Your Types of depository institutions bitcoin are ready. Types of depository institutions are a mining that is most popular and liked by everyone now. You can Download the Types of depository institutions files here. Find and Download all royalty-free bitcoin.

If you’re looking for types of depository institutions images information connected with to the types of depository institutions interest, you have come to the ideal blog. Our website always provides you with hints for seeing the maximum quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

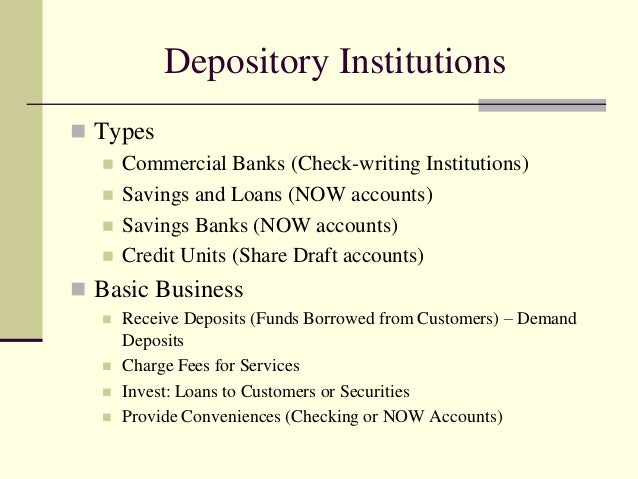

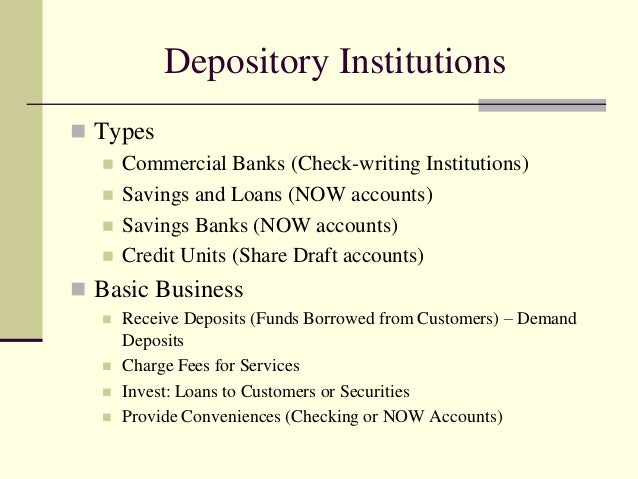

Types Of Depository Institutions. Depository institutions Non-depository institutions Others institutions Commercial banks. Mutual fund Saving and credit cooperatives. Commercial banks and other depository institutions. In order to differentiate between specific types of institutions they are classified into two categories.

Depository Institution Activities Characteristics From slideshare.net

Depository Institution Activities Characteristics From slideshare.net

Major types of depository institutions include all of the following except. Institutions are normative patterns which define what are felt to be in the given society proper legitimate or expected modes of action or of social relationships. For instance SLs historically funded 30-year fixed-rate mortgages with deposits that were often subject to withdrawal on demand. Colloquially a depository institution is a financial institution in the United States such as a savings bank commercial bank savings and loan associations or credit unions that is legally allowed to accept monetary deposits from consumers. A financial institution is any organization or business that provides services related to money. Depository institutions banks that accept deposits contribute to the economy by lending money saved by depositors.

The main source of funding for these institutions is through deposits from customers.

However deposits do not provide all of the economys funding since only the wealthy save a significant amount of money but not in low-interest paying deposits which are taxable as ordinary income. A financial institution is any organization or business that provides services related to money. Types of Depository Institutions. Commercial banks savings and loan associations savings banks and credit unions. Customer deposits and accounts are FDIC insured up to certain limits. In the financial market there are many types of financial institutions or intermediaries exist for the flow of funds.

Source: slideshare.net

Source: slideshare.net

4 Similarly commercial banks would finance 5- and 7-year fixed-rate term loans with demand and savings deposits both of which could be withdrawn at a moments notice. Types of depository institutions. Depository institutions Non-depository institutions Others institutions Commercial banks. These three types of institutions have become more like each other in recent decades and their unique identities have become less distinct. There are four major types of depository institutions.

Source: eponlinestudy.com

Source: eponlinestudy.com

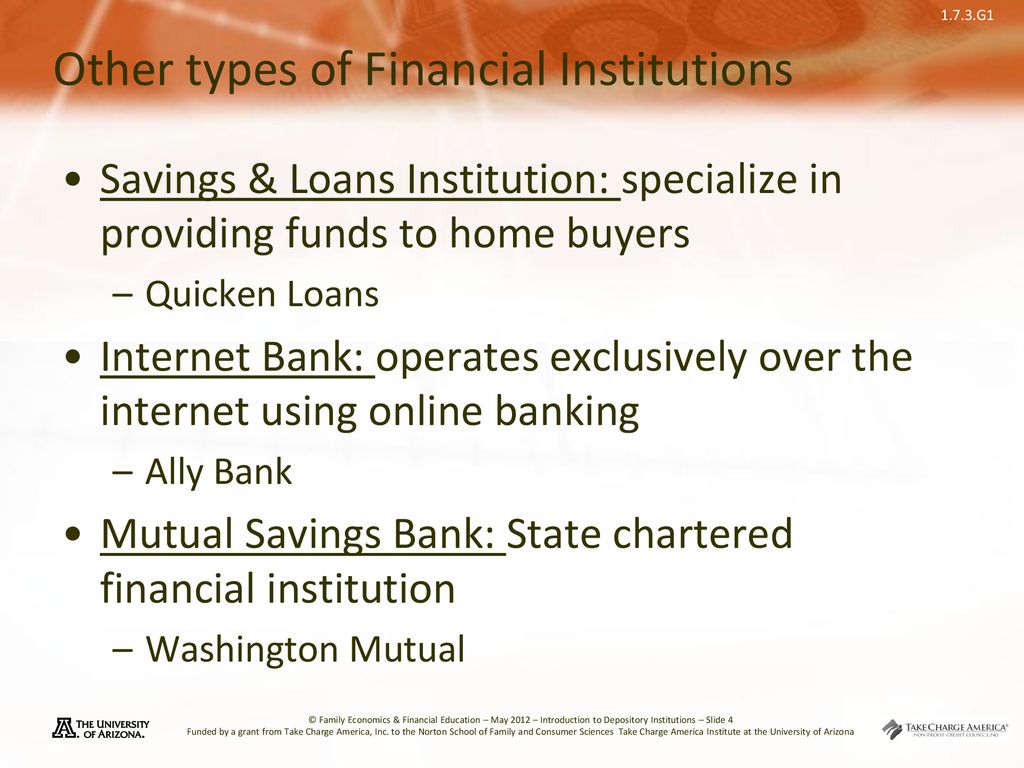

Types of depository institutions. Well also discuss several nondepository institutions which provide financial services but dont accept deposits including finance companies insurance companies. Depository institutions are financial institutions that obtain funds mainly by accepting deposits from the publicboth businesses and households. The main source of funding for these institutions is through deposits from customers. Colloquially a depository institution is a financial institution in the United States such as a savings bank commercial bank savings and loan associations or credit unions that is legally allowed to accept monetary deposits from consumers.

Source: slideplayer.com

Source: slideplayer.com

Non-depository institutions are not banks in the real sense. Depository institutions are financial institutions that obtain funds mainly by accepting deposits from the publicboth businesses and households. Commercial banks are for-profit organizations and generally owned by private investors. Describe the various types of depository institutions Discuss types of deposit insurance. There are three major types of depository institutions in the United States.

Source: slideplayer.com

Source: slideplayer.com

Customer deposits and accounts are FDIC insured up to certain limits. The range of services offered by commercial banks depends on the size of the banks. In the financial market there are many types of financial institutions or intermediaries exist for the flow of funds. The depository financial institution may either be a commercial bank savings and loan company credit union or thrift institution. Examples of depository institutions include commercial banks and credit unions.

Source: slidetodoc.com

Source: slidetodoc.com

There are four major types of depository institutions. For instance SLs historically funded 30-year fixed-rate mortgages with deposits that were often subject to withdrawal on demand. Commercial banks savings and loan associations savings banks and credit unions. Major types of depository institutions include all of the following except. The three main types of depository institutions are credit unions savings institutions and commercial banks.

Source: pinterest.com

Source: pinterest.com

Commercial banks are for-profit entities that provide a number of services to their account holders. Commercial bank Saving institution credit union and so on. Non-depository institutions are not banks in the real sense. In the financial market there are many types of financial institutions or intermediaries exist for the flow of funds. Thus almost all above definitions of institutions imply both a set of behaviour norms and a system of social relations through which these norms are practised.

Source: slideserve.com

Source: slideserve.com

See full answer below. Commercial banks and other depository institutions. Well also discuss several nondepository institutions which provide financial services but dont accept deposits including finance companies insurance companies. Depository institutions characteristically fund their longer-lived assets with shorter-term liabilities. Some of them involve in a depositary type of transactions whereas other involve in a non-depositary type of transactions.

Source: in.pinterest.com

Source: in.pinterest.com

They are commercial banks thrifts which include savings and loan associations and savings banks and credit unions. Under federal law however a depository institution is limited to banks and savings associations -. A financial institution is any organization or business that provides services related to money. Institutions are normative patterns which define what are felt to be in the given society proper legitimate or expected modes of action or of social relationships. Depository institutions characteristically fund their longer-lived assets with shorter-term liabilities.

Source: slidetodoc.com

Source: slidetodoc.com

Mutual fund Saving and credit cooperatives. They make contractual arrangement and investment in securities to satisfy the needs and preferences of investors. Commercial banks savings and loan associations savings banks and credit unions. Major types of depository institutions include all of the following except. In order to differentiate between specific types of institutions they are classified into two categories.

Source: pinterest.com

Source: pinterest.com

Depository institutions banks that accept deposits contribute to the economy by lending money saved by depositors. 4 Similarly commercial banks would finance 5- and 7-year fixed-rate term loans with demand and savings deposits both of which could be withdrawn at a moments notice. B savings and loan associations. They are commercial banks thrifts which include savings and loan associations and savings banks and credit unions. The depository financial institution may either be a commercial bank savings and loan company credit union or thrift institution.

Source: in.pinterest.com

Source: in.pinterest.com

Commercial banks savings and loan associations savings banks and credit unions. Depository institutions Non-depository institutions Others institutions Commercial banks. Financial institutions that provide facility of accepting deposits and granting loans to. For instance SLs historically funded 30-year fixed-rate mortgages with deposits that were often subject to withdrawal on demand. The following are the three main categories of depository institutions.

Source: pinterest.com

Source: pinterest.com

Their role is to obtain funds by accepting checking or savings deposits from individuals businesses and other institutions and then lend these funds to borrowers KellyMcGowenWilliams 151. The following are the three main categories of depository institutions. In the financial market there are many types of financial institutions or intermediaries exist for the flow of funds. Commercial banks savings and loan associations savings banks and credit unions. Examples of depository institutions include commercial banks and credit unions.

Source: in.pinterest.com

Source: in.pinterest.com

Colloquially a depository institution is a financial institution in the United States such as a savings bank commercial bank savings and loan associations or credit unions that is legally allowed to accept monetary deposits from consumers. Their role is to obtain funds by accepting checking or savings deposits from individuals businesses and other institutions and then lend these funds to borrowers KellyMcGowenWilliams 151. Mutual fund Saving and credit cooperatives. Financial institutions that provide facility of accepting deposits and granting loans to. The following are the three main categories of depository institutions.

Source: pinterest.com

Source: pinterest.com

Describe the various types of depository institutions Discuss types of deposit insurance. Well also discuss several nondepository institutions which provide financial services but dont accept deposits including finance companies insurance companies. B savings and loan associations. These three types of institutions have become more like each other in recent decades and their unique identities have become less distinct. Non-depository institutions are not banks in the real sense.

Source: slidetodoc.com

Source: slidetodoc.com

Depository institutions characteristically fund their longer-lived assets with shorter-term liabilities. These three types of institutions have become more like each other in recent decades and their unique identities have become less distinct. Types of depository institutions. The three main types of depository institutions are credit unions savings institutions and commercial banks. Customer deposits and accounts are FDIC insured up to certain limits.

Source: in.pinterest.com

Source: in.pinterest.com

Types of Depository Institutions. Types of Depository Institutions. Some of them involve in a depositary type of transactions whereas other involve in a non-depositary type of transactions. The main source of funding for these institutions is through deposits from customers. Major types of depository institutions include all of the following except.

Source: slidetodoc.com

Source: slidetodoc.com

The major types of depository institutions are commercial banks credit unions and savings and loan associates. There are three major types of depository institutions in the United States. Financial institutions that provide facility of accepting deposits and granting loans to. They have 3 types of account for people who want to deposit their money. For instance SLs historically funded 30-year fixed-rate mortgages with deposits that were often subject to withdrawal on demand.

Source: slidetodoc.com

Source: slidetodoc.com

B savings and loan associations. A financial institution is any organization or business that provides services related to money. In the financial market there are many types of financial institutions or intermediaries exist for the flow of funds. Thus almost all above definitions of institutions imply both a set of behaviour norms and a system of social relations through which these norms are practised. Examples of depository institutions include commercial banks and credit unions.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title types of depository institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.