Your Principal 401k loan news are ready in this website. Principal 401k loan are a coin that is most popular and liked by everyone this time. You can News the Principal 401k loan files here. News all free coin.

If you’re looking for principal 401k loan pictures information linked to the principal 401k loan keyword, you have pay a visit to the right site. Our site always provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Principal 401k Loan. Securities offered through Principal Securities Inc 800-547-7754 member SIPC andor independent broker-dealers. You may have to wait for the loan to be approved though in most cases youll qualify. Box 219971Kansas City MO 64121-9971For overnight deliveryPrincipal Funds430 W 7th St Ste. A year before the switch I took out a 401k loan for the purchase of my home which comes with a 15 year repayment duration.

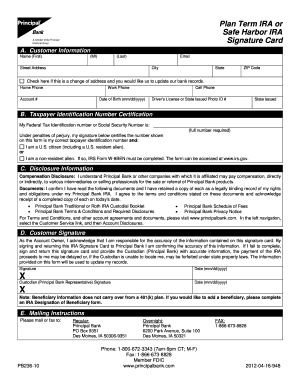

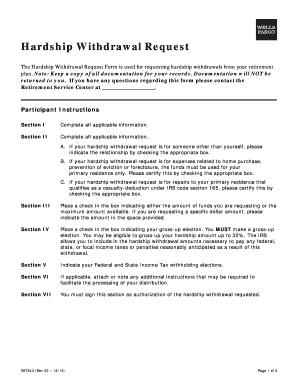

Principal 401k Terms Of Withdrawal Pdf Fill Online Printable Fillable Blank Pdffiller From pdffiller.com

Principal 401k Terms Of Withdrawal Pdf Fill Online Printable Fillable Blank Pdffiller From pdffiller.com

Box 219971Kansas City MO 64121-9971For overnight deliveryPrincipal Funds430 W 7th St Ste. Use the forms below to request a distribution or redemption from your Principal Traditional IRA Roth IRA SIMPLE IRA SEP IRA or 403b7 accountSubmit completed forms to your financial professional or directly to Principal FundsMail completed forms toPrincipal FundsPO. Interest Rate - The interest rate that you will pay for taking the 401k loan. 1 These considerations were prepared for pre-tax. For the year 2020 you can contribute up to 19500. Is distributed by Principal Funds Distributor Inc.

Excise taxes under IRC Section 4975 apply until the loan is fully repaid.

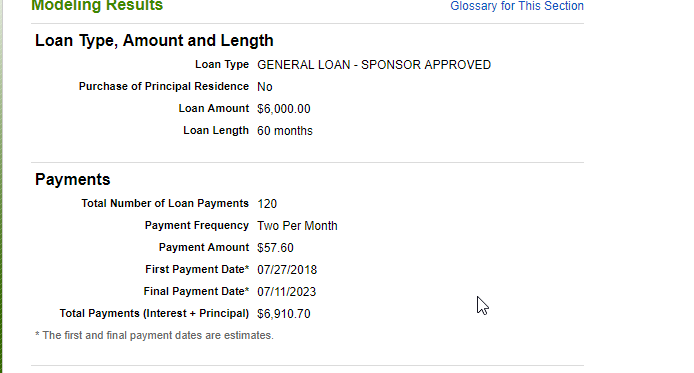

15 annual fee per account. Interest Rate - The interest rate that you will pay for taking the 401k loan. A unique feature of a 401k loan though is that unlike other types of borrowing from a lender the employee literally borrows their own money out of their own account such that the borrowers 401k loan repayments of principal and interest really do get paid right back to themselves into their own 401k plan. You cannot use this loan type for remodeling your current home nor can you use it to purchase a second home or vacation home. Rollover IRA minimum of 1000 no minimums on Traditional or Roth IRA accounts. If you leave your current job you might have to repay your loan in full in a very short time frame.

Source: portalloginfacts.com

Source: portalloginfacts.com

If youre already enrolled in a 401k 403b or 457b plan with services through Principal you might consider increasing the amount you contribute from each paycheck. When you borrow from your 401k you sign a loan agreement that spells out the principal the term of the loan the interest rate any fees and other terms that may apply. Principal Life and Principal Securities are members of the Principal Financial Group Des Moines Iowa 50392. 1 These considerations were prepared for pre-tax. In the case of a 401k loan you are borrowing money from yourself so you will actually be paying money back into your 401k account both in the form of principal and interestyes the interest is paid into the 401k account as well as the principal.

Source: mysolo401k.net

Source: mysolo401k.net

Is distributed by Principal Funds Distributor Inc. Principal residence 401K loans on the other hand can only be used toward the down payments and closing costs on a primary residence. If youre already enrolled in a 401k 403b or 457b plan with services through Principal you might consider increasing the amount you contribute from each paycheck. Again we take the smaller of A and B and that is the maximum Liz can take in the form of a. Because that money is meant for retirement withdrawals are discouraged before you reach age 59 ½.

Source: metriculum.com

Source: metriculum.com

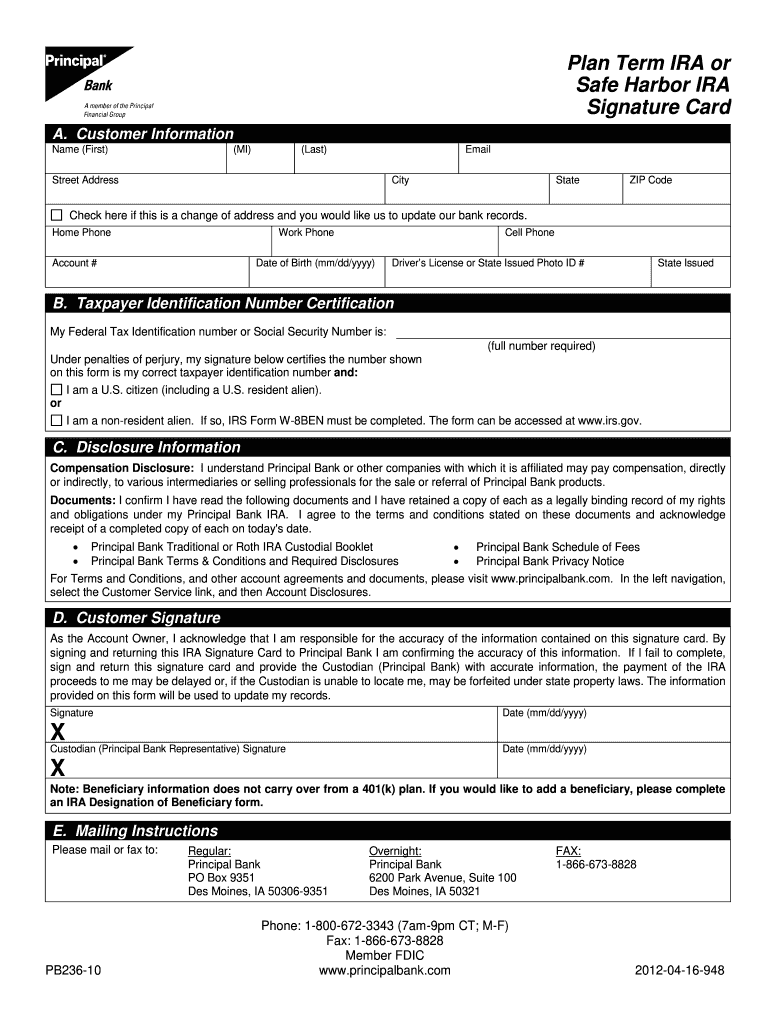

When I took out the loan via Slavic there was an ability to make one principal reduction payment a year on top of your normal payroll withdrawals. In the case of a 401k loan you are borrowing money from yourself so you will actually be paying money back into your 401k account both in the form of principal and interestyes the interest is paid into the 401k account as well as the principal. Principal Individual Retirement Account at a Glance. Principal residence 401K loans on the other hand can only be used toward the down payments and closing costs on a primary residence. Use the forms below to request a distribution or redemption from your Principal Traditional IRA Roth IRA SIMPLE IRA SEP IRA or 403b7 accountSubmit completed forms to your financial professional or directly to Principal FundsMail completed forms toPrincipal FundsPO.

Source: bogleheads.org

Source: bogleheads.org

Plan administrative services offered by Principal Life. Principal 401k Terms Of Withdrawal Free PDF eBooks. 15 annual fee per account. Even a few extra dollars per paycheck may add up significantly over timeand it only takes a. Is distributed by Principal Funds Distributor Inc.

Source: solo401k.com

Source: solo401k.com

Just think what you could do with your excess money. Insurance products issued by Principal National Life Insurance Co except in NY and Principal Life Insurance Co. Insurance products and plan administrative services provided through Principal Life Insurance Co. Box 219971Kansas City MO 64121-9971For overnight deliveryPrincipal Funds430 W 7th St Ste. Rollover IRA Traditional IRA and Roth IRA accounts.

Source: 401khelpcenter.com

Source: 401khelpcenter.com

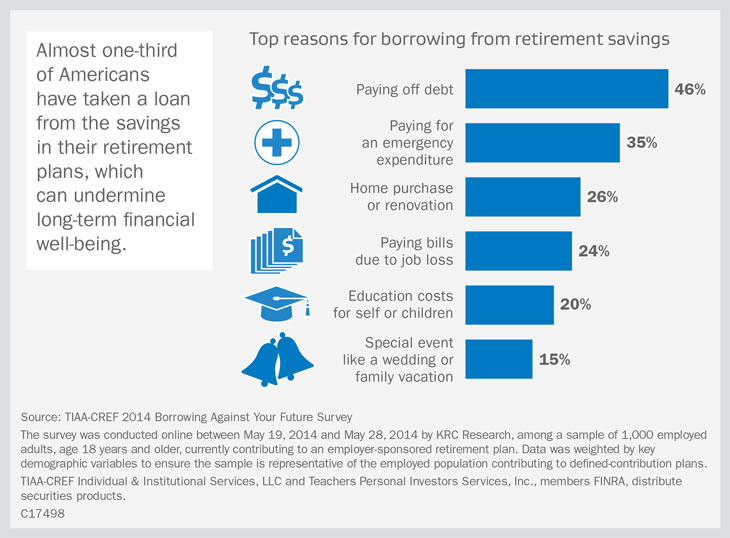

The Benefits of Paying Off Your 401k Loan Early The bottom line is that clearing off your loan quick will save you money from interest and lower the overall term of the loan. Flexibility when setting up periodic or unscheduled withdrawals. Securities offered through Principal Securities Inc 800-547-7754 member SIPC andor independent broker-dealers. 1 These considerations were prepared for pre-tax. You cannot use this loan type for remodeling your current home nor can you use it to purchase a second home or vacation home.

Source: signnow.com

Source: signnow.com

Principal Financial Services Inc. Know Your Options - Principal Financial. Rollover IRA minimum of 1000 no minimums on Traditional or Roth IRA accounts. For the year 2020 you can contribute up to 19500. Fortunately the interest goes to your own account so its a form of earnings for you.

Source: pdffiller.com

Source: pdffiller.com

Call Principal at 1-800-547-7754 to get your questions answered and if applicable initiate a loan. Rollover IRA minimum of 1000 no minimums on Traditional or Roth IRA accounts. 1 These considerations were prepared for pre-tax. Understandably so in a world keen on saddling us with debt. Flexibility when setting up periodic or unscheduled withdrawals.

Source: principalfunds.com

Source: principalfunds.com

Is distributed by Principal Funds Distributor Inc. Even a few extra dollars per paycheck may add up significantly over timeand it only takes a. As with any loan you pay interest when you borrow from your 401k. 1 These considerations were prepared for pre-tax. Know Your Options - Principal Financial.

Source: docplayer.net

Source: docplayer.net

But if you cant repay the loan for any reason its considered defaulted and youll owe both taxes and a 10 penalty if youre. The disqualified person pays the excise taxes on Form 5330 PDF Return of Excise Taxes Related to Employee Benefit Plans. You may have to wait for the loan to be approved though in most cases youll qualify. Box 219971Kansas City MO 64121-9971For overnight deliveryPrincipal Funds430 W 7th St Ste. Representatives are available to assist you Monday through Friday 700am to 900pm CST.

Source: fiduciaryfactor.com

Source: fiduciaryfactor.com

This is free money. Representatives are available to assist you Monday through Friday 700am to 900pm CST. Use the forms below to request a distribution or redemption from your Principal Traditional IRA Roth IRA SIMPLE IRA SEP IRA or 403b7 accountSubmit completed forms to your financial professional or directly to Principal FundsMail completed forms toPrincipal FundsPO. The Solo 401k Loan Primary Residence Rules. Fortunately the interest goes to your own account so its a form of earnings for you.

Source: docplayer.net

Source: docplayer.net

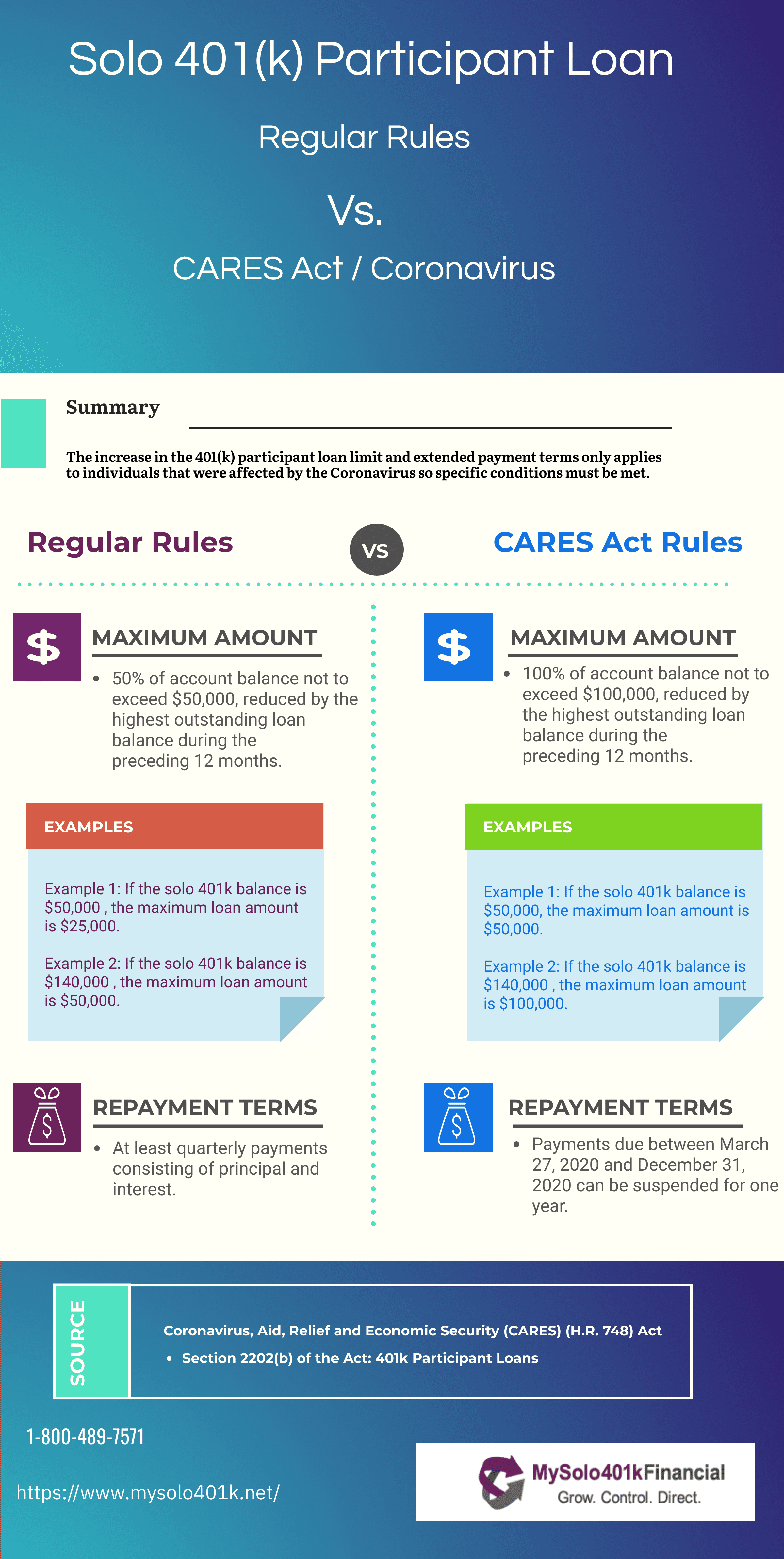

Securities offered through Principal Securities Inc member SIPC andor independent broker-dealers. But if you cant repay the loan for any reason its considered defaulted and youll owe both taxes and a 10 penalty if youre. If you miss a payment or default on your loan from a 401k it wont impact your credit score because defaulted loans are not reported to credit bureaus. Excise taxes under IRC Section 4975 apply until the loan is fully repaid. The rules that apply to a Solo 401k loan solo 401k participant loan whereby the proceeds are used for any purpose are the same but a little more favorable if the proceeds are used to acquire a principalprimary residence of the solo 401k participant.

Source: studylib.net

Source: studylib.net

Insurance products issued by Principal National Life Insurance Co except in NY and Principal Life Insurance Co. A year before the switch I took out a 401k loan for the purchase of my home which comes with a 15 year repayment duration. Her previous loan is paid in full but the highest outstanding balance in the last twelve months was 4000. Use the forms below to request a distribution or redemption from your Principal Traditional IRA Roth IRA SIMPLE IRA SEP IRA or 403b7 accountSubmit completed forms to your financial professional or directly to Principal FundsMail completed forms toPrincipal FundsPO. Rollover IRA minimum of 1000 no minimums on Traditional or Roth IRA accounts.

Source: principal.com

Source: principal.com

When I took out the loan via Slavic there was an ability to make one principal reduction payment a year on top of your normal payroll withdrawals. Securities offered through Principal Securities Inc member SIPC andor independent broker-dealers. In the case of a 401k loan you are borrowing money from yourself so you will actually be paying money back into your 401k account both in the form of principal and interestyes the interest is paid into the 401k account as well as the principal. Principal 401k Terms Of Withdrawal Free PDF eBooks. Principal Individual Retirement Account at a Glance.

Source: pdffiller.com

Source: pdffiller.com

This is free money. If youre already enrolled in a 401k 403b or 457b plan with services through Principal you might consider increasing the amount you contribute from each paycheck. Excise taxes under IRC Section 4975 apply until the loan is fully repaid. But if you cant repay the loan for any reason its considered defaulted and youll owe both taxes and a 10 penalty if youre. Flexibility when setting up periodic or unscheduled withdrawals.

Source: pdfprof.com

Source: pdfprof.com

Principal 401k Terms Of Withdrawal Free PDF eBooks. Rollover IRA minimum of 1000 no minimums on Traditional or Roth IRA accounts. Plan administrative services offered by Principal Life. Principal Life and Principal Securities are members of the Principal Financial Group Des Moines Iowa 50392. The rules that apply to a Solo 401k loan solo 401k participant loan whereby the proceeds are used for any purpose are the same but a little more favorable if the proceeds are used to acquire a principalprimary residence of the solo 401k participant.

Source: fiduciaryfactor.com

Source: fiduciaryfactor.com

Principal Individual Retirement Account at a Glance. Representatives are available to assist you Monday through Friday 700am to 900pm CST. Is distributed by Principal Funds Distributor Inc. You cannot use this loan type for remodeling your current home nor can you use it to purchase a second home or vacation home. Box 219971Kansas City MO 64121-9971For overnight deliveryPrincipal Funds430 W 7th St Ste.

Source: pdffiller.com

Source: pdffiller.com

If youre already enrolled in a 401k 403b or 457b plan with services through Principal you might consider increasing the amount you contribute from each paycheck. You cannot use this loan type for remodeling your current home nor can you use it to purchase a second home or vacation home. Liz has a vested account balance of 30000. Securities offered through Principal Securities Inc member SIPC. Principal Life and Principal Securities are members of the Principal Financial Group Des Moines Iowa 50392.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title principal 401k loan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.