Your Non depository financial institutions mining are obtainable. Non depository financial institutions are a wallet that is most popular and liked by everyone today. You can Get the Non depository financial institutions files here. Download all free exchange.

If you’re searching for non depository financial institutions images information connected with to the non depository financial institutions interest, you have come to the ideal site. Our site frequently provides you with hints for downloading the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that fit your interests.

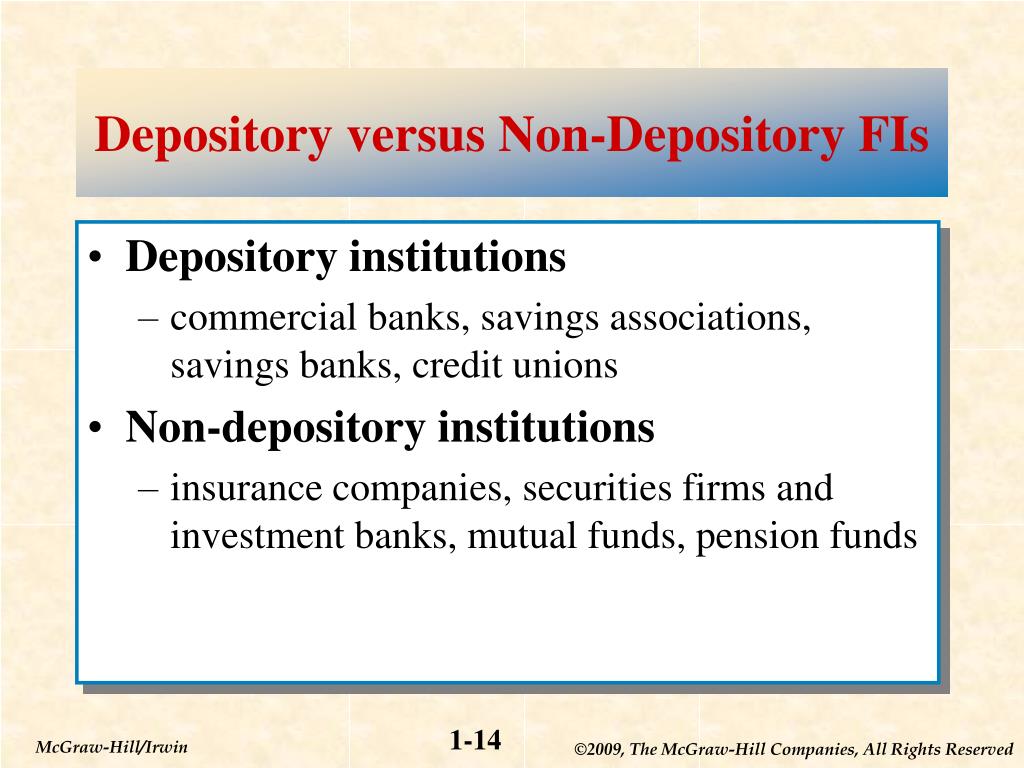

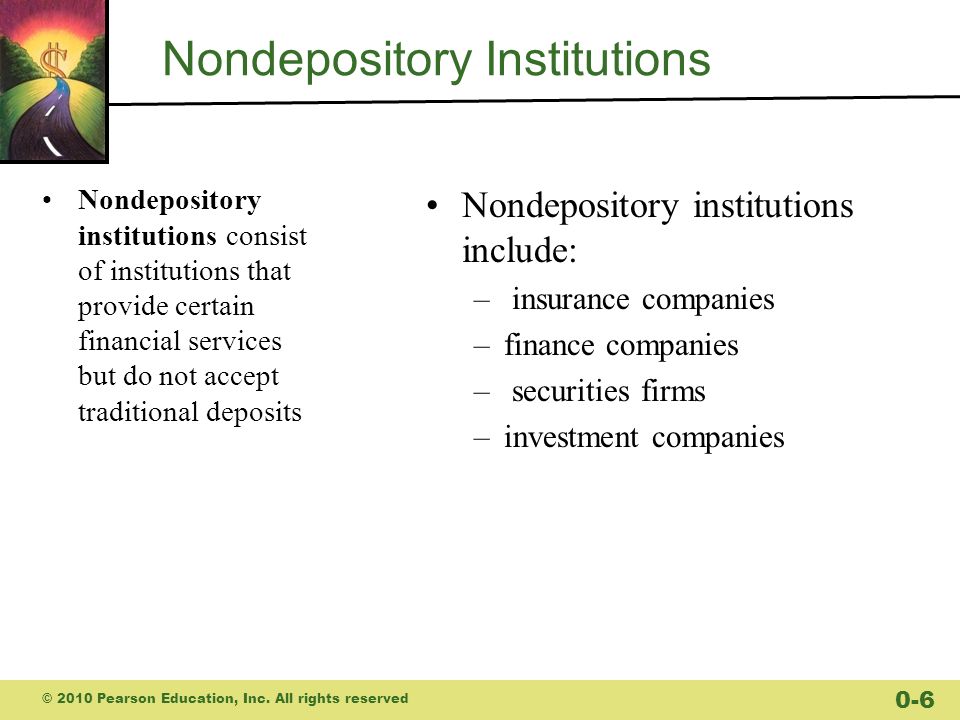

Non Depository Financial Institutions. Non-depository institutions do not take deposit from customer or clients as depository institution. Financial non depository institutions. This policy is subject to change based on examination practices state rules and statutes and changes to. The depository financial institution may either be a commercial bank savings and loan company credit union or thrift institution.

Ppt Chapter 7 Banking Powerpoint Presentation Free Download Id 1676180 From slideserve.com

Ppt Chapter 7 Banking Powerpoint Presentation Free Download Id 1676180 From slideserve.com

Risk pooling institutions Insurance companies underwrite economic risks associated with death illness damage to. Are financial intermediaries that do not accept deposits but do pool the payments of many people in the form of premiums or contributions and either invest it or provide credit to others. Non-depository financial institution. Nondepository financial institution - a financial institution that funds their investment activities from the sale of securities or insurance financial institution financial organisation financial organization - an institution public or private that collects funds from the public or. Nondepository institutions include insurance companies pension funds securities firms government-sponsored enterprises and finance companies. Accepts and executes trusts but does not issue currency.

The non-depository institutions include insurance companies pension funds finance companies and mutual funds.

Non-deposit Trust Company - Non-Member. Risk pooling institutions Insurance companies underwrite economic risks associated with death illness damage to. Complete and clear explanation about difference between depository and non depository institution by knowledge topper with suitable examplesYoutube. Explore the definition examples and roles of financial institution and discover the different types called depository non-depository and investment institutions. A non-depository institution such as an insurance broker an attorney or a stockbroker receives money from clients who are members of the public or on their behalf and until that money has been paid over to those clients or spent according to their instructions the money remains the property of the client and must be kept separate from the institutions own money. These non-bank financial institutions provide services that are not necessarily suited to banks serve as competition to banks and specialize in sectors or groups.

Source: slideshare.net

Source: slideshare.net

First week only 499. The non-depository institutions include insurance companies pension funds finance companies and mutual funds. There are also smaller nondepository institutions such as pawnshops and venture capital firms but they are much smaller sources of funds for the economy. This policy is subject to change based on examination practices state rules and statutes and changes to. Non-deposit Trust Company - Non-Member.

Source: slideserve.com

Source: slideserve.com

Introduction to Business What are the four main types of non-depository financial institutions. Accepts and executes trusts but does not issue currency. They provide long-term or short-term loan to depository institutions. Accounts of nonbank financial institutions NBFI and managements ability to implement effective monitoring and reporting systems. Risk pooling institutions Insurance companies underwrite economic risks associated with death illness damage to.

Source: prezi.com

Source: prezi.com

NBFC facilitate bank-related financial services such as investment risk pooling contractual savings and market brokering. Accounts of nonbank financial institutions NBFI and managements ability to implement effective monitoring and reporting systems. In many cases these institutions are private companies. Where you cannot put your money and withdraw it. A depository financial institution is a company that participates in the economy by lending money accepting deposits and making investments.

Source: slideplayer.com

Source: slideplayer.com

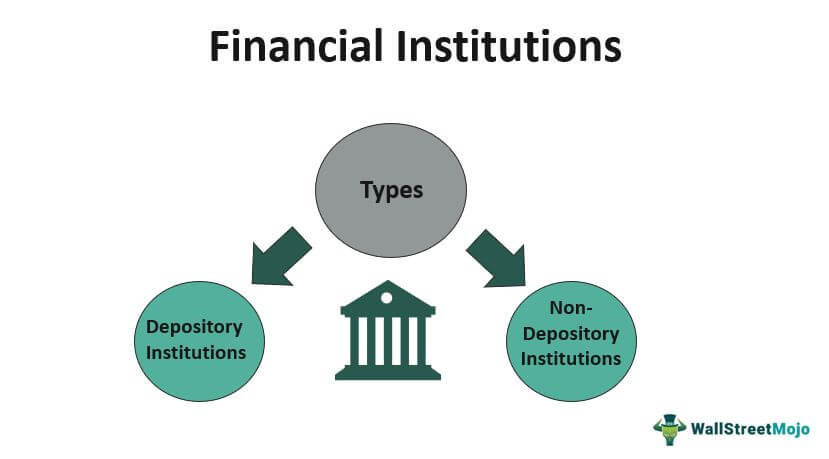

This policy is subject to change based on examination practices state rules and statutes and changes to. Given below are different non-depository intermediaries. Types of Financial Institutions We can divide financial institutions into depository and non depository institutions. NBFC facilitate bank-related financial services such as investment risk pooling contractual savings and market brokering. The non-depository institutions include insurance companies pension funds finance companies and mutual funds.

Source: slidetodoc.com

Source: slidetodoc.com

These non-bank financial institutions provide services that are not necessarily suited to banks serve as competition to banks and specialize in sectors or groups. Risk pooling institutions Insurance companies underwrite economic risks associated with death illness damage to. 2 NON-DEPOSITORY INSTITUTIONS. Explore the definition examples and roles of financial institution and discover the different types called depository non-depository and investment institutions. Non-depository institutions are mutual funds insurance companies provident funds finance companies.

Source: eponlinestudy.com

Source: eponlinestudy.com

A non-depository institution such as an insurance broker an attorney or a stockbroker receives money from clients who are members of the public or on their behalf and until that money has been paid over to those clients or spent according to their instructions the money remains the property of the client and must be kept separate from the institutions own money. The main non-depository financial institutions are. In many cases these institutions are private companies. A non-banking financial institution NBFI or non-bank financial company NBFC is a financial institution that does not have a full banking license or is not supervised by a national or international banking regulatory agency. A depository financial institution is a company that participates in the economy by lending money accepting deposits and making investments.

Source: slidetodoc.com

Source: slidetodoc.com

Start your trial now. Accounts of nonbank financial institutions NBFI and managements ability to implement effective monitoring and reporting systems. 2 NON-DEPOSITORY INSTITUTIONS. This policy is subject to change based on examination practices state rules and statutes and changes to. Where you cannot put your money and withdraw it.

Source: slideserve.com

Source: slideserve.com

Insurance Companies Insurance companies are the contractual saving institutions which collect periodic premium from an insured party and in return agree to compensate against the risk of loss of life and properties. Non Depository institution. The non-depository institutions include insurance companies pension funds finance companies and mutual funds. Non-depository institutions are mutual funds insurance companies provident funds finance companies. This policy is subject to change based on examination practices state rules and statutes and changes to.

Source: slideplayer.com

Source: slideplayer.com

2 NON-DEPOSITORY INSTITUTIONS. Non-depository institutions do not take deposit from customer or clients as depository institution. Nondepository financial institution - a financial institution that funds their investment activities from the sale of securities or insurance financial institution financial organisation financial organization - an institution public or private that collects funds from the public or. Non-deposit Trust Company - Non-Member. The non-depository institutions include insurance companies pension funds finance companies and mutual funds.

Source: slideserve.com

Source: slideserve.com

2 NON-DEPOSITORY INSTITUTIONS. Where you buy scheme in units. In many cases these institutions are private companies. Accepts and executes trusts but does not issue currency. Can either be Federal Reserve members or Non-Members.

Source: assignmentpoint.com

Source: assignmentpoint.com

Nondepository institutions include insurance companies pension funds securities firms government-sponsored enterprises and finance companies. Start your trial now. Can either be Federal Reserve members or Non-Members. Where you buy scheme in units. Non-depository financial institution.

You would not get interest. Accepts and executes trusts but does not issue currency. The depository financial institution may either be a commercial bank savings and loan company credit union or thrift institution. They are intermediary between borrowers and saver. NBFIs are broadly defined as institutions other than banks that offer financial services.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Nondepository institutions include insurance companies pension funds securities firms government-sponsored enterprises and finance companies. 2 NON-DEPOSITORY INSTITUTIONS. They are intermediary between borrowers and saver. Government or private organization such as building society insurance company investment trust or mutual fund or unit trust that serves as an intermediary between savers and borrowers but does not accept time deposits. You would not get interest.

Source: slideserve.com

Source: slideserve.com

Implied rate of returnaccouting rate of returnhow to get rate of returnrate of return calcrate of return pdfrate of return investopediapre tax rate of return. Implied rate of returnaccouting rate of returnhow to get rate of returnrate of return calcrate of return pdfrate of return investopediapre tax rate of return. 2 NON-DEPOSITORY INSTITUTIONS. Risk pooling institutions Insurance companies underwrite economic risks associated with death illness damage to. A depository financial institution is a company that participates in the economy by lending money accepting deposits and making investments.

This policy is subject to change based on examination practices state rules and statutes and changes to. Non-depository institutions are mutual funds insurance companies provident funds finance companies. Risk pooling institutions Insurance companies underwrite economic risks associated with death illness damage to. NBFIs are broadly defined as institutions other than banks that offer financial services. Commence Financial Institutions Non-Depository Division to examine Mortgage companies for compliance with SAFE Mortgage Licensing Act SAFE MLA and federal and state regulations.

Although they may be regulated by the government they are usually not backed or protected by the government. Non-deposit Trust Company - Non-Member. They provide long-term or short-term loan to depository institutions. Then they pay you bonus and even you can sales it on market. Non-depository financial institution.

Source: ppt-online.org

Source: ppt-online.org

Given below are different non-depository intermediaries. The depository financial institution may either be a commercial bank savings and loan company credit union or thrift institution. They are intermediary between borrowers and saver. Non-depository institutions do not take deposit from customer or clients as depository institution. Given below are different non-depository intermediaries.

Source: slideplayer.com

Source: slideplayer.com

1 Role of non-depository financial institutions. Accounts of nonbank financial institutions NBFI and managements ability to implement effective monitoring and reporting systems. The y collect fund by collecting premiums or other sources. 1 Role of non-depository financial institutions. Are financial intermediaries that do not accept deposits but do pool the payments of many people in the form of premiums or contributions and either invest it or provide credit to others.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title non depository financial institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.