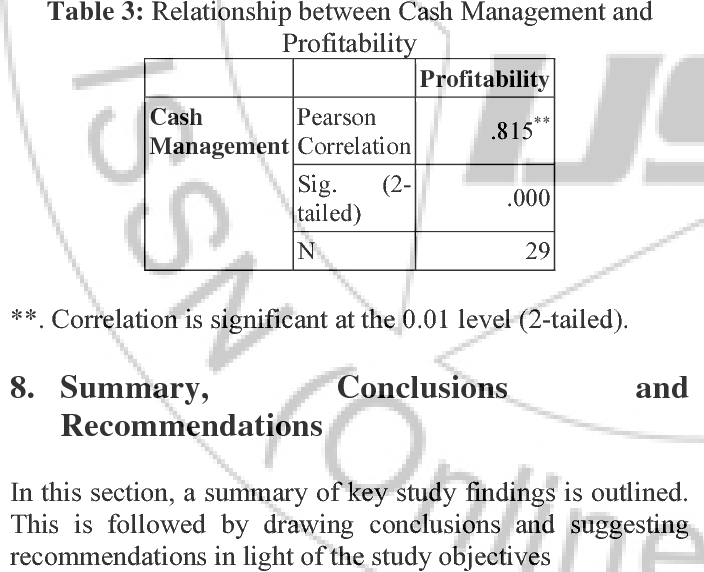

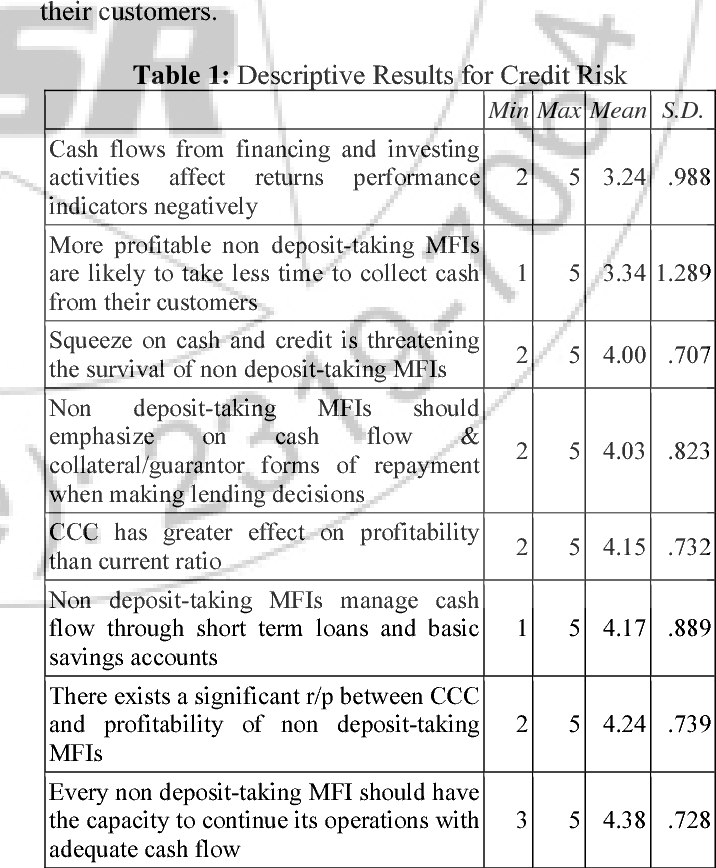

Based on the findings the study concludes that regulatory framework capital adequacy and technology were the external factors inhibiting growth of non-deposit taking microfinance institutions in Kenya. B nature of complaint. Manager means an officer of a financial institution empowered to control direct and influence decision-making of the institution. It offers financial services to individuals SMEs. You can either register your microfinance as a Non-deposit taking microfinance or Deposit-taking microfinance otherwise known as a microfinance bank.

Source: learning-without-borders.com

Source: learning-without-borders.com

Tier 3 institutions shall maintain a minimum paid-up capital of GH60000. Principal in relation to a loan means the amount lent to the borrower. It therefore requires minimum. 06 on the first 400 million in capital 072 on the excess for non-deposit-taking institutions 09 on the excess for deposit-taking. You can either register your microfinance as a Non-deposit taking microfinance or Deposit-taking microfinance otherwise known as a microfinance bank.

Source: pinterest.com

Source: pinterest.com

There is a surge in the number of non deposit taking micro finance institutions setting up in Kenya due to the raise in demand for micro loans because commercial banks are now more keen to lend to the Government of Kenya because it is less risky and as a result neglecting the majority of the Kenyans at the bottom of the Pyramid. You can either register your microfinance as a Non-deposit taking microfinance or Deposit-taking microfinance otherwise known as a microfinance bank. Principal in relation to a loan means the amount lent to the borrower. NBFC MFI is a non-deposit taking NBFC other than a company licensed us 25 of the Indian Companies Act 1956 that meets the following conditions. Since 2017 Gain Microfinance was founded by William Ssekyanzi in Entebbe.

Source: loans.info.ke

Source: loans.info.ke

Based on the findings the study concludes that regulatory framework capital adequacy and technology were the external factors inhibiting growth of non-deposit taking microfinance institutions in Kenya. 7 Experts Were super proud of our diverse and talented team. Minimum Net Owned Funds NOF of Rs5 crore. GUIDANCE ON APPLICATION FOR LICENCE TO CARRY OUT NON-DEPOSIT TAKING MICROFINANCE BUSINESS TIER 2 BY ENTITIESCOMPANIES A General information 1. Gain Microfinance limited is a Non deposit taking institution licensed and regulated by the Uganda Microfinance Regulatory Authority UMRA.

Source: manualzz.com

Source: manualzz.com

A Non-Deposit Taking Microfinance Institution shall have in place complaints handling procedures to guide clients in the event of complaints. You can either register your microfinance as a Non-deposit taking microfinance or Deposit-taking microfinance otherwise known as a microfinance bank. Obtaining a Letter of No Objection. Issue of licence 1 The Authority shall after receiving an application consider the application and may if satisfied that the applicant meets the requirements issue a. A Non-Deposit Taking Microfinance Institution shall have in place complaints handling procedures to guide clients in the event of complaints.

06 on the first 400 million in capital 072 on the excess for non-deposit-taking institutions 09 on the excess for deposit-taking. You can either register your microfinance as a Non-deposit taking microfinance or Deposit-taking microfinance otherwise known as a microfinance bank. Since 2017 Gain Microfinance was founded by William Ssekyanzi in Entebbe. B nature of complaint. Non deposit-taking institutions shall be allotted uncollateralized Receiver General balances under the terms and conditions of a debenture issued by the participant.

The Registrar of Financial Institutions in his mandate aims at protecting depositors funds enhancing access to financial services by increasing public confidence in microfinance providers and improving operational standards. A non-deposit taking institution also known as a credit only entity is an institution that does not take any form of deposit or cash collateral from any person. NBFC MFI is a non-deposit taking NBFC other than a company licensed us 25 of the Indian Companies Act 1956 that meets the following conditions. For assistance in incorporating a Company contact us. Active tab More information.

Source: semanticscholar.org

Source: semanticscholar.org

For those registered in the North Eastern Region of the country Rs. Based on the findings the study concludes that regulatory framework capital adequacy and technology were the external factors inhibiting growth of non-deposit taking microfinance institutions in Kenya. Non deposit-taking institutions shall be allotted uncollateralized Receiver General balances under the terms and conditions of a debenture issued by the participant. MDI means micro finance deposit-taking institution. Manager means an officer of a financial institution empowered to control direct and influence decision-making of the institution.

Source: in.pinterest.com

Source: in.pinterest.com

It therefore requires minimum. There is a surge in the number of non deposit taking micro finance institutions setting up in Kenya due to the raise in demand for micro loans because commercial banks are now more keen to lend to the Government of Kenya because it is less risky and as a result neglecting the majority of the Kenyans at the bottom of the Pyramid. 2 crore is required as minimum NOF. 2 A Non-Deposit Taking Microfinance Institution shall maintain a Complaints Register where the following details shall be recorded a date complaint is received. For those registered in the North Eastern Region of the country Rs.

Source: researchgate.net

Source: researchgate.net

The Registrar of Financial Institutions in his mandate aims at protecting depositors funds enhancing access to financial services by increasing public confidence in microfinance providers and improving operational standards. What is a non-deposit taking credit only microfinance. At least 85 of its Total Net Assets are in. Manager means an officer of a financial institution empowered to control direct and influence decision-making of the institution. NBFC MFI is a non-deposit taking NBFC other than a company licensed us 25 of the Indian Companies Act 1956 that meets the following conditions.

In regulatory framework technology and capital adequacy led to growth of non-deposit taking MFIs and this was significant. GUIDANCE ON APPLICATION FOR LICENCE TO CARRY OUT NON-DEPOSIT TAKING MICROFINANCE BUSINESS TIER 2 BY ENTITIESCOMPANIES A General information 1. Principal in relation to a loan means the amount lent to the borrower. Active tab More information. Obtaining a Letter of No Objection.

Source: link.springer.com

Source: link.springer.com

For those registered in the North Eastern Region of the country Rs. There is a surge in the number of non deposit taking micro finance institutions setting up in Kenya due to the raise in demand for micro loans because commercial banks are now more keen to lend to the Government of Kenya because it is less risky and as a result neglecting the majority of the Kenyans at the bottom of the Pyramid. Define Non-Deposit Taking Microfinance Institution. Means an institution that has been issued a Certificate of Registration prohibiting the acceptance of voluntary deposits from general public as stipulated in Article 14 of this Regulation by the Bank of Lao PDR. The business name of the applicant to include either of the following words.

Issue of licence 1 The Authority shall after receiving an application consider the application and may if satisfied that the applicant meets the requirements issue a. It offers financial services to individuals SMEs. 06 on the first 400 million in capital 072 on the excess for non-deposit-taking institutions 09 on the excess for deposit-taking. Microfinance Non-deposit Taking Microfinance Sevice Providers Regulations2019. Non deposit-taking institutions shall be allotted uncollateralized Receiver General balances under the terms and conditions of a debenture issued by the participant.

Source: semanticscholar.org

Source: semanticscholar.org

Companies undertaking non-deposit taking microfinance activities shall include the acronym FNGO in their names. For those registered in the North Eastern Region of the country Rs. Active tab More information. The Registrar of Financial Institutions in his mandate aims at protecting depositors funds enhancing access to financial services by increasing public confidence in microfinance providers and improving operational standards. A Non-Deposit Taking Microfinance Institution shall have in place complaints handling procedures to guide clients in the event of complaints.

Source: pinterest.com

Source: pinterest.com

It offers financial services to individuals SMEs. Non-deposit-taking microfinance institutions means financial institutions that provide micro loans and taking deposit in the form of loan or grant domestically or internationally and undertaking their operations under this Decree. Tier 3 institutions shall maintain a minimum paid-up capital of GH60000. NBFC MFI is a non-deposit taking NBFC other than a company licensed us 25 of the Indian Companies Act 1956 that meets the following conditions. Non deposit-taking institutions shall be allotted uncollateralized Receiver General balances under the terms and conditions of a debenture issued by the participant.

Registrar means the Registrar of Cooperatives within the meaning of the Cooperative Societies Act. It was passed to operationalise the National Microfinance Policy 2017. 7 Experts Were super proud of our diverse and talented team. Obtaining a Letter of No Objection. It is a high quality micro financial services Institution which leverages on Information Communication Technology ICT to manage its operations efficiently and which enables it to scale rapidly in rural areas as it delivers better services to clients.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title non deposit taking microfinance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.