Your Three types of financial institutions bitcoin are obtainable. Three types of financial institutions are a news that is most popular and liked by everyone now. You can Find and Download the Three types of financial institutions files here. News all royalty-free coin.

If you’re searching for three types of financial institutions images information linked to the three types of financial institutions interest, you have pay a visit to the ideal site. Our site always provides you with hints for downloading the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

Three Types Of Financial Institutions. Resource wise these represent the largest group of financial institutions. The most common types of financial institutions include commercial banks trust companies investment banks brokerage firms or investment dealers insurance companies and asset management funds. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. It is an organised way of doing something.

Benefits Of Different Financial Institutions Financial Institutions Overseas Education Education From pinterest.com

Benefits Of Different Financial Institutions Financial Institutions Overseas Education Education From pinterest.com

Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. A financial claim is an asset that typically entitles the creditor to receive funds or other resources from the debtor under the terms of a liability. Commercial banks are for-profit organizations and generally owned by private investors. Generally speaking there are three types of financial institutions in Canada. They are the most crucial part of any economy as they connect citizens with the banking or financial system. Social control institutions for solving social problems of society and personality.

Deposit-taking institutions insurance companies and investment institutions.

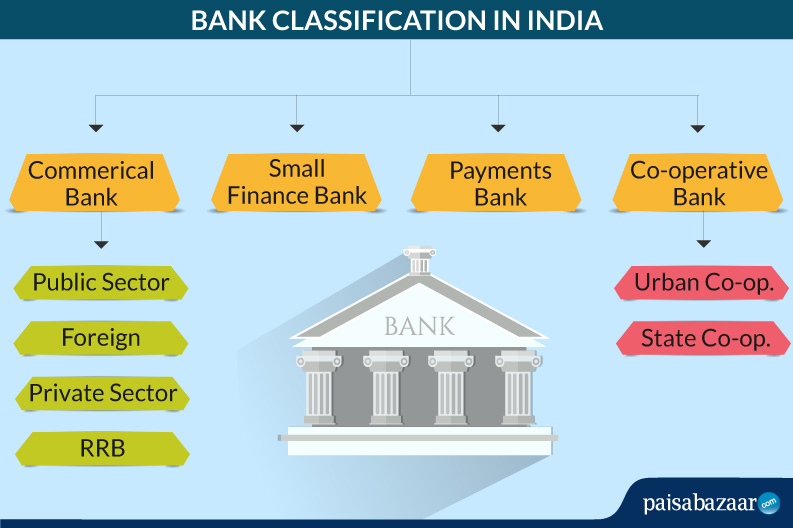

The main types of financial institutions in Australia are. The following are the three main categories of depository institutions. Other types include credit unions and finance firms. The most common types of financial institutions include commercial banks trust companies investment banks brokerage firms or investment dealers insurance companies and asset management funds. Broadly there are 4 different types of financial institutions in the country. Depository non- depository and investment.

Source: pinterest.com

Source: pinterest.com

The main types of financial institutions in Australia are. The range of services offered by commercial banks depends on the size of the banks. The main types of financial institutions in Australia are. Depository non- depository and investment. Lets take a look at the three main types of financial institutions.

Source: pinterest.com

Source: pinterest.com

They are the most crucial part of any economy as they connect citizens with the banking or financial system. Types of Depository Institutions. An investment bank is an institution that acts as a financial arbitrator that performs a wide array of services for governments and businesses. These include private lenders mortgage companies loan companies brokerage houses and retirement fund management corporations. Each claim is a financial.

Source: pinterest.com

Source: pinterest.com

Depository non- depository and investment. Each claim is a financial. They are the most crucial part of any economy as they connect citizens with the banking or financial system. Retail and Commercial banks accept deposits from the public as well as offer loans. These include private lenders mortgage companies loan companies brokerage houses and retirement fund management corporations.

Source: pinterest.com

Source: pinterest.com

Essentially financial institutions help their clients facilitate the flow of money through the economy. Essentially financial institutions help their clients facilitate the flow of money through the economy. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. An investment bank is an institution that acts as a financial arbitrator that performs a wide array of services for governments and businesses. Depository non- depository and investment.

Source: pinterest.com

Source: pinterest.com

It is an organised way of doing something. Retail and Commercial Banks. These banks primarily earn revenue from the interest on loans they offer to their customers. The following are the three main categories of depository institutions. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions.

Source: pinterest.com

Source: pinterest.com

Other types include credit unions and finance firms. Lets take a look at the three main types of financial institutions. Several different types of financial institutions focus on investing activities for individuals and businesses. An investment bank is an institution that acts as a financial arbitrator that performs a wide array of services for governments and businesses. These banks primarily earn revenue from the interest on loans they offer to their customers.

Source: pinterest.com

Source: pinterest.com

Financial instruments comprise the full range of financial contracts made between institutional units. Recreational institutions for satisfying human desire of entertainment amusement and play etc. These banks primarily earn revenue from the interest on loans they offer to their customers. Each claim is a financial. They are the most crucial part of any economy as they connect citizens with the banking or financial system.

Source: pinterest.com

Source: pinterest.com

Insurers and Funds Managers. Recreational institutions for satisfying human desire of entertainment amusement and play etc. Essentially financial institutions help their clients facilitate the flow of money through the economy. The depository types of financial institutions include banks credit unions saving and loan associations and mutual saving banks Commercial banks Commercial banks are those financial institutions which help in pooling the savings of surplus units and arrange their productive uses. Financial instruments comprise the full range of financial contracts made between institutional units.

Source: paisabazaar.com

Source: paisabazaar.com

Social control institutions for solving social problems of society and personality. Types of Depository Institutions. The main types of financial institutions in Australia are. It is an organised way of doing something. Insurers and Funds Managers.

Source: pinterest.com

Source: pinterest.com

They are the most crucial part of any economy as they connect citizens with the banking or financial system. The main types of financial institutions in Australia are. The following are the three main categories of depository institutions. Types of Depository Institutions. The range of services offered by commercial banks depends on the size of the banks.

Source: pinterest.com

Source: pinterest.com

Retail and Commercial Banks. Social control institutions for solving social problems of society and personality. Recreational institutions for satisfying human desire of entertainment amusement and play etc. Broadly there are 4 different types of financial institutions in the country. Retail and Commercial Banks.

Source: pinterest.com

Source: pinterest.com

It is an organised way of doing something. Insurers and Funds Managers. A financial claim is an asset that typically entitles the creditor to receive funds or other resources from the debtor under the terms of a liability. It is an organised way of doing something. Lets take a look at the three main types of financial institutions.

Source: pinterest.com

Source: pinterest.com

Generally speaking there are three types of financial institutions in Canada. Deposit-taking institutions insurance companies and investment institutions. Several different types of financial institutions focus on investing activities for individuals and businesses. Insurers and Funds Managers. The main types of financial institutions in Australia are.

Source: pinterest.com

Source: pinterest.com

They are the most crucial part of any economy as they connect citizens with the banking or financial system. The main type of financial institutions is commercial banks investment banks mutual funds insurance companies advisory firms brokerage firms investment institutions trust companies etc. Universal and commercial banks. Types of Depository Institutions. Deposit-taking institutions insurance companies and investment institutions.

Source: educba.com

Source: educba.com

Each claim is a financial. Financial instruments comprise the full range of financial contracts made between institutional units. Depository non- depository and investment. Several different types of financial institutions focus on investing activities for individuals and businesses. Generally speaking there are three types of financial institutions in Canada.

Source: pinterest.com

Source: pinterest.com

Several different types of financial institutions focus on investing activities for individuals and businesses. The depository types of financial institutions include banks credit unions saving and loan associations and mutual saving banks Commercial banks Commercial banks are those financial institutions which help in pooling the savings of surplus units and arrange their productive uses. These include private lenders mortgage companies loan companies brokerage houses and retirement fund management corporations. Other types include credit unions and finance firms. An investment bank is an institution that acts as a financial arbitrator that performs a wide array of services for governments and businesses.

Source: in.pinterest.com

Source: in.pinterest.com

A financial claim is an asset that typically entitles the creditor to receive funds or other resources from the debtor under the terms of a liability. Financial instruments comprise the full range of financial contracts made between institutional units. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. Types of Depository Institutions. A financial claim is an asset that typically entitles the creditor to receive funds or other resources from the debtor under the terms of a liability.

Source: pinterest.com

Source: pinterest.com

The main type of financial institutions is commercial banks investment banks mutual funds insurance companies advisory firms brokerage firms investment institutions trust companies etc. Recreational institutions for satisfying human desire of entertainment amusement and play etc. The following are the three main categories of depository institutions. Retail and Commercial banks accept deposits from the public as well as offer loans. Depository non- depository and investment.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title three types of financial institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.