Your Sebi registered intermediary news are available in this site. Sebi registered intermediary are a wallet that is most popular and liked by everyone this time. You can Find and Download the Sebi registered intermediary files here. Download all free trading.

If you’re searching for sebi registered intermediary images information linked to the sebi registered intermediary keyword, you have come to the ideal blog. Our website always provides you with hints for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

Sebi Registered Intermediary. KYC Registration Agency KRA is an agency registered with SEBI under the Securities and Exchange Board of India KYC Know Your Client Registration Agency Regulations 2011. Markets regulator SEBI on Wednesday came out with an investor charter aimed at protecting the interest of investors in the securities market. Was not uniform at all. Entities Permitted to Send Stock Tips using Bulk SMS.

Investment Advisor Registration With Sebi A Comperhensive Guide From enterslice.com

Investment Advisor Registration With Sebi A Comperhensive Guide From enterslice.com

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process again when you approach another intermediary Dear Investor if you are subscribing to. In this regard SEBI has issued the SEBI KYC Know Your Client Registration Agency KRA Regulations 2011. CNBC-TV18 and the National Stock Exchange have come together to promote investor awareness through a special campaign InformedInvestor that empowers you to. Markets regulator SEBI on Wednesday came out with an investor charter aimed at protecting the interest of investors in the securities market. SEBI registered Mutual Funds. SEBI Bans Investment Advisors from Providing Free Trial of Services.

Intermediary and where such intermediary is a body corporate will include its.

There was a separate KYC process for each intermediary which was very tiresome for investors. Duly recognised by or registered with the Board and includes a stock exchange. Regulatory action taken by Market Infrastructure Institutions. The KRA will maintain KYC records of the investors centrally on behalf of capital market intermediaries registered with SEBI. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process again when you approach another intermediary. Sebi said it has put in place an alternate dispute redressal mechanism for grievances against brokers depository participants at the level of stock exchanges and depositories.

Source: cskruti.com

Source: cskruti.com

SEBI has issued an investor charter in which the market regulator has asked mutual funds RIA and other SEBI registered intermediaries to put in place a mechanism to disclose average turn around time for redressal of investor grievances on their respective websites. Duly recognised by or registered with the Board and includes a stock exchange. The KRA will maintain KYC records of the investors centrally on behalf of capital market intermediaries registered with SEBI. In this regard SEBI has issued the SEBI KYC Know Your Client Registration Agency KRA Regulations 2011. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process again when you approach another intermediary Dear Investor if you are subscribing to.

Source: blog.ipleaders.in

Source: blog.ipleaders.in

2 Words and expressions used and not defined in these regulations shall have the. If they provide their registration number you can verify the same through SEBI website wwwsebigovin If their number and name matches the details provide to you they are authentic SEBI registered Investment advisor or research analyst. Regulatory action taken by Market Infrastructure Institutions. Deal with SEBI-recognised market infrastructure institutions and SEBI-registered intermediaries regulated entities only. In case of Stock brokers their sub-brokers or Authorised Persons appointed by the stock brokers after getting approval from the concerned Stock Exchanges in terms of SEBI Circular No.

Source: blog.ipleaders.in

Source: blog.ipleaders.in

The preamble of Securities and Exchange Board of India describes the basic functions of the Securities and Exchange Board of India as. SEBI Bans Investment Advisors from Providing Free Trial of Services. Thus in order to bring uniformity in the KYC process SEBI introduced the concept of. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process again when you approach another intermediary. Intermediary and where such intermediary is a body corporate will include its.

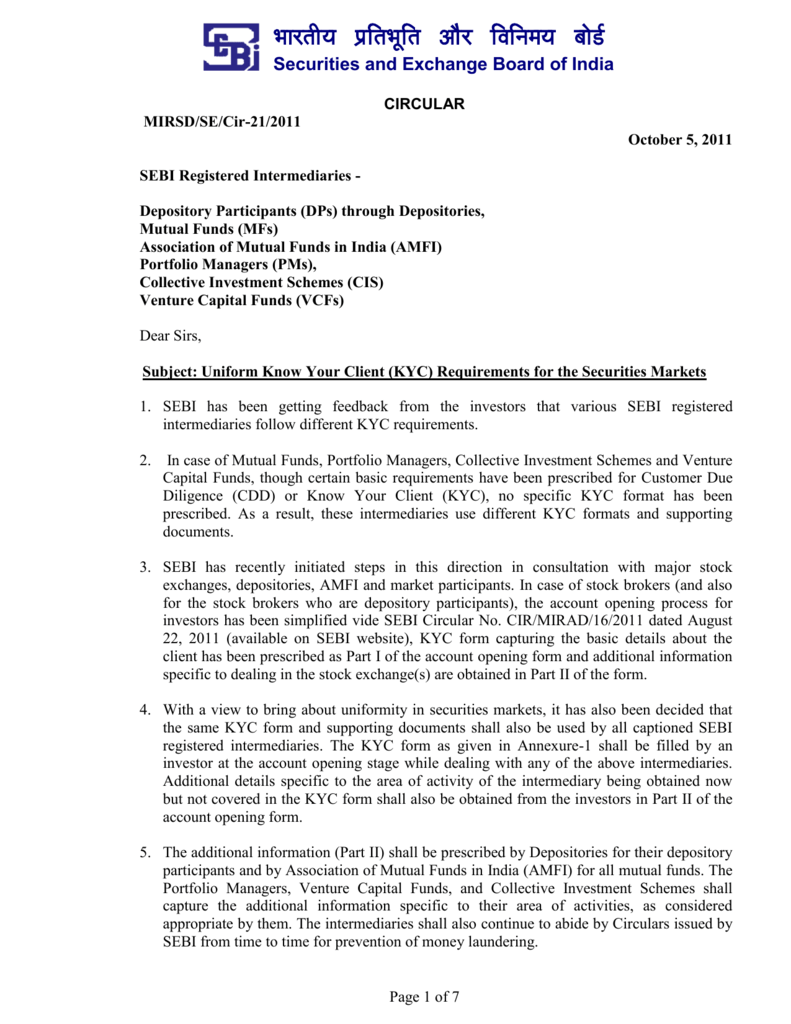

Source: taxguru.in

Source: taxguru.in

SEBI registered Mutual Funds. The Securities and Exchange Board Of India was established on 12 April1992 in accordance with the provisions of the Securities and Exchange Board of India Act 1992. Was not uniform at all. 2 Words and expressions used and not defined in these regulations shall have the. Once the investor has done KYC with a SEBI registered intermediary the investor need not undergo the same process again with another intermediary including mutual funds.

Source: taxguru.in

Source: taxguru.in

KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process again when you approach another intermediary Dear Investor if you are subscribing to. MIRSDDR-1Cir-1609 dated November 06 2009 can. Application Formats and Fees. CNBC-TV18 and the National Stock Exchange have come together to promote investor awareness through a special campaign InformedInvestor that empowers you to. 1 Inserted by the SEBI Stock Brokers and Sub- Brokers Amendment Regulations 2008 wef.

Source: enterslice.com

Source: enterslice.com

Intermediary and where such intermediary is a body corporate will include its. In this regard SEBI has issued the SEBI KYC Know Your Client Registration Agency KRA Regulations 2011. With a view to bring uniformity in the KYC requirements for the securities markets SEBI has initiated usage of uniform KYC by all SEBI registered intermediaries. 26 rows Securities and Exchange Board of India Intermediaries Second Amendment. Regulatory action taken by Market Infrastructure Institutions.

Source: cskruti.com

Source: cskruti.com

Regulatory action taken by Market Infrastructure Institutions. An Intermediary is a person who acts as a mediator between people with an intent to bring about an agreement or reconciliation. KYC Registration Agency KRA is an agency registered with SEBI under the Securities and Exchange Board of India KYC Know Your Client Registration Agency Regulations 2011. With a view to bring uniformity in the KYC requirements for the securities markets SEBI has initiated usage of uniform KYC by all SEBI registered intermediaries. If they provide their registration number you can verify the same through SEBI website wwwsebigovin If their number and name matches the details provide to you they are authentic SEBI registered Investment advisor or research analyst.

Source: blog.ipleaders.in

Source: blog.ipleaders.in

The preamble of Securities and Exchange Board of India describes the basic functions of the Securities and Exchange Board of India as. The Securities and Exchange Board Of India was established on 12 April1992 in accordance with the provisions of the Securities and Exchange Board of India Act 1992. Duly recognised by or registered with the Board and includes a stock exchange. SEBI has issued an investor charter in which the market regulator has asked mutual funds RIA and other SEBI registered intermediaries to put in place a mechanism to disclose average turn around time for redressal of investor grievances on their respective websites. KYC Registration Agency KRA is an agency registered with SEBI under the Securities and Exchange Board of India KYC Know Your Client Registration Agency Regulations 2011.

The KRA will maintain KYC records of the investors centrally on behalf of capital market intermediaries registered with SEBI. The KRA will maintain KYC records of the investors centrally on behalf of capital market intermediaries registered with SEBI. Similarly SEBI Intermediaries acts as a link between investor and SEBIStock exchanges. The Securities and Exchange Board Of India was established on 12 April1992 in accordance with the provisions of the Securities and Exchange Board of India Act 1992. 2 Words and expressions used and not defined in these regulations shall have the.

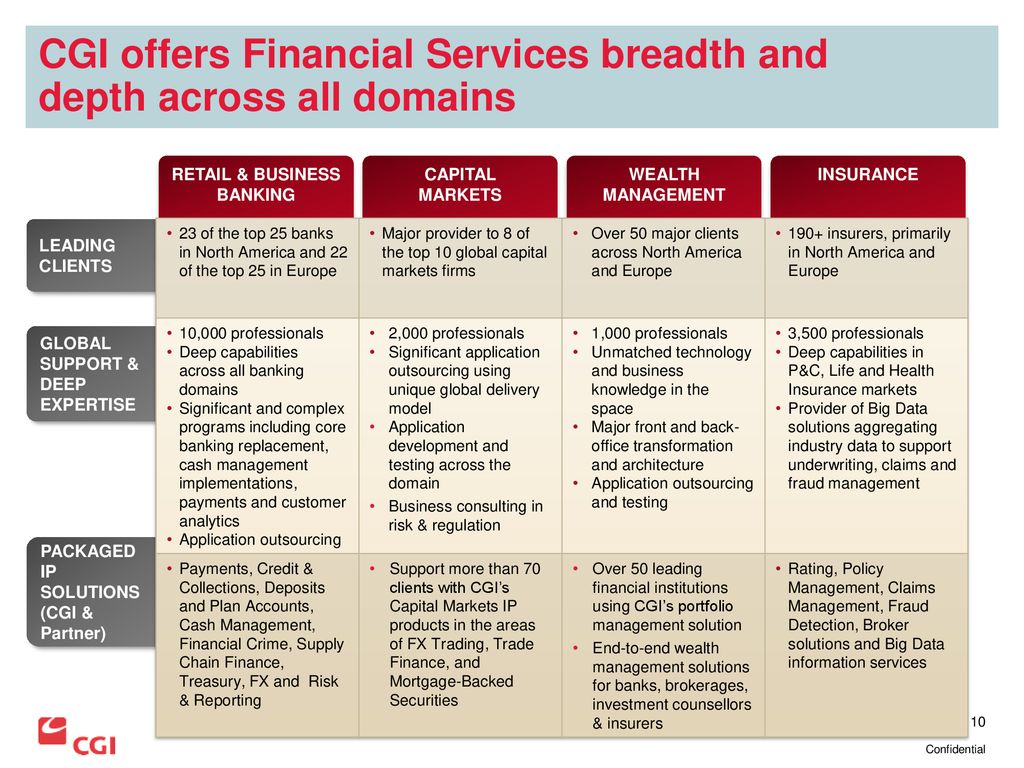

Source: slidetodoc.com

Source: slidetodoc.com

Regulatory action taken by Market Infrastructure Institutions. The IPV carried out by one SEBI registered intermediary can be relied upon by another intermediary. Previously the KYC process across different SEBI registered intermediaries like venture capital funds portfolio managers Mutual Funds etc. 1 Inserted by the SEBI Stock Brokers and Sub- Brokers Amendment Regulations 2008 wef. The Securities and Exchange Board Of India was established on 12 April1992 in accordance with the provisions of the Securities and Exchange Board of India Act 1992.

Source: asianlaws.org

Source: asianlaws.org

If they provide their registration number you can verify the same through SEBI website wwwsebigovin If their number and name matches the details provide to you they are authentic SEBI registered Investment advisor or research analyst. Duly recognised by or registered with the Board and includes a stock exchange. By definition an Intermediary means a person as mentioned in sub-sections of section 11 and section 12 of SEBI Act. 1 Inserted by the SEBI Stock Brokers and Sub- Brokers Amendment Regulations 2008 wef. An Intermediary is a person who acts as a mediator between people with an intent to bring about an agreement or reconciliation.

Source: enterslice.com

Source: enterslice.com

Was not uniform at all. Effective from January 1 2020 the Securities and Exchange Board of India SEBI announced new measures to enhance the conduct of registered investment advisors. In this regard SEBI has issued the SEBI KYC Know Your Client Registration Agency KRA Regulations 2011. The IPV carried out by one SEBI registered intermediary can be relied upon by another intermediary. Intermediary and where such intermediary is a body corporate will include its.

Source: slidetodoc.com

Source: slidetodoc.com

Was not uniform at all. Intermediary and where such intermediary is a body corporate will include its. MIRSDDR-1Cir-1609 dated November 06 2009 can. Nodal Officers of SCSBs for IPO applications. The IPV carried out by one SEBI registered intermediary can be relied upon by another intermediary.

Source: yumpu.com

Source: yumpu.com

An Intermediary is a person who acts as a mediator between people with an intent to bring about an agreement or reconciliation. An Intermediary is a person who acts as a mediator between people with an intent to bring about an agreement or reconciliation. In case of Stock brokers their sub-brokers or Authorised Persons appointed by the stock brokers after getting approval from the concerned Stock Exchanges in terms of SEBI Circular No. In this regard SEBI has issued the SEBI KYC Know Your Client Registration Agency KRA Regulations 2011. Thus in order to bring uniformity in the KYC process SEBI introduced the concept of.

Source: studylib.net

Source: studylib.net

In case of Stock brokers their sub-brokers or Authorised Persons appointed by the stock brokers after getting approval from the concerned Stock Exchanges in terms of SEBI Circular No. The KRA will maintain KYC records of the investors centrally on behalf of capital market intermediaries registered with SEBI. Deal with SEBI-recognised market infrastructure institutions and SEBI-registered intermediaries regulated entities only. The IPV carried out by one SEBI registered intermediary can be relied upon by another intermediary. Previously the KYC process across different SEBI registered intermediaries like venture capital funds portfolio managers Mutual Funds etc.

Source: swaritadvisors.com

Source: swaritadvisors.com

Once the investor has done KYC with a SEBI registered intermediary the investor need not undergo the same process again with another intermediary including mutual funds. Application Formats and Fees. Entities Permitted to Send Stock Tips using Bulk SMS. Sebi said it has put in place an alternate dispute redressal mechanism for grievances against brokers depository participants at the level of stock exchanges and depositories. As per the circular issued by SEBI the registered investment advisors RIAs are banned from giving free trials.

Source: studylib.net

Source: studylib.net

Previously the KYC process across different SEBI registered intermediaries like venture capital funds portfolio managers Mutual Funds etc. An Intermediary is a person who acts as a mediator between people with an intent to bring about an agreement or reconciliation. In this regard SEBI has issued the SEBI KYC Know Your Client Registration Agency KRA Regulations 2011. Institutions and SEBI-registered intermediaries. We advise investors to make informed decisions and are cautioned to invest only with SEBI registered.

Source: swaritadvisors.com

Source: swaritadvisors.com

Each registered intermediary has their own SEBI registration number with valid license. KYC is one time exercise while dealing in securities markets - once KYC is done through a SEBI registered intermediary broker DP Mutual Fund etc you need not undergo the same process again when you approach another intermediary Dear Investor if you are subscribing to. KYC Registration Agency KRA is an agency registered with SEBI under the Securities and Exchange Board of India KYC Know Your Client Registration Agency Regulations 2011. Markets regulator SEBI on Wednesday came out with an investor charter aimed at protecting the interest of investors in the securities market. An Intermediary is a person who acts as a mediator between people with an intent to bring about an agreement or reconciliation.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sebi registered intermediary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.