Your Under basel 3 systemically important banks are mining are available in this site. Under basel 3 systemically important banks are are a mining that is most popular and liked by everyone now. You can Download the Under basel 3 systemically important banks are files here. Get all free news.

If you’re searching for under basel 3 systemically important banks are pictures information related to the under basel 3 systemically important banks are topic, you have pay a visit to the right site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly search and find more informative video articles and images that match your interests.

Under Basel 3 Systemically Important Banks Are. Minimum capital requirements for credit risk market risk and operational risk ii Pillar 2. We are also required to. Risks of systemically important banks Calibration of capital including quality of capital 2013 2015 2018 2023 Equity 35 45 7 7 Other Tier 1 10 15 15 15. Under a proportionate application of the Basel standards smaller institutions with less complex.

3 Basel Iii Capital Charges Download Scientific Diagram From researchgate.net

3 Basel Iii Capital Charges Download Scientific Diagram From researchgate.net

And the updated assessment methodology published by the BCBS in July. The metrics did not take into consideration banks differing business models and market positions effectively imposing a one-size-fits-all standard. BBVA Standard Chartered and Industrial and Commercial Bank of China Limited. What does basel iii mean for banks. The list is based on end-2019 data. For global systemically important banks G-SIBs in order to address Too-Big-To-Fail problems 1 enhancement to regulatory framework for preventing failure of G-SIBs 2 enhancement to effectiveness of supervision and 3 development of orderly resolution.

May also be used to add banks with scores below the cut-off to the list of G-SIBs.

For global systemically important banks G-SIBs in order to address Too-Big-To-Fail problems 1 enhancement to regulatory framework for preventing failure of G-SIBs 2 enhancement to effectiveness of supervision and 3 development of orderly resolution. ING reports these indicators every year to the Basel Committee through DNB. Differentiating liquidity requirements for systemically important banks. What basel iii means for banks. Systemically important banks G-SIBs. The leverage ratio as defined under Basel-III norms is Tier-I capital as a percentage of the banks exposuresThe leverage ratio stands reduced to 4 for Domestic Systemically Important Banks 3.

Source: slidetodoc.com

Source: slidetodoc.com

Supervisory review of capital adequacy iii Pillar 3. And the updated assessment methodology published by the BCBS in July. The leverage ratio as defined under Basel-III norms is Tier-I capital as a percentage of the banks exposuresThe leverage ratio stands reduced to 4 for Domestic Systemically Important Banks 3. The changes in the allocation of the institutions to buckets see below. The liquidity coverage ratio Basel III hereinafter the LCR will be applied as a prudential ratio for systemically important banks according to Article 57 of the Federal Law On the Central Bank of the Russian Federation Bank of Russia from 1 October 2015.

Source: gtrisk.com

Source: gtrisk.com

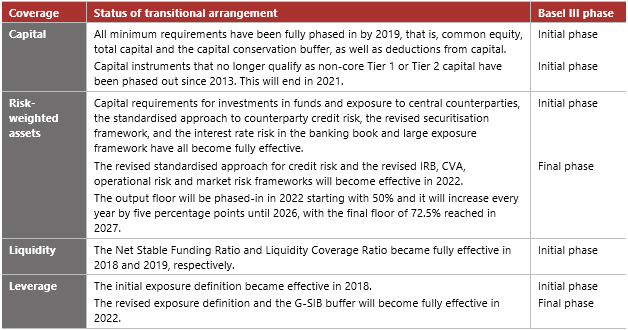

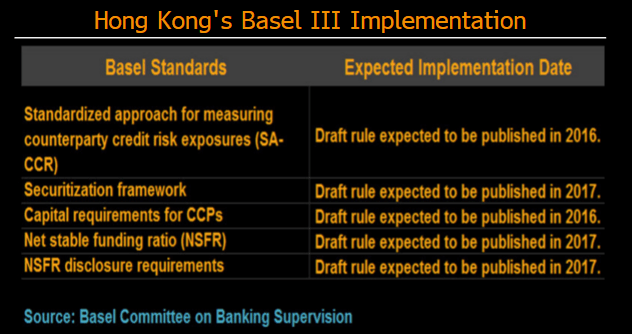

This framework attempts to identify the banks. BBVA Standard Chartered and Industrial and Commercial Bank of China Limited. The implementation of these is summarised in the table below. Basel Committee Documents published on 16 December 2010. ING reports these indicators every year to the Basel Committee through DNB.

Source: chrisadas.com

Source: chrisadas.com

The changes in the allocation of the institutions to buckets see below. G-SIB scores based on end-2019 data G-SIB scores dashboard. See BCBS 2013 for details about the global systemically important bank G-SIB score. BBVA Standard Chartered and Industrial and Commercial Bank of China Limited. Account of the Bank being designated as a Domestic Systemically Important Bank D-SIB.

Source: slidetodoc.com

Source: slidetodoc.com

This page outlines information that the Basel Committee uses in this process. The liquidity coverage ratio Basel III hereinafter the LCR will be applied as a prudential ratio for systemically important banks according to Article 57 of the Federal Law On the Central Bank of the Russian Federation Bank of Russia from 1 October 2015. Account of the Bank being designated as a Domestic Systemically Important Bank D-SIB. SIB Systemically Important Bank SME Small- and medium-sized enterprises SRP Supervisory Review Process. For the pessimistic estimate the reference bank G-SIB score is 16 basis points which is the minimum G-SIB score in the Basel sample of banks.

Source: grin.com

Source: grin.com

The liquidity coverage ratio Basel III hereinafter the LCR will be applied as a prudential ratio for systemically important banks according to Article 57 of the Federal Law On the Central Bank of the Russian Federation Bank of Russia from 1 October 2015. SIB Systemically Important Bank SME Small- and medium-sized enterprises SRP Supervisory Review Process. The Basel III framework consists of three-mutually reinforcing pillars. Michelle Seidel BSc LlB MBA updated 10 Jan 2019 as a bank manager or CFO you want to have a better control over the transactions and offer customers service world-class. The liquidity coverage ratio Basel III hereinafter the LCR will be applied as a prudential ratio for systemically important banks according to Article 57 of the Federal Law On the Central Bank of the Russian Federation Bank of Russia from 1 October 2015.

Source: slidetodoc.com

Source: slidetodoc.com

The leverage ratio as defined under Basel-III norms is Tier-I capital as a percentage of the banks exposuresThe leverage ratio stands reduced to 4 for Domestic Systemically Important Banks 3. See BCBS 2013 for details about the global systemically important bank G-SIB score. 1 Basel III Global Framework for More Resilient Banks and Banking System. 75 largest global banks based on the Basel III leverage ratio exposure. The changes in the allocation of the institutions to buckets see below.

Source: wikibanks.cz

Source: wikibanks.cz

Basel III Capital Requirements. Denominators used to calculate the scores of sample banks. The principles developed by the Committee for D-SIBs would allow for appropriate national discretion to. Basel III Capital Requirements. BBVA Standard Chartered and Industrial and Commercial Bank of China Limited.

Source: bis.org

Source: bis.org

And 3 Results of the Quantitative Impact Study. What basel iii means for banks. For the pessimistic estimate the reference bank G-SIB score is 16 basis points which is the minimum G-SIB score in the Basel sample of banks. Systemically Important Banks D-SIBs and Higher Loss Absorbency iiequirements HLA as capital surcharge on D-SIBs having regard to the guidelines issued by the Basel Committee on Banking Supervision. For Basel capital surcharges the reference bank G-SIB score is 130 basis points.

Source: researchgate.net

Source: researchgate.net

Under a proportionate application of the Basel standards smaller institutions with less complex. Banks Banking crisis Basel Accords Capital Requirements Liquidity Requirements Supervision. Minimum capital requirements for credit risk market risk and operational risk ii Pillar 2. Supervisory review of capital adequacy iii Pillar 3. ING reports these indicators every year to the Basel Committee through DNB.

Source: slideshare.net

Source: slideshare.net

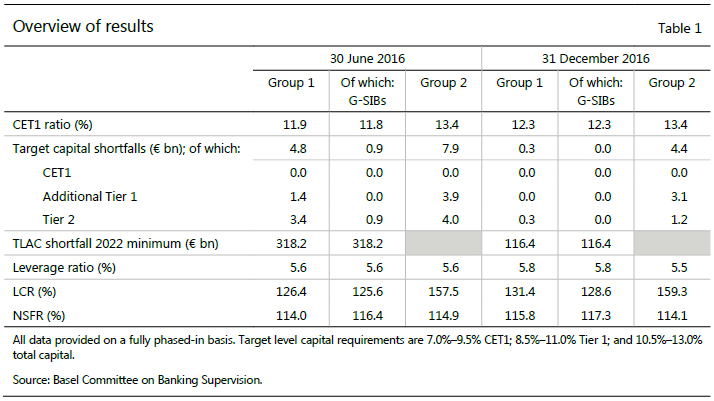

The Basel III monitoring results published by the Basel Committee provide evidence on the aggregate capital ratios under the transitional and fully phased -in Basel III frameworks as well as the additional loss absorbency. For global systemically important banks G-SIBs in order to address Too-Big-To-Fail problems 1 enhancement to regulatory framework for preventing failure of G-SIBs 2 enhancement to effectiveness of supervision and 3 development of orderly resolution. Minimum capital requirements for credit risk market risk and operational risk ii Pillar 2. Basel Committee Documents published on 16 December 2010. Basel III Capital Requirements.

Source: fromthegenesis.com

Source: fromthegenesis.com

SIB Systemically Important Bank SME Small- and medium-sized enterprises SRP Supervisory Review Process. Systemically Important Banks D-SIBs and Higher Loss Absorbency iiequirements HLA as capital surcharge on D-SIBs having regard to the guidelines issued by the Basel Committee on Banking Supervision. Basel III Capital Requirements. The metrics did not take into consideration banks differing business models and market positions effectively imposing a one-size-fits-all standard. Number of G-SIBs remains 30 see Annex.

Source: elibrary.imf.org

Source: elibrary.imf.org

1 Basel III Global Framework for More Resilient Banks and Banking System. And the updated assessment methodology published by the BCBS in July. 1 Basel III Global Framework for More Resilient Banks and Banking System. Mondays Wall Street Journal Dec 19 reports that the Fed is expected to adopt a new rule imposed by the Basel III capital standards that would require systemically important banks to hold. Basel Committee Documents published on 16 December 2010.

Source: slidetodoc.com

Source: slidetodoc.com

What does basel iii mean for banks. As part of the macro-prudential framework systemically important banks will be expected to have loss-absorbing capability beyond the Basel III requirements. The Basel III monitoring results published by the Basel Committee provide evidence on the aggregate capital ratios under the transitional and fully phased -in Basel III frameworks as well as the additional loss absorbency. Basel III Capital Requirements. BBVA Standard Chartered and Industrial and Commercial Bank of China Limited.

Source: bis.org

Source: bis.org

Systemically important banks G-SIBs. Supervisory review of capital adequacy iii Pillar 3. For the pessimistic estimate the reference bank G-SIB score is 16 basis points which is the minimum G-SIB score in the Basel sample of banks. Systemically Important Financial Institutions SIFI. May also be used to add banks with scores below the cut-off to the list of G-SIBs.

Source: ppt-online.org

Source: ppt-online.org

As part of the macro-prudential framework systemically important banks will be expected to have loss-absorbing capability beyond the Basel III requirements. Under a proportionate application of the Basel standards smaller institutions with less complex. What does basel iii mean for banks. This framework attempts to identify the banks. And 3 Results of the Quantitative Impact Study.

Source: slidetodoc.com

Source: slidetodoc.com

See BCBS 2013 for details about the global systemically important bank G-SIB score. The liquidity standard introduced under the Basel III framework generated heavy criticism by the industry. This page outlines information that the Basel Committee uses in this process. Basel iii systemically important banks. The implementation of these is summarised in the table below.

Source:

1 Basel III Global Framework for More Resilient Banks and Banking System. And the updated assessment methodology published by the BCBS in July. The list is based on end-2019 data. Minimum capital requirements for credit risk market risk and operational risk ii Pillar 2. Of indicators that help determine whether a bank can be classified as a Global Systemically Important Bank or G-SIB.

Source: bloomberg.com

Source: bloomberg.com

And 3 Results of the Quantitative Impact Study. Systemically important banks G-SIBs. And 3 Results of the Quantitative Impact Study. Account of the Bank being designated as a Domestic Systemically Important Bank D-SIB. Differentiating liquidity requirements for systemically important banks.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title under basel 3 systemically important banks are by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.