Your Rotating savings and credit association trading are ready. Rotating savings and credit association are a bitcoin that is most popular and liked by everyone today. You can Get the Rotating savings and credit association files here. Find and Download all royalty-free bitcoin.

If you’re looking for rotating savings and credit association pictures information connected with to the rotating savings and credit association topic, you have come to the ideal site. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Rotating Savings And Credit Association. Rotating Credit and Savings Association or ROSCA is an alternative financial vehicle in which a group of individuals fills the role of an informal financial institution. Rotating savings and credit associations Roscas. And social cohesion approached by introducing the case in Egypt by using Rotating Savings and Credit Associations ROSCAs and Village Savings and Loans Association VSLA approaches as interventions for economic empowerment for women and social cohesion in Egypt. Roscas are locally organized groups that meet at regular intervals.

The Economics Of Rotating Savings And Credit Associations By Timothy Besley Stephen Coate And Glenn Loury Ppt Download From slideplayer.com

The Economics Of Rotating Savings And Credit Associations By Timothy Besley Stephen Coate And Glenn Loury Ppt Download From slideplayer.com

This thesis investigates the rotating savings and credit association rosca as an economic social and cultural institution. This study examined whether participation in mujin a traditional Japanese rotating savings and credit association affected the maintenance of higher-level functional capacity in older adults. Rotating savings and credit associations ROSCA are among the oldest and most prevalent savings institutions found in the world and play an important role in savings mobilization in many developing economies. This is not an example of the work written by professional essay writers. In the ASCRA funds are not immediately withdrawn but are left to grow for loan making. Comparing the two groups the author finds similarities and differences.

2006 Rotating Savings and Credit Association or ROSCA is a gro up of individ uals who agree to meet for a defined period of ti me i n ord er to save a nd borrow to gether.

Ownership of the property is eventually transferred to the last surviving investor in case of death. Rotating savings and credit associations ROSCA are among the oldest and most prevalent savings institutions found in the world and play an important role in savings mobilization in many developing economies. Yet even in societies where levels of trust on financial matters are relatively low it is possible for ROSCAs to be popular and effective. This essay has been submitted by a student. Rotating savings and credit association ROSCA is the most popular informal financial sector in Ghana. Rotating savings and credit associations Roscas.

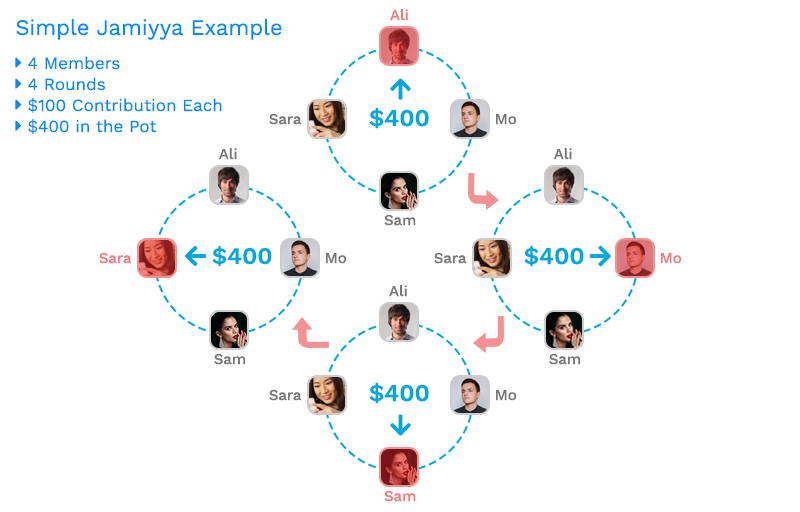

Source: shamseya.org

Source: shamseya.org

Overview Of Rotating Savings And Credit Association ROSCA. Rotating Savings and Credit Associations or ROSCAs are a popular form of informal saving in many countries and can be considered a form of informal microfinance. The members agree to contribute an equal amount of money typically on a. Financial self-help groups in low-income countries consist of two basic types Rotating and Accumulating Savings and Credit Associations or ROSCAs and ASCRAs. And social cohesion approached by introducing the case in Egypt by using Rotating Savings and Credit Associations ROSCAs and Village Savings and Loans Association VSLA approaches as interventions for economic empowerment for women and social cohesion in Egypt.

Source: lateefapp.com

Source: lateefapp.com

Rotating savings and credit associations ROSCA are among the oldest and most prevalent savings institutions found in the world and play an important role in savings mobilization in many developing economies. ROSCAs operate on trust. Essay Example 626 words GradesFixer. This is not an example of the work written by professional essay writers. Rotating Savings and Credit Associations or ROSCAs are a popular form of informal saving in many countries and can be considered a form of informal microfinance.

Source: researchgate.net

Source: researchgate.net

This is not an example of the work written by professional essay writers. They play a complementary role by fil ling in the gap left by the formal sector. Roscas are one of the most common informal nancial systems found in the developing world and provide goods or bene ts that are missing. The Case of India. ROSCAs operate on trust.

Source: slideplayer.com

Source: slideplayer.com

The root of ROSCA was traced by Geertz 1962 from the regions of West Africa countries that were economically developed during the slave trade era into the Caribbean and the southern part of the United States. This essay has been submitted by a student. Rotating savings and credit association ROSCA is the most popular informal financial sector in Ghana. Rotating savings and credit associations ROSCA are among the oldest and most prevalent savings institutions found in the world and play an important role in savings mobilization in many developing economies. And social cohesion approached by introducing the case in Egypt by using Rotating Savings and Credit Associations ROSCAs and Village Savings and Loans Association VSLA approaches as interventions for economic empowerment for women and social cohesion in Egypt.

Source: behavioraldevelopmentblog.wordpress.com

Source: behavioraldevelopmentblog.wordpress.com

Rotating Savings and Credit Association ROSCA are financial instruments in which the members participate voluntarily ROSCAs are prevalent all. And social cohesion approached by introducing the case in Egypt by using Rotating Savings and Credit Associations ROSCAs and Village Savings and Loans Association VSLA approaches as interventions for economic empowerment for women and social cohesion in Egypt. The root of ROSCA was traced by Geertz 1962 from the regions of West Africa countries that were economically developed during the slave trade era into the Caribbean and the southern part of the United States. Rotating savings and credit association ROSCA is the most popular informal financial sector in Ghana. 2006 Rotating Savings and Credit Association or ROSCA is a gro up of individ uals who agree to meet for a defined period of ti me i n ord er to save a nd borrow to gether.

Source: investopedia.com

Source: investopedia.com

This essay has been submitted by a student. According to one paper it may even date as far back as 13th century JapanDetails vary but the typical. This study examined whether participation in mujin a traditional Japanese rotating savings and credit association affected the maintenance of higher-level functional capacity in older adults. The Economics of Rotating Savings and Credit Associations By TIMOTHY BESLEY STEPHEN COATE AND GLENN LoURY This paper analyzes the economic role and performance of a type of financial institution which is observed worldwide. Rotating savings and credit association ROSCA is the most popular informal financial sector in Ghana.

Source: collaborativefinance.org

Source: collaborativefinance.org

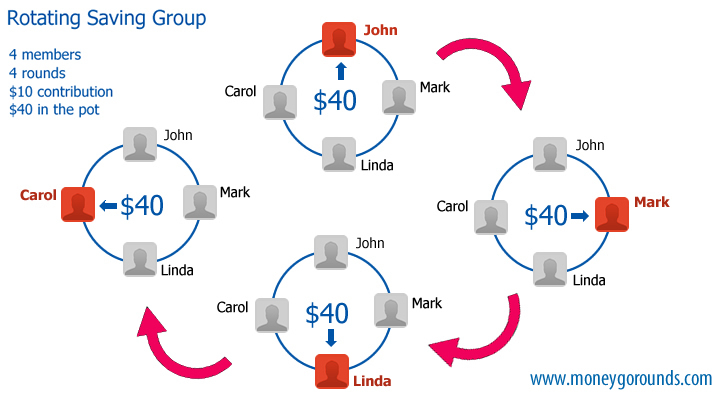

Essay Example 626 words GradesFixer. Rotating savings and credit associations ROSCAs as a component of the infor mal sector of the economies of developing countries meet essential financial needs of the bulk of the population of these countries. At each meeting members contribute funds that are given in turn to one. 2006 Rotating Savings and Credit Association or ROSCA is a gro up of individ uals who agree to meet for a defined period of ti me i n ord er to save a nd borrow to gether. In the ASCRA funds are not immediately withdrawn but are left to grow for loan making.

Source: researchgate.net

Source: researchgate.net

According to one paper it may even date as far back as 13th century JapanDetails vary but the typical. Yet even in societies where levels of trust on financial matters are relatively low it is possible for ROSCAs to be popular and effective. A rotating savings and credit association ROSCA is a group of individuals who agree to meet for a defined period in order to save and borrow together a form of combined peer-to-peer banking and peer-to-peer lending. ROSCAs operate on trust. Financial self-help groups in low-income countries consist of two basic types Rotating and Accumulating Savings and Credit Associations or ROSCAs and ASCRAs.

Source: researchgate.net

Source: researchgate.net

Rotating savings and credit associations Roscas are one of the most popular and widely documented informal financial arrangement in the developing world. Rotating savings and credit associations ROSCA are among the oldest and most prevalent savings institutions found in the world and play an important role in savings mobilization in many developing economies. 5 Benefits of a Rotating Savings and Credit Association for Small Businesses An informal saving club or Rotating Savings and Credit Association for small businesses allows each contributing Member of the ROSCA group to benefit from loans and disbursement. Rotating savings and credit associations ROSCAs as a component of the infor mal sector of the economies of developing countries meet essential financial needs of the bulk of the population of these countries. Using a model in which individuals save for an indivisible durable.

Source: slideplayer.com

Source: slideplayer.com

The Economics of Rotating Savings and Credit Associations By TIMOTHY BESLEY STEPHEN COATE AND GLENN LoURY This paper analyzes the economic role and performance of a type of financial institution which is observed worldwide. Yet even in societies where levels of trust on financial matters are relatively low it is possible for ROSCAs to be popular and effective. Comparing the two groups the author finds similarities and differences. They play a complementary role by fil ling in the gap left by the formal sector. Rotating savings and credit associations ROSCA are among the oldest and most prevalent savings institutions found in the world and play an important role in savings mobilization in many developing economies.

Source: youtube.com

Source: youtube.com

Rotatory saving and credit associations ROSCAs are informal financing association serving the needs of many people specifically those who had no access to formal financial markets in. In its original sense a rotating savings and credit association RSCA is an agreement reached by a group of people to jointly invest in a property. Rotating savings and credit associations Roscas. The Economics of Rotating Savings and Credit Associations By TIMOTHY BESLEY STEPHEN COATE AND GLENN LoURY This paper analyzes the economic role and performance of a type of financial institution which is observed worldwide. Yet even in societies where levels of trust on financial matters are relatively low it is possible for ROSCAs to be popular and effective.

Rotating Savings and Credit Association ROSCA are financial instruments in which the members participate voluntarily ROSCAs are prevalent all. The concept of rotating savings and credit associations has existed for hundreds of years. Using a model in which individuals save for an indivisible durable. They play a complementary role by fil ling in the gap left by the formal sector. Rotating savings and credit associations Roscas.

Source: researchgate.net

Source: researchgate.net

Frauds in Unorganized Investment Schemes. This is not an example of the work written by professional essay writers. A rotating savings and credit association - an informal local microfinance group - provides community-dwelling older adults with cohesive social capital. Rotating savings and credit associations Roscas. Rotating Savings and Credit Association ROSCA are financial instruments in which the members participate voluntarily ROSCAs are prevalent all.

Source: slideplayer.com

Source: slideplayer.com

A rotating savings and credit association - an informal local microfinance group - provides community-dwelling older adults with cohesive social capital. Rotating savings and credit associations ROSCAs as a component of the infor mal sector of the economies of developing countries meet essential financial needs of the bulk of the population of these countries. Frauds in Unorganized Investment Schemes. According to one paper it may even date as far back as 13th century JapanDetails vary but the typical. Financial self-help groups in low-income countries consist of two basic types Rotating and Accumulating Savings and Credit Associations or ROSCAs and ASCRAs.

Source: fao.org

Source: fao.org

At each meeting members contribute funds that are given in turn to one. A rotating savings and credit association ROSCA is a group of individuals who agree to meet for a defined period in order to save and borrow together a form of combined peer-to-peer banking and peer-to-peer lending. Rotating savings and credit association ROSCA is the most popular informal financial sector in Ghana. Financial self-help groups in low-income countries consist of two basic types Rotating and Accumulating Savings and Credit Associations or ROSCAs and ASCRAs. The concept of rotating savings and credit associations has existed for hundreds of years.

Source: slideplayer.com

Source: slideplayer.com

Roscas are locally organized groups that meet at regular intervals. Rotatory saving and credit associations ROSCAs are informal financing association serving the needs of many people specifically those who had no access to formal financial markets in. These partnerships are formed by a group of participants who make regular contributions to a fund which is given to each contributor in turn until each member has received the fund. The members agree to contribute an equal amount of money typically on a. This is not an example of the work written by professional essay writers.

Rotating savings and credit association ROSCA is the most popular informal financial sector in Ghana. Roscas are one of the most common informal nancial systems found in the developing world and provide goods or bene ts that are missing. ROSCAs and VSLA Approaches aims to empowering marginalized. The root of ROSCA was traced by Geertz 1962 from the regions of West Africa countries that were economically developed during the slave trade era into the Caribbean and the southern part of the United States. This is not an example of the work written by professional essay writers.

Source: slideplayer.com

Source: slideplayer.com

A rotating savings and credit association ROSCA is a group of individuals who agree to meet for a defined period in order to save and borrow together a form of combined peer-to-peer banking and peer-to-peer lending. 2006 Rotating Savings and Credit Association or ROSCA is a gro up of individ uals who agree to meet for a defined period of ti me i n ord er to save a nd borrow to gether. Rotating Savings and Credit Associations or ROSCAs are a popular form of informal saving in many countries and can be considered a form of informal microfinance. ROSCAs and VSLA Approaches aims to empowering marginalized. This study examined whether participation in mujin a traditional Japanese rotating savings and credit association affected the maintenance of higher-level functional capacity in older adults.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title rotating savings and credit association by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.