Your Types of non depository institutions coin are available in this site. Types of non depository institutions are a coin that is most popular and liked by everyone this time. You can Download the Types of non depository institutions files here. Get all royalty-free trading.

If you’re searching for types of non depository institutions pictures information linked to the types of non depository institutions topic, you have come to the right blog. Our website always gives you hints for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Types Of Non Depository Institutions. Accepts and executes trusts but does not issue currency. There are also smaller nondepository institutions such as pawnshops and venture capital firms but they are much smaller sources of funds for the economy. Examples of non-depository financial institutions. Where you cannot put your money and withdraw it.

Debenture Example Angel Investors Accounting And Finance Business Basics From in.pinterest.com

Debenture Example Angel Investors Accounting And Finance Business Basics From in.pinterest.com

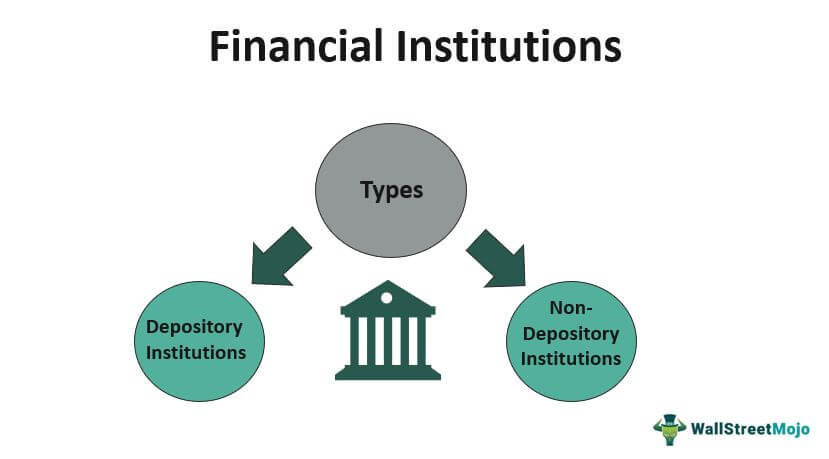

The usual answer I find goes something like this. Those that accept deposits from customersdepository institutions include commercial banks savings banks and credit unions. It then lists examples of depository institutions banks credit unions savings and loans. Given below are different non-depository intermediaries. Those that dontnondepository institutionsinclude finance companies insurance companies and brokerage firms. Where you cannot put your money and withdraw it.

It then lists examples of depository institutions banks credit unions savings and loans.

The usual answer I find goes something like this. In this article we will discuss the main types of non-depository institutions. In this article we will discuss the main types of non-depository institutions. Can either be Federal Reserve members or Non-Members. Mutual funds sell their shares to individuals and firms and invest the proceeds in various types of assets. They collect amount in the form of periodic premium from insured party and in return agree to compensate against the risk of life or property.

Source: pinterest.com

Source: pinterest.com

Life insurance and non-life insurance. Non-depository institutions are nonbank financial institutions that do not have a banking license and cannot accept deposits from the public. This group includes the following Institution Types. It then lists examples of depository institutions banks credit unions savings and loans. Life insurance and non-life insurance.

Source: pinterest.com

Source: pinterest.com

Those that accept deposits from customersdepository institutionsinclude commercial banks savings banks and credit unions. Can either be Federal Reserve members or Non-Members. It then lists examples of depository institutions banks credit unions savings and loans. See full answer below. B Property and Casualty P C insurance.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Then they pay you bonus and even you can sales it on market. Hence the interest rate charged by credit unions on loans is lower and they pay a higher interest rate on deposits. The major non-depository institutions are as follows. Non-depository institutions are nonbank financial institutions that do not have a banking license and cannot accept deposits from the public. Accepts and executes trusts but does not issue currency.

Source: in.pinterest.com

Source: in.pinterest.com

The banks serving a local community and loan institutions are called savings institutions. There are also smaller nondepository institutions such as pawnshops and venture capital firms but they are much smaller sources of funds for the economy. Some mutual funds known as money market mutual funds invest in short-term safe assets such as Treasury Bills certificates of deposit of banks etc. Since credit unions are non-profit institutions they pay no federal or state tax. Mutual funds sell their shares to individuals and firms and invest the proceeds in various types of assets.

Source: in.pinterest.com

Source: in.pinterest.com

The non-depository institutions include insurance companies pension funds finance companies and mutual funds. Principal even like death retirement benefits. Normally insurance companies can be classified into two categories. The usual answer I find goes something like this. Non-deposit institutions are helpful because they usually provide other services that you might not be able to obtain through depository institutions.

Source: in.pinterest.com

Source: in.pinterest.com

Insurance companies are non-depository institutions. Non Depository institution. Non-deposit institutions are helpful because they usually provide other services that you might not be able to obtain through depository institutions. Non-depository institutions are nonbank financial institutions that do not have a banking license and cannot accept deposits from the public. In this article we will discuss the main types of non-depository institutions.

Source: pinterest.com

Source: pinterest.com

Hence the interest rate charged by credit unions on loans is lower and they pay a higher interest rate on deposits. Insurance companies provide customers with policies that protect them from risk for which they charge them monthly premiums. A non-bank financial institution NBFI is an institution that offers loans and financial products but does not have a full banking license. They collect amount in the form of periodic premium from insured party and in return agree to compensate against the risk of life or property. Financial institutions that provide facility of accepting deposits and granting loans to.

Source: pinterest.com

Source: pinterest.com

Nondepository institutions include insurance companies pension funds securities firms government-sponsored enterprises and finance companies. B Property and Casualty P C insurance. Since credit unions are non-profit institutions they pay no federal or state tax. The non-depository institutions include insurance companies pension funds finance companies and mutual funds. Types of depository institutions.

Source: pinterest.com

Source: pinterest.com

Non-deposit Trust Company - Member. This group includes the following Institution Types. Insurance companies provide customers with policies that protect them from risk for which they charge them monthly premiums. Financial intermediateries that will make a payment if a certain event occurs. Insurance Companies Insurance companies are the contractual saving institutions which collect periodic premium from insured party and in return agree to compensate against the risk of loss of life and properties.

Source: tr.pinterest.com

Source: tr.pinterest.com

Although they may be regulated by the government they are usually not backed or protected by the government. A depository institution accepts deposits while a non-depository institution does not accept deposits. Introduction to Business What are the four main types of non-depository financial institutions. Non Depository institution. Insurance Companies These include things like life insurance companies which as you know a life insurance companies.

Source: in.pinterest.com

Source: in.pinterest.com

Insurance companies are the contractual saving institutions. The banks serving a local community and loan institutions are called savings institutions. Non-depository institutions are nonbank financial institutions that do not have a banking license and cannot accept deposits from the public. They are intermediary between borrowers and saver. Can either be Federal Reserve members or Non-Members.

Source: pinterest.com

Source: pinterest.com

Normally insurance companies can be classified into two categories. They collect amount in the form of periodic premium from insured party and in return agree to compensate against the risk of life or property. Those that dontnondepository institutionsinclude finance companies insurance companies and brokerage firms. Non-deposit institutions are helpful because they usually provide other services that you might not be able to obtain through depository institutions. Examples of non-depository financial institutions.

Source: br.pinterest.com

Source: br.pinterest.com

Non-deposit Trust Company - Non-Member. Hence the interest rate charged by credit unions on loans is lower and they pay a higher interest rate on deposits. The major non-depository institutions are as follows. Non-deposit Trust Company - Member. Those that dontnondepository institutionsinclude finance companies insurance companies and brokerage firms.

Source: pinterest.com

Source: pinterest.com

Those that dontnondepository institutionsinclude finance companies insurance companies and brokerage firms. Principal even like death retirement benefits. Then they pay you bonus and even you can sales it on market. Insurance companies are the contractual saving institutions. Hence the interest rate charged by credit unions on loans is lower and they pay a higher interest rate on deposits.

Source: pinterest.com

Source: pinterest.com

Hence the interest rate charged by credit unions on loans is lower and they pay a higher interest rate on deposits. Insurance companies provide customers with policies that protect them from risk for which they charge them monthly premiums. Where you buy scheme in units. Where you cannot put your money and withdraw it. They collect amount in the form of periodic premium from insured party and in return agree to compensate against the risk of life or property.

Source: pinterest.com

Source: pinterest.com

Non-deposit institutions are helpful because they usually provide other services that you might not be able to obtain through depository institutions. Examples of non-depository financial institutions. Insurance companies are non-depository institutions. Those that dontnondepository institutionsinclude finance companies insurance companies and brokerage firms. Insurance companies provide customers with policies that protect them from risk for which they charge them monthly premiums.

Source: pinterest.com

Source: pinterest.com

See full answer below. Financial intermediateries that will make a payment if a certain event occurs. Introduction to Business What are the four main types of non-depository financial institutions. Insurance companies provide customers with policies that protect them from risk for which they charge them monthly premiums. Mutual funds sell their shares to individuals and firms and invest the proceeds in various types of assets.

Source: in.pinterest.com

Source: in.pinterest.com

Non-depository institutions are nonbank financial institutions that do not have a banking license and cannot accept deposits from the public. The non-depository institutions include insurance companies pension funds finance companies and mutual funds. Non Depository institution. The non-depository institutions include insurance companies pension funds finance companies and mutual funds. Insurance companies are the contractual saving institutions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title types of non depository institutions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.