Your Types of lending institutions wallet are available. Types of lending institutions are a coin that is most popular and liked by everyone now. You can Download the Types of lending institutions files here. Download all free coin.

If you’re looking for types of lending institutions pictures information related to the types of lending institutions interest, you have come to the right blog. Our website frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and find more enlightening video content and images that match your interests.

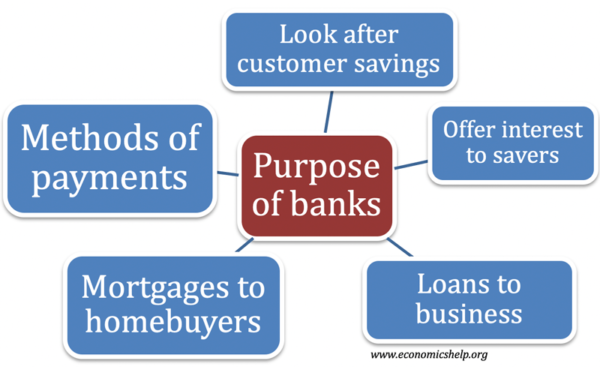

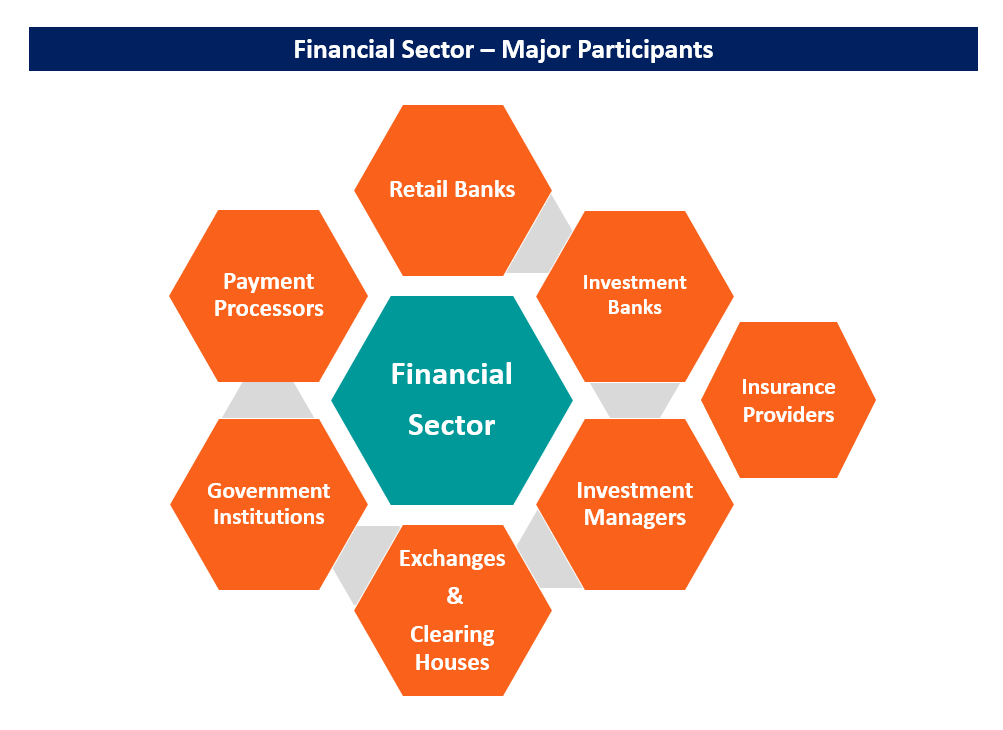

Types Of Lending Institutions. The lending institution can seize the consumers property as compensation if the consumer defaults on the loan. Identify various types of lending institutions and the similarities and differences between them understand their various roles in the industry identify the different types of loan types available in the. Financial institution financial organisation financial organization an institution public or private that collects funds from the public or other institutions and invests them in financial assets. As one of the few non-bank provisionally Registered US.

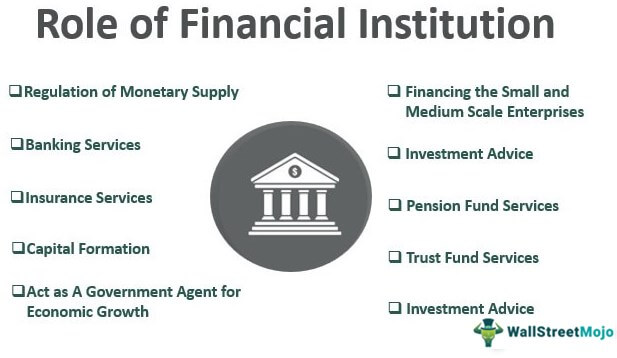

Role Of Financial Institutions Top 10 Roles In Economic Development From wallstreetmojo.com

Role Of Financial Institutions Top 10 Roles In Economic Development From wallstreetmojo.com

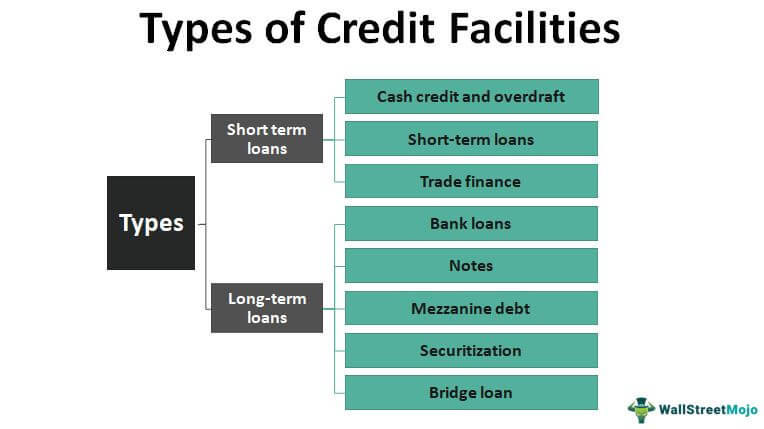

An example would be a savings loan which is more concerned with an individuals savings history than being able to fully document income and other things. A lending institution is any type of financial organization or institution that provides loans to borrowers. For the remaining three-fourths a number of different types of institutions are involved. 1 n a financial institution that makes loans Type of. The lending institution can seize the consumers property as compensation if the consumer defaults on the loan. Portfolio lenders also can serve as niche lenders because certain things are more important to them than meeting the more standardized underwriting guidelines of a mortgage banker.

Swap Dealers StoneX Markets LLC is focused on helping lenders effectively manage interest.

These include the following. Some mortgage bankers service the loans they originate but some do not. For the remaining three-fourths a number of different types of institutions are involved. Often these types of institutions work with and through banks and similar organizations in order to conduct business on behalf of their clients. Identify various types of lending institutions and the similarities and differences between them. As one of the few non-bank provisionally Registered US.

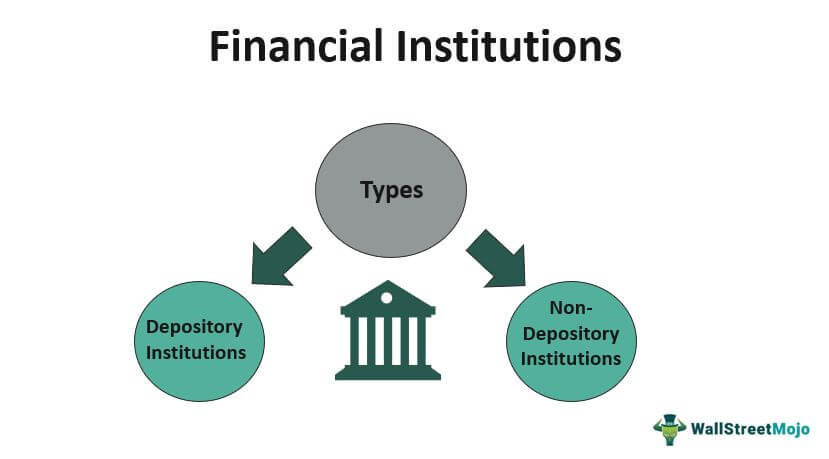

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Fannie Mae Freddie Mac Ginnie Mae. The main types of financial institutions in Australia are. If playback doesnt begin shortly try restarting your device. Often these types of institutions work with and through banks and similar organizations in order to conduct business on behalf of their clients. Swap Dealers StoneX Markets LLC is focused on helping lenders effectively manage interest.

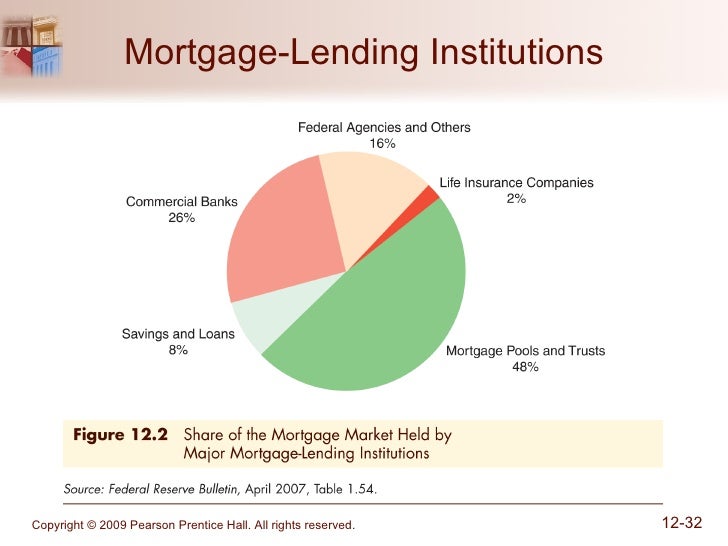

Source: slideplayer.com

Source: slideplayer.com

Financial institution financial organisation financial organization an institution public or private that collects funds from the public or other institutions and invests them in financial assets. Mortgage bankers can very significantly when it comes to size. Consumers can get a loan for just about anything they want to purchase which tells you approximately how many loan types there are available. An example would be a savings loan which is more concerned with an individuals savings history than being able to fully document income and other things. These include the following.

Source: ppt-online.org

Source: ppt-online.org

Any company that assembles then sells loans is considered to be a mortgage banker. Often these types of institutions work with and through banks and similar organizations in order to conduct business on behalf of their clients. If playback doesnt begin shortly try restarting your device. There are retail lenders direct lenders mortgage brokers correspondent lenders wholesale lenders and others where some of these categories can. Any company that assembles then sells loans is considered to be a mortgage banker.

Source: slideshare.net

Source: slideshare.net

A lending institution is any type of financial organization or institution that provides loans to borrowers. Insurers and Funds Managers. Upon completion of this section you will be able to. Identify various types of lending institutions and the similarities and differences between them understand their various roles in the industry identify the different types of loan types available in the. Swap Dealers StoneX Markets LLC is focused on helping lenders effectively manage interest.

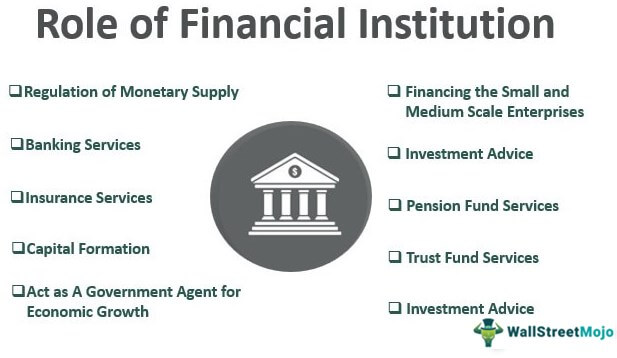

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Upon completion of this section you will be able to. Financial institution financial organisation financial organization an institution public or private that collects funds from the public or other institutions and invests them in financial assets. Most legit mortgage bankers have. The lending institution can seize the consumers property as compensation if the consumer defaults on the loan. Identify various types of lending institutions and the similarities and differences between them.

Source: quora.com

Source: quora.com

1 n a financial institution that makes loans Type of. There are retail lenders direct lenders mortgage brokers correspondent lenders wholesale lenders and others where some of these categories can. The main types of financial institutions in Australia are. There are many different types of lenders in the marketplace today ranging from banks and credit unions to mortgage and payday loan companies. If playback doesnt begin shortly try restarting your device.

Source: slideplayer.com

Source: slideplayer.com

A lending institution is any type of financial organization or institution that provides loans to borrowers. Commercial banks national and state Mutual savings banks. Any company that assembles then sells loans is considered to be a mortgage banker. These include private lenders mortgage companies loan companies brokerage houses and retirement fund management corporations. The range of loan types offered by any one financial institution will vary depending on the structure of the organization.

Source: educba.com

Source: educba.com

Insurers and Funds Managers. For the remaining three-fourths a number of different types of institutions are involved. Commercial banks national and state Mutual savings banks. Some mortgage bankers service the loans they originate but some do not. If playback doesnt begin shortly try restarting your device.

Source: economicshelp.org

Source: economicshelp.org

Commercial banks national and state Mutual savings banks. Commercial banks national and state Mutual savings banks. Most legit mortgage bankers have. Upon completion of this section you will be able to. We provide FX and interest rate expertise along with unparalleled market access to liquidity so our clients can focus on their core business.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Consumers can get a loan for just about anything they want to purchase which tells you approximately how many loan types there are available. As one of the few non-bank provisionally Registered US. Building a quality loan portfolio. 5 Types Of Lending Institutions To Secure Loans For Business. An example would be a savings loan which is more concerned with an individuals savings history than being able to fully document income and other things.

Source: slideteam.net

Source: slideteam.net

Upon completion of this section you will be able to. A lending institution is any type of financial organization or institution that provides loans to borrowers. There are many different types of lenders in the marketplace today ranging from banks and credit unions to mortgage and payday loan companies. Often these types of institutions work with and through banks and similar organizations in order to conduct business on behalf of their clients. Building a quality loan portfolio.

Source: theinvestorsbook.com

Source: theinvestorsbook.com

We provide FX and interest rate expertise along with unparalleled market access to liquidity so our clients can focus on their core business. Consumers can get a loan for just about anything they want to purchase which tells you approximately how many loan types there are available. Mortgage bankers can very significantly when it comes to size. Insurers and Funds Managers. I dentify various types of lending institutions and the similarities and differences between them understand their various roles in the industry.

Source: slideplayer.com

Source: slideplayer.com

There are many different types of lenders in the marketplace today ranging from banks and credit unions to mortgage and payday loan companies. For the remaining three-fourths a number of different types of institutions are involved. 5 Types Of Lending Institutions To Secure Loans For Business. Building a quality loan portfolio. Upon completion of this section you will be able to.

Source: cinfo.ch

Source: cinfo.ch

There are retail lenders direct lenders mortgage brokers correspondent lenders wholesale lenders and others where some of these categories can. Some mortgage bankers service the loans they originate but some do not. These include the following. The most common lenders are banks credit unions and other traditional financial institutions. Consumers can get a loan for just about anything they want to purchase which tells you approximately how many loan types there are available.

Source: rba.gov.au

Source: rba.gov.au

Fannie Mae Freddie Mac Ginnie Mae. There are many different types of lenders in the marketplace today ranging from banks and credit unions to mortgage and payday loan companies. Authorised Deposit-taking Institutions ADIs Non-ADI Financial Institutions. Upon completion of this section you will be able to. Building a quality loan portfolio.

Source: businessfirstfamily.com

Source: businessfirstfamily.com

Often these types of institutions work with and through banks and similar organizations in order to conduct business on behalf of their clients. Portfolio lenders also can serve as niche lenders because certain things are more important to them than meeting the more standardized underwriting guidelines of a mortgage banker. We provide FX and interest rate expertise along with unparalleled market access to liquidity so our clients can focus on their core business. For the remaining three-fourths a number of different types of institutions are involved. Building a quality loan portfolio.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Insurers and Funds Managers. Identify various types of lending institutions and the similarities and differences between them. 1 n a financial institution that makes loans Type of. Types of Lenders. There are many different types of lenders in the marketplace today ranging from banks and credit unions to mortgage and payday loan companies.

Source: wikifinancepedia.com

Source: wikifinancepedia.com

The main types of financial institutions in Australia are. Examples of lending institutions that buy loans and pools of loans from mortgage bankers include. The lending institution can seize the consumers property as compensation if the consumer defaults on the loan. Commercial banks national and state Mutual savings banks. Upon completion of this section you will be able to.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title types of lending institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.