Your Under basel iii systemically important banks are trading are available in this site. Under basel iii systemically important banks are are a trading that is most popular and liked by everyone now. You can News the Under basel iii systemically important banks are files here. Get all free wallet.

If you’re looking for under basel iii systemically important banks are pictures information linked to the under basel iii systemically important banks are interest, you have come to the right site. Our website frequently gives you hints for seeing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that match your interests.

Under Basel Iii Systemically Important Banks Are. Produced by the Bank for International Settlements the central bankers bank based in Basel Switzerland they are intended to make the worlds banks and especially the systemically important institutions known as Sifis stronger and safer. In many cases banks built up excessive leverage while maintaining seemingly strong risk-based capital ratios. Basel Committee for Banking Supervision BCBS. The liquidity standard introduced under the Basel III framework generated heavy criticism by the industry.

The List Of Global Systemically Important Banks And Fsb Requirements On Download Table From researchgate.net

The List Of Global Systemically Important Banks And Fsb Requirements On Download Table From researchgate.net

Capital adequacy reporting form in the context of Basel III. Basel III systemically important banks SIB Breakdown by country of the stock of securities IMF Coordinated Portfolio Investment Survey Capital adequacy reporting according to art. The difficulties experienced by some banks were due to lapses in basic principles of liquidity risk management. Ii Capital Surcharge for Domestic Systemically Important Banks D-SIBs for licensed banks with total assets equal to or greater than Rs. Options for implementation include. Systemically Important Financial Institutions SIFI.

Assessment methodology and the additional loss absorbency requirement.

BCBS Finalized Document entitled A Framework for Dealing with Domestic Systemically Important Banks of October 2012 Circular 9186 dated 5 Dec. The list is based on end-2019 data. The metrics did not take into consideration banks differing business models and market positions effectively imposing a one-size-fits-all standard. This page provides data to be used by banks in calculating the indicators to be reported as part of the Basel Committees assessment methodology for global systemically important banks. CCyB and G-SIB buffer. These far-reaching global standards must be fully implemented by 2019.

Source: slidetodoc.com

Source: slidetodoc.com

The liquidity coverage ratio Basel III hereinafter the LCR will be applied as a prudential ratio for systemically important banks according to Article 57 of the Federal Law On the Central Bank of the Russian Federation Bank of Russia from 1 October 2015. For an extended period of time. As part of the macro-prudential framework systemically important banks will be expected to have loss-absorbing capability beyond the Basel III requirements. Following the assessment methodology established by Basel III Rule 21-11 qualifies banks as systemically important under an indicator-based system that considers the size complexity interconnectedness with other financial institutions and degree of substitutability of Chilean banks. 500 billion iii Countercyclical Buffers will be implemented as and when excess aggregate credit growth is judged to be associated with a build-up of system wide risk.

Source: elibrary.imf.org

Source: elibrary.imf.org

The changes in the allocation of the institutions to buckets see below. Global systemically important banks. Differentiating liquidity requirements for systemically important banks. CCyB and G-SIB buffer. And the updated assessment methodology published by the BCBS in July.

Source: bis.org

Source: bis.org

The banking system came under severe stress which necessitated central bank action to support both the functioning of money markets and in some cases individual institutions. Following the assessment methodology established by Basel III Rule 21-11 qualifies banks as systemically important under an indicator-based system that considers the size complexity interconnectedness with other financial institutions and degree of substitutability of Chilean banks. 500 billion iii Countercyclical Buffers will be implemented as and when excess aggregate credit growth is judged to be associated with a build-up of system wide risk. Capital adequacy reporting form in the context of Basel III. This page provides data to be used by banks in calculating the indicators to be reported as part of the Basel Committees assessment methodology for global systemically important banks.

Source: slidetodoc.com

Source: slidetodoc.com

The selected indicators are chosen to reflect the different aspects of what generates negative externalities and makes a bank critical for the stability of the financial system. CCyB and G-SIB buffer. Options for implementation include. These far-reaching global standards must be fully implemented by 2019. Basel III Capital Requirements.

Source: slidetodoc.com

Source: slidetodoc.com

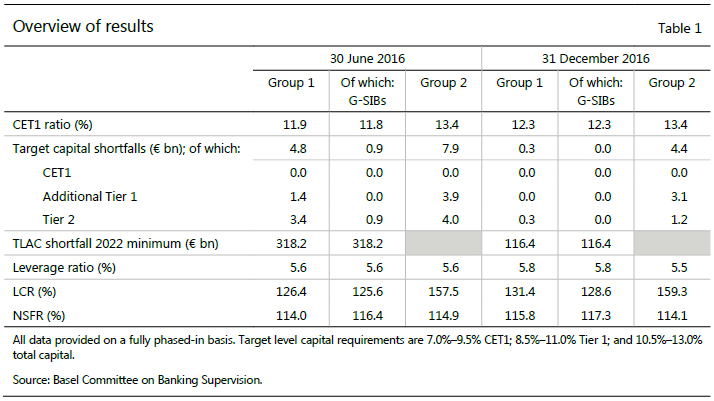

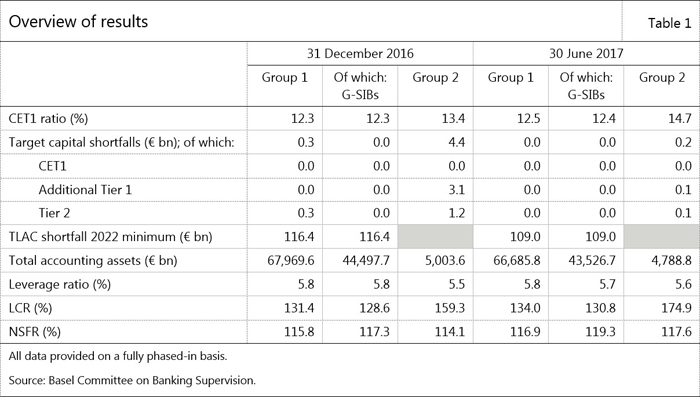

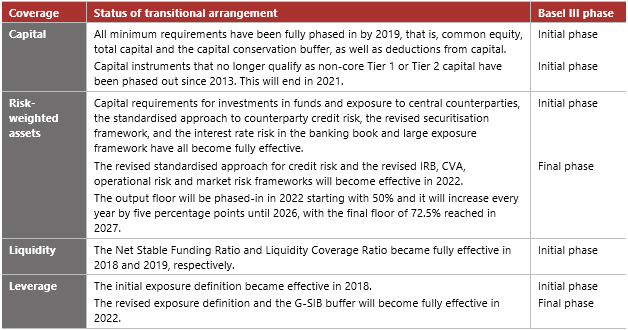

This picture does not fit the bulk of banks in emerging markets particularly those in emerging Asia. The difficulties experienced by some banks were due to lapses in basic principles of liquidity risk management. The liquidity coverage ratio Basel III hereinafter the LCR will be applied as a prudential ratio for systemically important banks according to Article 57 of the Federal Law On the Central Bank of the Russian Federation Bank of Russia from 1 October 2015. The implementation of these is summarised in the table below. The list is based on end-2019 data.

Source: ppt-online.org

Source: ppt-online.org

The changes in the allocation of the institutions to buckets see below. For an extended period of time. Larger institutions typically banks with over 250bn of assets covered by the advanced approach must comply by January 1 2014. Number of G-SIBs remains 30 see Annex. Differentiating liquidity requirements for systemically important banks.

Source: slideplayer.com

Source: slideplayer.com

The BCBS introduced a leverage ratio in Basel III to reduce the risk of such periods of deleveraging in the future and the damage they inflict on. Basel III is designed essentially for global systemically important banks or national banks with nationally systemic international exposure. Basel III Capital Requirements. As part of the macro-prudential framework systemically important banks will be expected to have loss-absorbing capability beyond the Basel III requirements. Basel III systemically important banks SIB Breakdown by country of the stock of securities IMF Coordinated Portfolio Investment Survey Capital adequacy reporting according to art.

Source: finadium.com

Source: finadium.com

The implementation of these is summarised in the table below. Implementation of the Basel standards. This picture does not fit the bulk of banks in emerging markets particularly those in emerging Asia. A framework for dealing with domestic systemically important banks assessment conducted by the local authorities who are best placed to evaluate the impact of failure on the. These far-reaching global standards must be fully implemented by 2019.

Source: gtrisk.com

Source: gtrisk.com

In many cases banks built up excessive leverage while maintaining seemingly strong risk-based capital ratios. Basel III is designed essentially for global systemically important banks or national banks with nationally systemic international exposure. The metrics did not take into consideration banks differing business models and market positions effectively imposing a one-size-fits-all standard. These far-reaching global standards must be fully implemented by 2019. Produced by the Bank for International Settlements the central bankers bank based in Basel Switzerland they are intended to make the worlds banks and especially the systemically important institutions known as Sifis stronger and safer.

Source: wikibanks.cz

Source: wikibanks.cz

These far-reaching global standards must be fully implemented by 2019. Larger institutions typically banks with over 250bn of assets covered by the advanced approach must comply by January 1 2014. BCBS Finalized Document entitled A Framework for Dealing with Domestic Systemically Important Banks of October 2012 Circular 9186 dated 5 Dec. The US is implementing Basel III under the auspices of the Dodd-Frank Act from 1 January 2015 for banks utilizing the standard approach. Basel III Definition of Capital Frequently Asked Questions Circular BCS 24331 dated 04 Sept.

Source: slidetodoc.com

Source: slidetodoc.com

Mondays Wall Street Journal Dec 19 reports that the Fed is expected to adopt a new rule imposed by the Basel III capital standards that would require systemically important banks to hold. These far-reaching global standards must be fully implemented by 2019. A domestic systemically important bank D-SIB framework is best understood as taking the complementary perspective to the G-SIB regime by focusing on the impact that the distress or failure of banks including by international banks will have on the. Larger institutions typically banks with over 250bn of assets covered by the advanced approach must comply by January 1 2014. Systemically Important Financial Institutions SIFI.

Source: chrisadas.com

Source: chrisadas.com

These far-reaching global standards must be fully implemented by 2019. The changes in the allocation of the institutions to buckets see below. Differentiating liquidity requirements for systemically important banks. The US is implementing Basel III under the auspices of the Dodd-Frank Act from 1 January 2015 for banks utilizing the standard approach. The banking system came under severe stress which necessitated central bank action to support both the functioning of money markets and in some cases individual institutions.

Source: elibrary.imf.org

Source: elibrary.imf.org

The liquidity standard introduced under the Basel III framework generated heavy criticism by the industry. For an extended period of time. A domestic systemically important bank D-SIB framework is best understood as taking the complementary perspective to the G-SIB regime by focusing on the impact that the distress or failure of banks including by international banks will have on the. Basel III is designed essentially for global systemically important banks or national banks with nationally systemic international exposure. Differentiating liquidity requirements for systemically important banks.

Source: suerf.org

Source: suerf.org

Basel III systemically important banks SIB Breakdown by country of the stock of securities IMF Coordinated Portfolio Investment Survey Capital adequacy reporting according to art. Options for implementation include. CCyB and G-SIB buffer. The list is based on end-2019 data. These far-reaching global standards must be fully implemented by 2019.

Source: slidetodoc.com

Source: slidetodoc.com

Systemically important banks G-SIBs. For an extended period of time. BCBS Finalized Document entitled A Framework for Dealing with Domestic Systemically Important Banks of October 2012 Circular 9186 dated 5 Dec. This picture does not fit the bulk of banks in emerging markets particularly those in emerging Asia. The selected indicators are chosen to reflect the different aspects of what generates negative externalities and makes a bank critical for the stability of the financial system.

Source: slidetodoc.com

Source: slidetodoc.com

Systemically important banks G-SIBs. Number of G-SIBs remains 30 see Annex. Basel III is designed essentially for global systemically important banks or national banks with nationally systemic international exposure. BCBS Finalized Document entitled A Framework for Dealing with Domestic Systemically Important Banks of October 2012 Circular 9186 dated 5 Dec. Larger institutions typically banks with over 250bn of assets covered by the advanced approach must comply by January 1 2014.

Source: bis.org

Source: bis.org

Following the assessment methodology established by Basel III Rule 21-11 qualifies banks as systemically important under an indicator-based system that considers the size complexity interconnectedness with other financial institutions and degree of substitutability of Chilean banks. Basel III Capital Requirements. Capital composition The new Basel minima for bank capital are set out in the boxes. Basel III is designed essentially for global systemically important banks or national banks with nationally systemic international exposure. 500 billion iii Countercyclical Buffers will be implemented as and when excess aggregate credit growth is judged to be associated with a build-up of system wide risk.

Source: researchgate.net

Source: researchgate.net

In many cases banks built up excessive leverage while maintaining seemingly strong risk-based capital ratios. BCBS Finalized Document entitled A Framework for Dealing with Domestic Systemically Important Banks of October 2012 Circular 9186 dated 5 Dec. Differentiating liquidity requirements for systemically important banks. Assessment methodology and the additional loss absorbency requirement. This picture does not fit the bulk of banks in emerging markets particularly those in emerging Asia.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title under basel iii systemically important banks are by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.